Q2 was one of the most exciting in our team’s history as we introduced the world to Syrup, a permissionless DeFi protocol built on top of Maple’s permissioned debt market. Powered by the same institutional lending infrastructure behind Maple, Syrup creates access for a wider pool of lenders; in three months, Syrup was scoped, developed and delivered - and has been the fastest growing Maple pool in history.

Commercial expansion on the Maple side was the second part of our story this quarter, as all products saw strong deposit and loan growth over the last three months. Our Secured Lending products brought consistent, outsized yields to lenders as rates compressed onchain throughout the summer chop. The team’s focus has always been on bringing innovative and secure lending solutions to the digital asset economy, and we are proud of the success in doing so to date.

The data and information in this report are intended for informational purposes only and are subject to change. The data provided are based on the status of the Maple Treasury on the 30th of June 2024. All figures are shown in USD and based on the corresponding CoinGecko closing price. For more information, see the disclaimer linked below.

Q2 in Summary

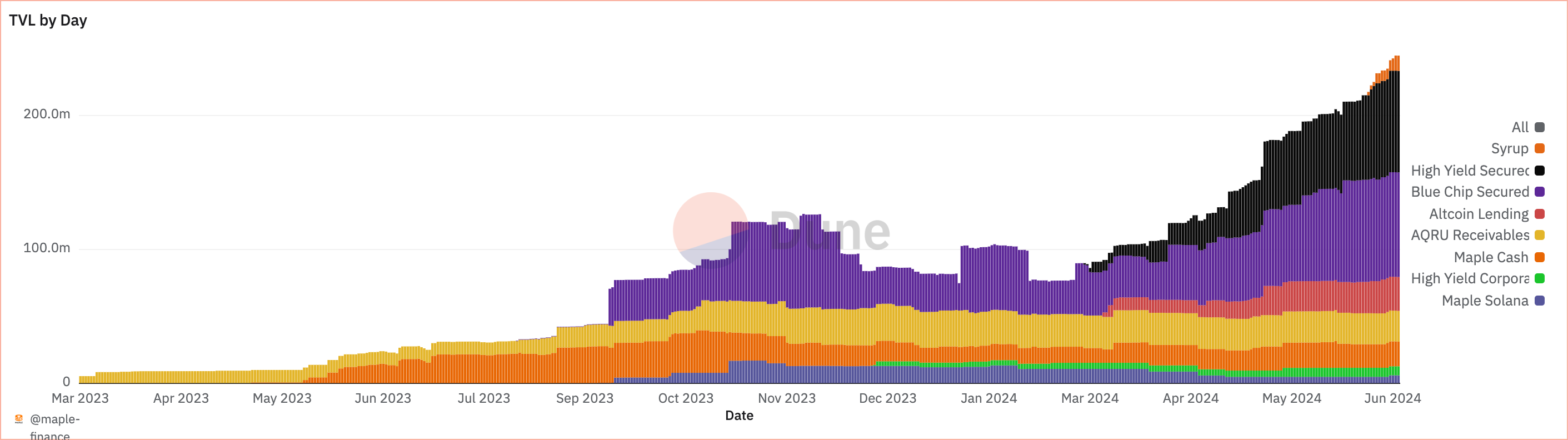

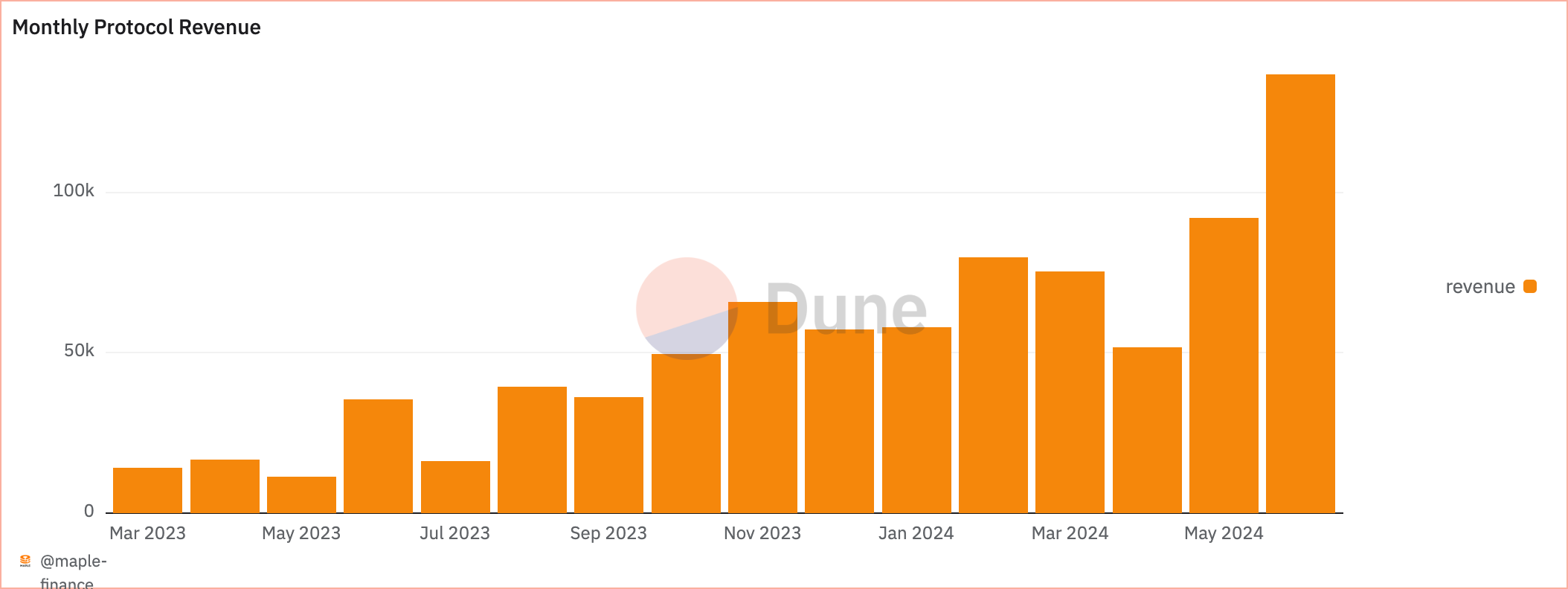

