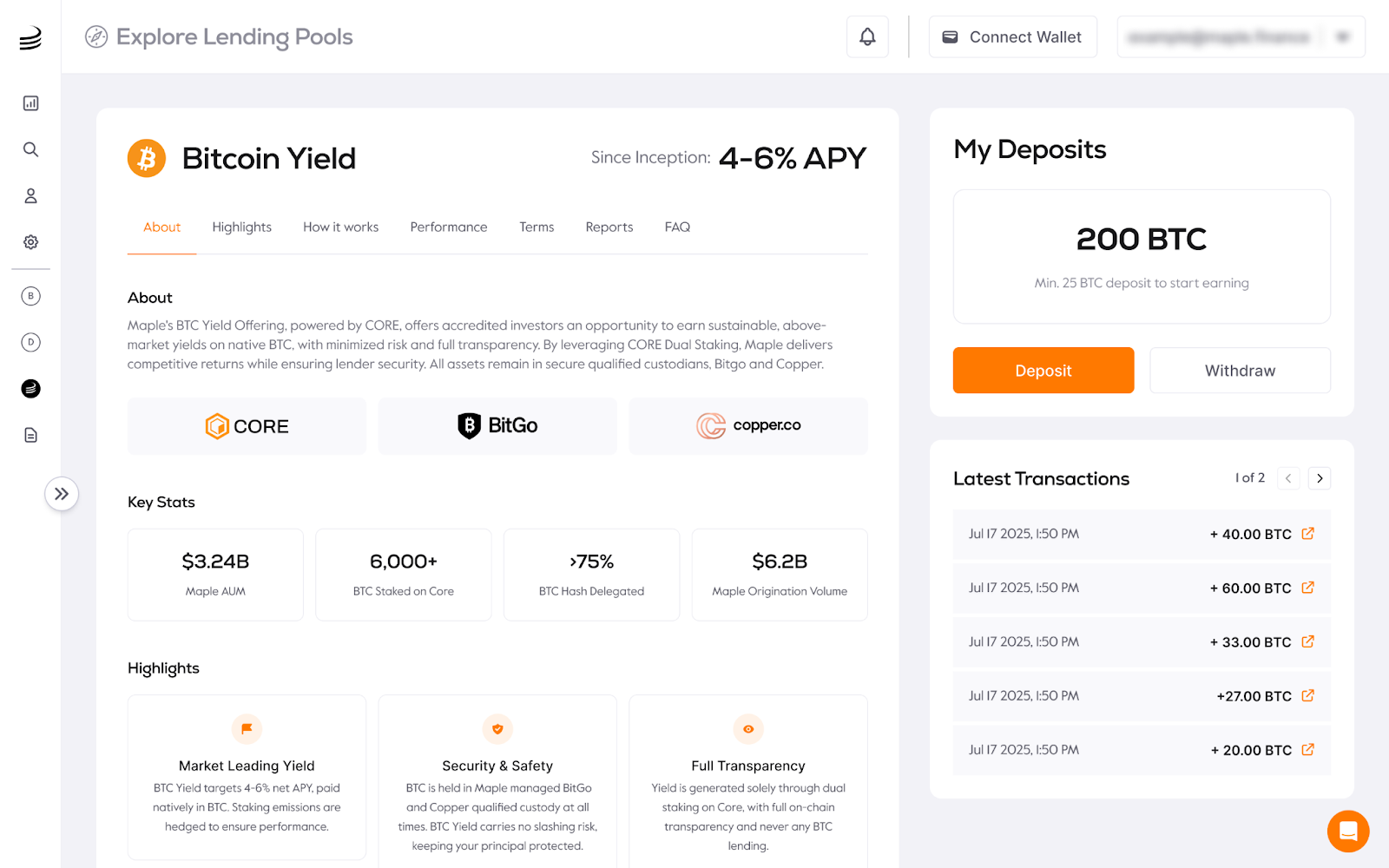

Maple launched the Bitcoin Yield product in February 2025, and the response has been incredible. More than 1,500 BTC has been deposited, totalling $180M with an APY of 5.13%–paid in BTC.

Starting today, accredited investors and institutions can directly access Maple’s BTC Yield. For first-time depositors, visit Maple to start earning today.

Existing depositors will receive an email to access the dashboard shortly.

