Maple is the largest onchain asset manager with $2.6B in AUM at the end of Q2 2025 ($3.2B at time of writing). This growth is grounded in our institutional expertise, active asset management and robust risk frameworks—enabling us to deliver institutional DeFi products at a global scale.

Q2 performance validated our approach across institutional and DeFi products. syrupUSD emerged as DeFi's fastest-growing yield-bearing dollar asset, accumulating $1.9B in AUM, while our institutional lending pools delivered market-leading returns with 9.2% on High Yield products and 5.2% BTC Yield. We strengthened $SYRUP's value proposition by maintaining our 20% revenue allocation to buybacks, securing major exchange listings including Binance and expanding our DeFi partnerships.

Market Context: The Institutional DeFi Renaissance

Q2 2025 marked the acceleration of institutional capital into DeFi, with lending AUM surging 41% from $17B to $24B as regulatory clarity emerged. Amid this shift, Maple surpassed BlackRock as the largest onchain asset manager. No protocol is better positioned across the three most explosive themes in crypto: stablecoins, Bitcoin Yield, and digital asset lending.

Market Momentum

- Legislation Tailwinds: Legislative momentum accelerated with the CLARITY, GENIUS, and Anti-CBDC bills advancing through Congress, promising to establish the regulatory framework stablecoins require for mainstream adoption. As adoption scales, Maple is positioned to capture additional marketshare with the leading institutional-grade liquid yield asset and full suite of institutionally compliant offerings.

- Stablecoin Surge: Total stablecoin capitalization grew to $242B, continuing 21 months of consistent growth dating back to September 2023.

- Credit Growth: Overcollateralized lending grew to $26B (+24% QoQ) — Maple has now originated $8.4B in loans, offering deep liquidity, tailored structuring, and non-dilutive access to capital as the preferred institutional financing partner.