The second quarter of 2024 saw strong growth across the entire platform. TVL increased 130% from the end of March off the backs of both Secured Lending pools as well as our altcoin lending and the late June launch of Syrup.

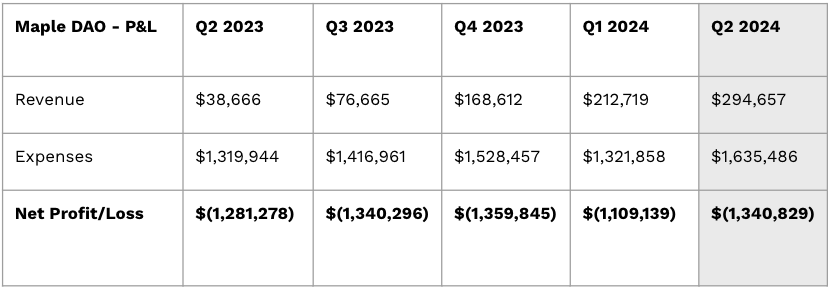

Revenues have continued to grow with Q2 revenue paid up 30% Q/Q. Annualized revenue numbers finished the quarter up ~150% Q/Q.

Syrup: Institutional Yield, Unlocked

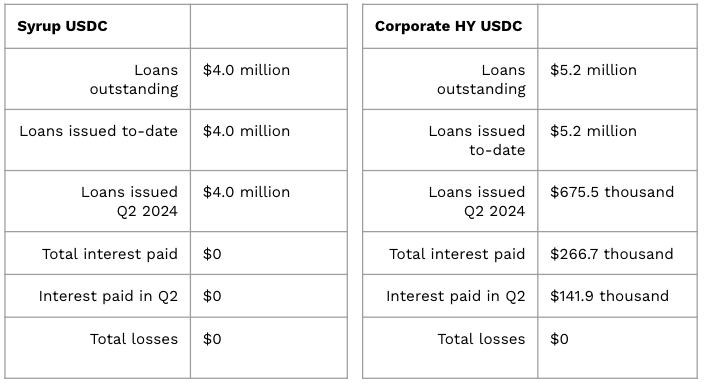

In Q1, the team met in New York to discuss our return to the permissionless DeFi ecosystem. From ideation to launch in less than three months, Syrup represents a significant milestone in our mission to bridge institutional-grade lending with the wider DeFi ecosystem. Syrup utilizes the same smart contract and lending infrastructure behind Blue Chip and High Yield Secured Pools, offering lenders high risk-adjusted yield sourced from loans to creditworthy institutions in the digital asset ecosystem.

Key features of Syrup:

- Permissionless access (excluding geo-blocked regions) to institutional lending backed by select digital assets

- Consistent, high yield enabled by fixed-rate, short duration, overcollateralised loans

- Leveraging Maple's battle-tested infrastructure that has originated over $4.3 billion in loans

- An innovative rewards program, "Drips," rewarding early depositors with token rewards that will convert to SYRUP token.