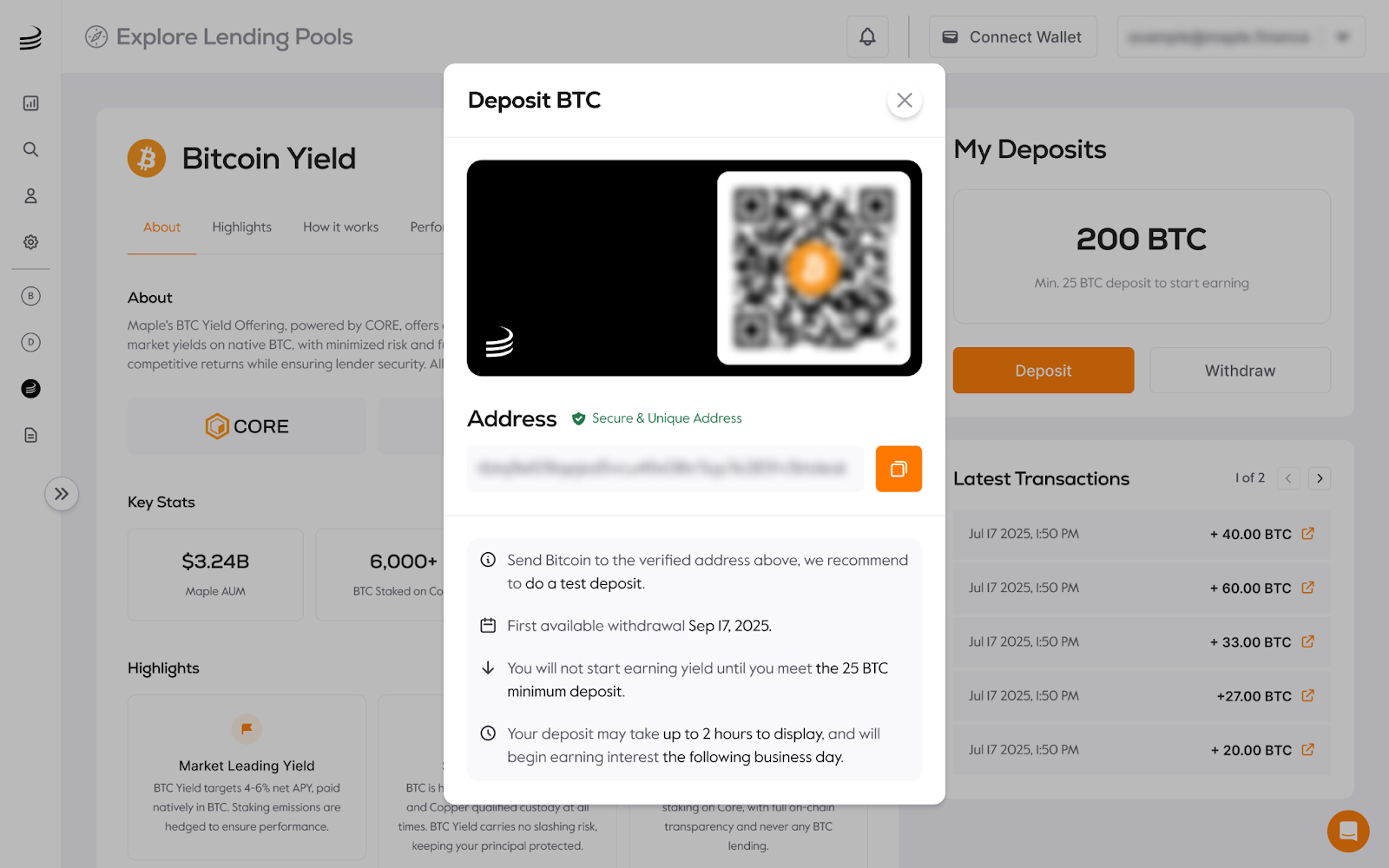

BTC Yield Onboarding: What to Expect

After completing onboarding through Maple, you'll receive a secure, unique deposit address.

BTC Depositors have full visibility of their balance and transaction history in one place. The Maple Institutional platform provides real-time updates, so depositors always know exactly how much BTC they have.

Why Maple BTC Yield

BTC Yield is built with accredited investors and institutional requirements in mind–onchain transparency, detailed reporting, and industry leading security standards.

Allocators know exactly where their Bitcoin sits and how we generate yield. Monthly statements break down earnings, and the dashboard displays balances with complete transaction history.

Maple’s BTC Yield Sources

By leveraging Core Network’s dual staking, Maple enables Bitcoin holders to earn native BTC yield - securely, transparently, and without lending risk.

Core is an EVM-compatible blockchain that uses Bitcoin's security to power smart contracts. Through its "Satoshi Plus" consensus mechanism, Core enables Bitcoin holders to earn yield by staking their BTC, whilst maintaining full custody.

Step 1: Deposit BTC With Secure Custody

- Depositors onboard seamlessly, via the Maple Institutional platform

- BTC is sent to a secure address generated in the platform. Maple manages BTC staking in qualified custodians (Copper and BitGo)

- BTC is never wrapped, rehypothecated, or bridged from the BTC network

- Depositors can monitor their balance & transactions in real time via the platform

Step 2: Maple Acquires CORE Tokens & Hedges Risk

- Maple borrows CORE tokens to participate in dual staking while purchasing protective put options to hedge volatility

- This hedging strategy retains upside regardless of CORE action

Step 3: BTC + CORE Dual Staking

- BTC and Maple’s CORE tokens are dual staked, earning rewards at the highest staking tier (Satoshi)

Step 4: BTC Yield Payouts

- As CORE emissions are earned, Maple converts back to BTC, and distributes to depositors at maturity.

Closing

Unlike other BTC “yield” programs that rely on points, tokens, or lending to counterparties, Maple’s offering generates real BTC-denominated returns through staking, not lending. This eliminates counterparty risk. Furthermore, unlike ETH staking, Core’s staking model does not involve slashing, eliminating the risk of principal loss due to network penalties.

Create an account to earn BTC on BTC

Disclaimers: This report is for informational purposes only. All data as of July 25th, 2025. Figures shown in USD per Maple.