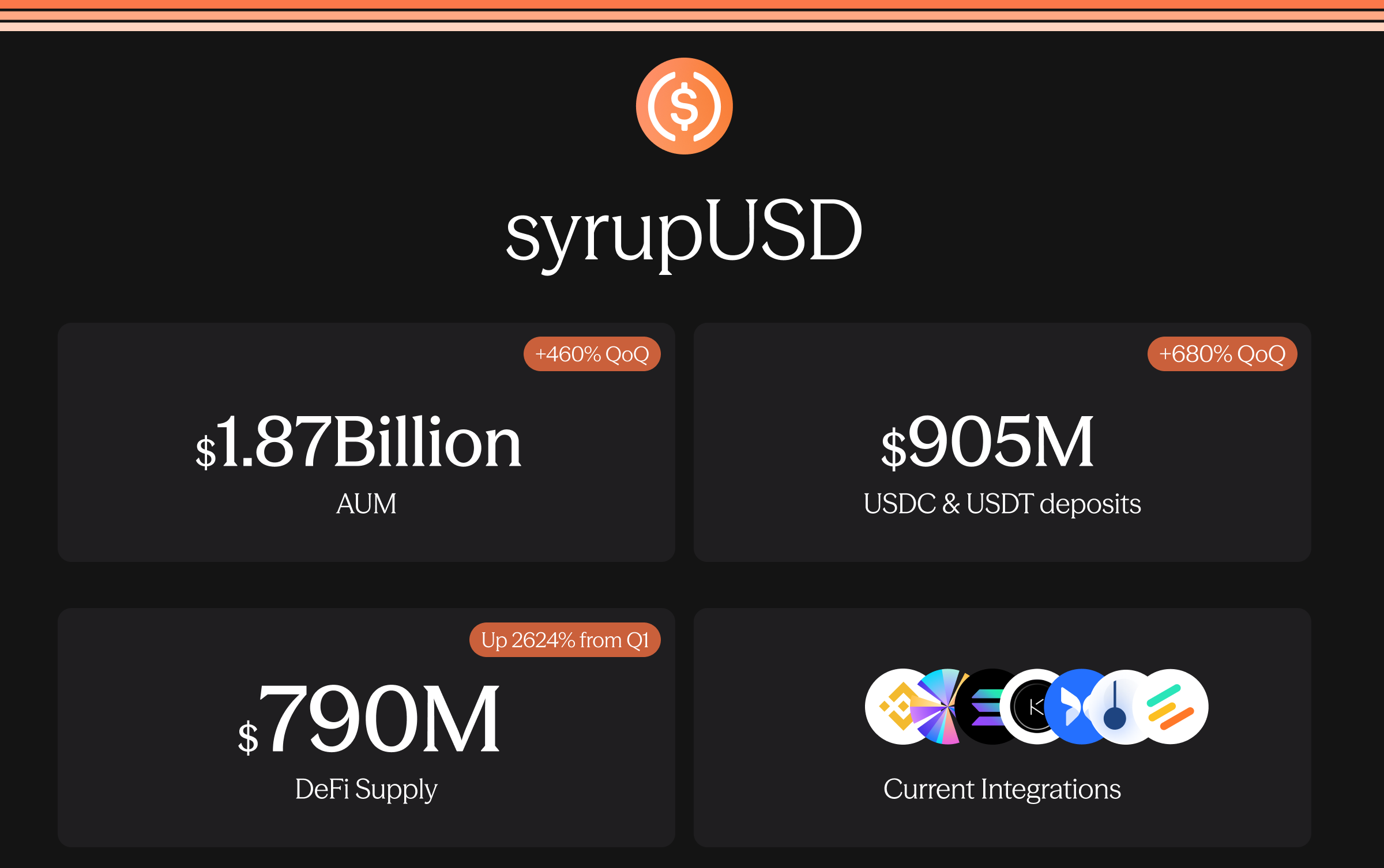

syrupUSD: The Liquid Yield Dollar

syrupUSD was DeFi’s fastest-growing yield-bearing dollar asset in Q2.

With instant liquidity, constant utilization, and growing protocol integrations, syrupUSD now sits firmly among the top three yield-bearing assets on Ethereum and Solana.

As AUM climbs, market positioning will continue to strengthen. Unlike other assets where scale dilutes returns, syrupUSD’s growth reinforces the quality and sustainability of its underlying yield. With stablecoin market cap projected to hit ~$400B by year-end, syrupUSD is positioned to capture a larger slice of a growing pie.

syrupUSD is the preferred collateral and yield-bearing dollar for all allocator types. With major integrations, a refreshed SDK, and continued capital inflows, the next leg of syrupUSD growth to $3.5B AUM is underway.

syrupUSD Q2 Integration Highlights

- Binance Web3 Wallet: Resulting in $140M+ in flows into syrupUSD.

- Morpho: syrupUSD users on Morpho earned up to 24% through leverage strategies with over $150M+ allocated.

- Pendle: $130M+ market with average APY of 12% post-Drips.

- Spark: $400M+ of deposits into syrupUSD, delivering consistent high yield to the Sky ecosystem.

- Kamino x Solana: $60M+ minted within 2 weeks of launch, making Maple most successful dollar yield asset launch on Solana.

For performance and growth metrics of syrupUSD and other key documentation go to the syrupUSD data room here.