Commercial Expansion

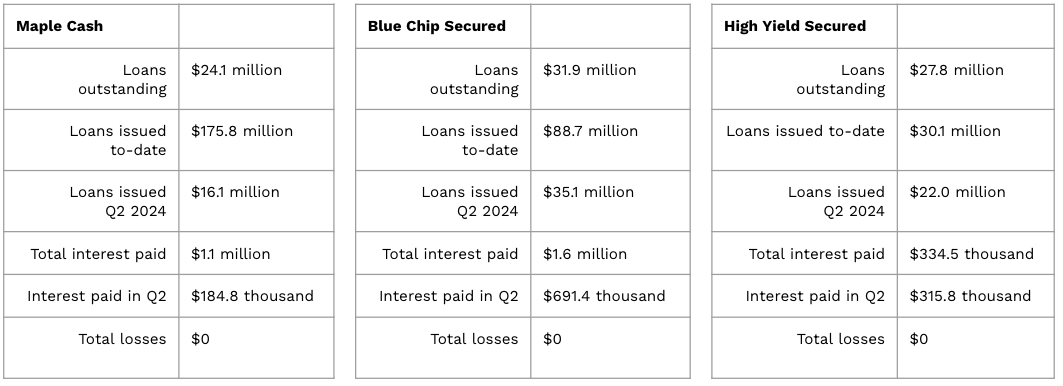

In March of Q1, we launched our second overcollateralized lending product with High Yield Secured. This pool has been a notable success story, delivering 20% net yields throughout Q2 while growing nearly 300% Q/Q. Outstanding loans in this pool grew nearly 300% this quarter and (prior to Syrup) was the fastest launch in Maple’s history.

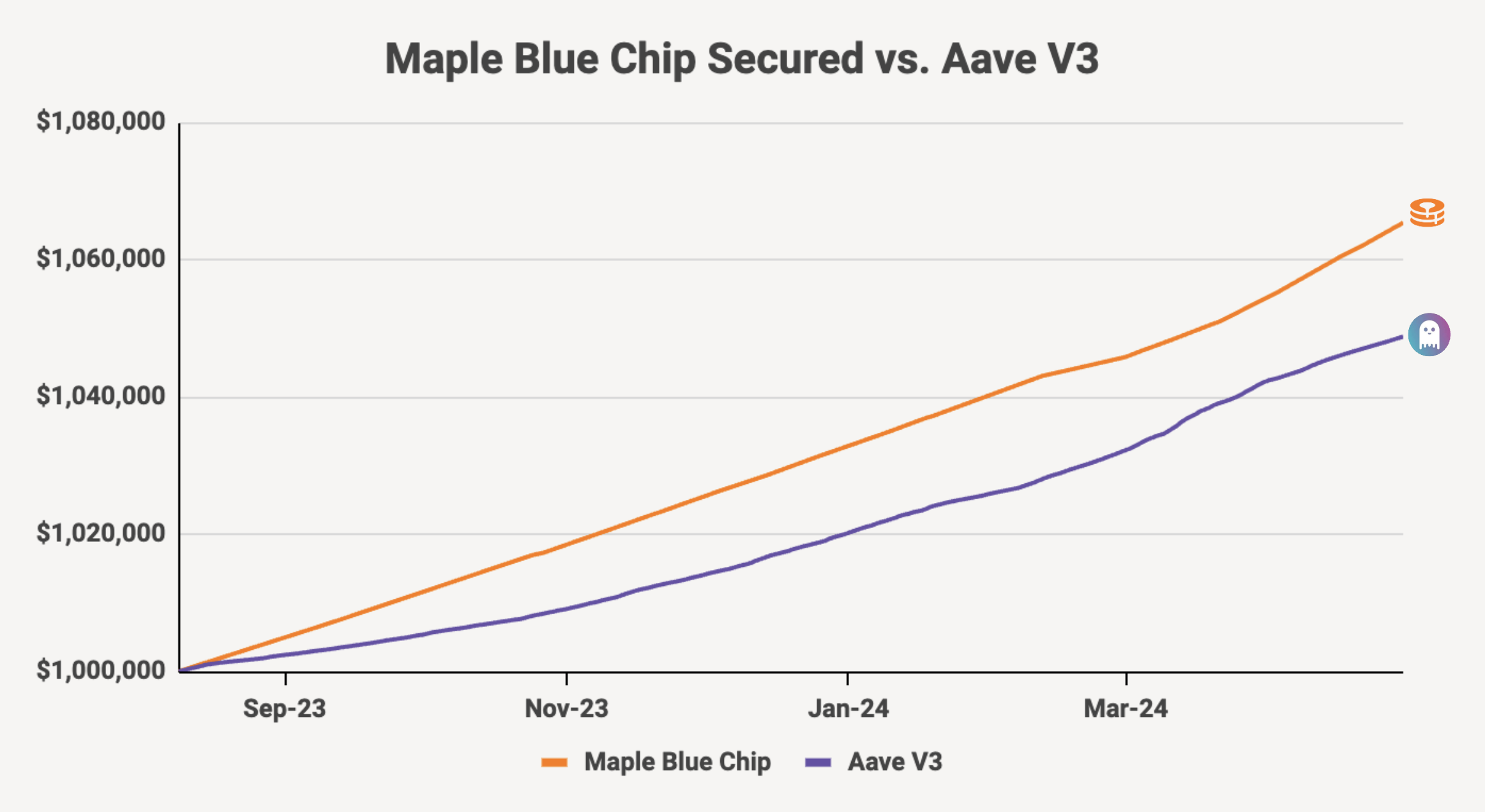

Meanwhile, Blue Chip continues to offer net yields around 12% and we see lenders often allocating across products for a blended rate of return. That pool grew outstanding loans by 95% this quarter and continues to be a lender favorite.

Consistent Outsized Yield for Lenders

Maple and Syrup have offered superior risk-adjusted trailing yield across DeFi over the last 3 months. Supply rates for USDC on Aave V3 and Compound compressed down to 5-7% range for most of Q2. Meanwhile, realized net APY for lenders in Q2 was 12.7% in Blue Chip and >20% in High Yield! Lenders loved this consistent, high yield from fully collateralized lending. In fact, we are seeing record numbers stickiness on the platform, with lenders in more than one product growing >130% Q/Q. You can read more about Maple and Syrup’s outperformance here and here.

Closing

The story in Q2 was twofold: the complete development of Syrup and bringing that exciting new product to life, and scaling our Secured Lending pools on the Maple side after finding product market fit. Moving into the rest of the year, the team has a lot planned.

A large focus will be on the expansion of Syrup. Additional assets will be supported with a USDT pool on the immediate horizon. The second key focus will be on developing deep integrations throughout the DeFi ecosystem for Syrup LP tokens as TVL in the pool continues to scale rapidly and Syrup becomes a building block for the entirety of DeFi.

Drips seasons will continue in Q3 as part of our renewed focus on revitalizing the token community as we near the migration for MPL <> SYRUP. Once that migration occurs, we are also excited to release staking for SYRUP tokenholders to share in the success of the Maple & Syrup protocols. More details to come and be sure to reach out to the team with any interest in lending.

Q2 2024 Highlights

- Grew outstanding Maple Direct loans by 105% Q/Q

- Deposits into Maple Direct up 63% Q/Q

- Active LPs on the platform grew 65% Q/Q, with LPs active in more than one Pool +127% Q/Q

Table 1: Q2 Liquidity and Total Loan Originations

Table 2: Maple DAO Revenue & Expenses

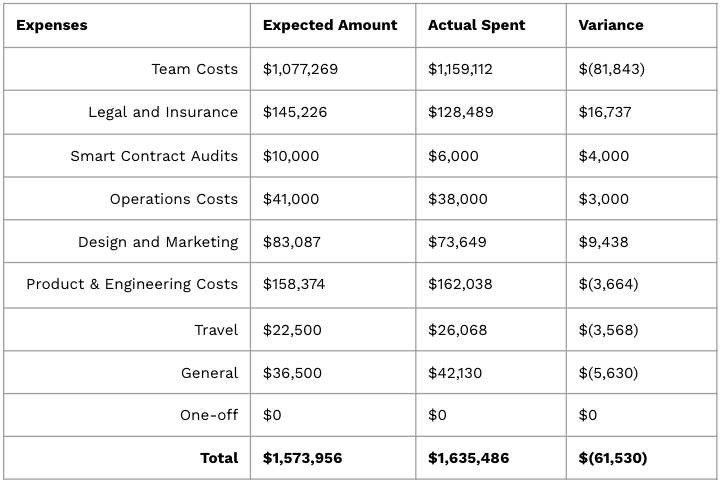

Q2 2024 Expenses

Table 3: Maple Labs Q2 Actual vs Budget Variance

Table 4: Q2 Pool Statistics