Maple Institutional: The Onchain Credit Standard

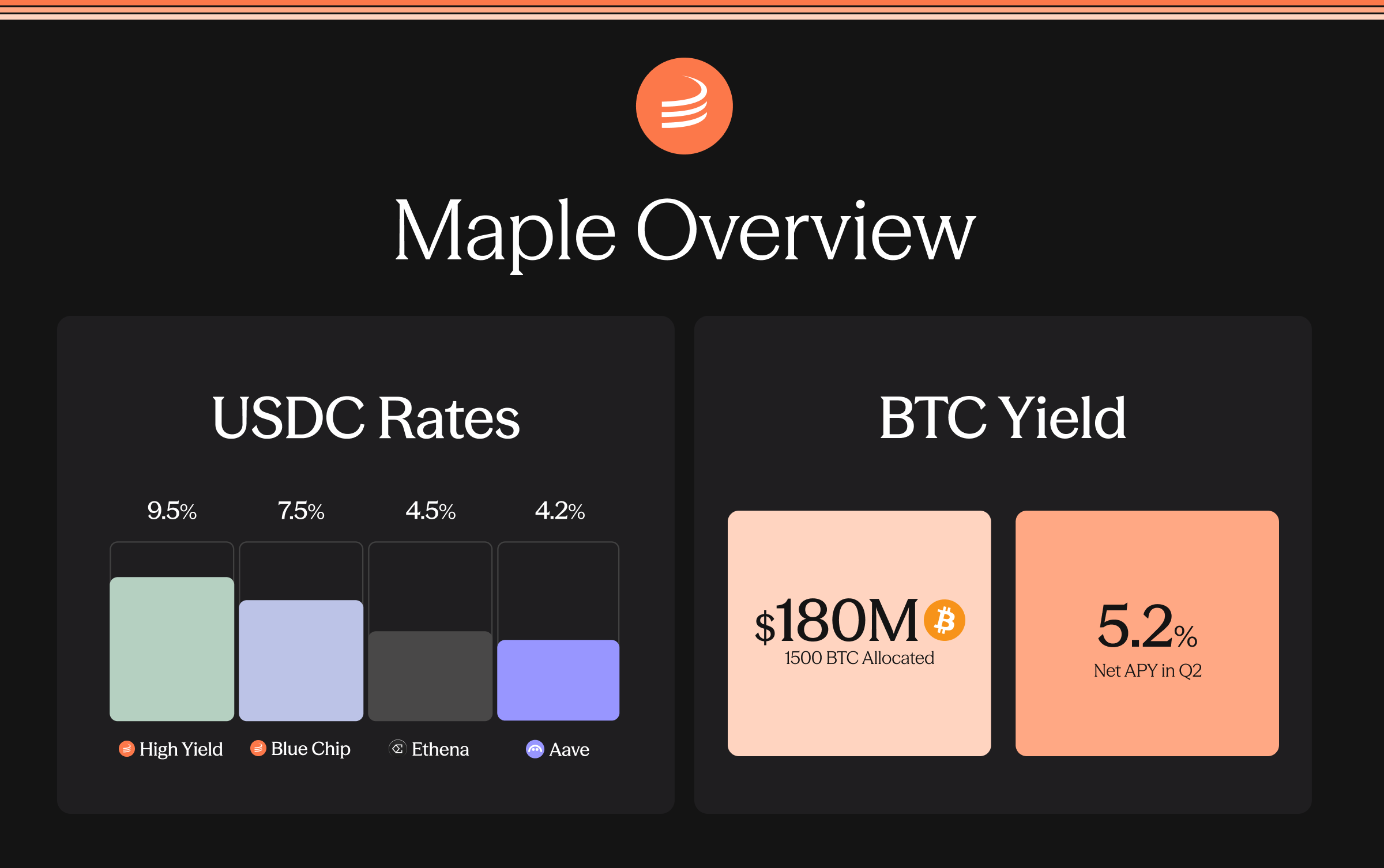

In Q2 2025, Professional allocators continued to choose Maple's institutional products above all others, securing market-leading yields on USDC and BTC through transparent, actively-managed strategies.

For allocators seeking institutional-grade lending strategies, Maple has positioned itself as the leading platform for KYC-compliant onchain credit at scale.

The High Yield Secured Pool continued to outperform the market, offering the highest USDC yield among platforms with over $100M AUM. Consistent performance at scale reflects the sustainability of Maple’s active credit underwriting and risk-managed approach exemplified by being the first to partner with Cantor Fitzgerald for a BTC backed lending facility.

Maple Bitcoin Yield solidified its position as the premier onchain BTC yield solution, delivering 5.2% net APY and reaching over $180M in AUM. This performance validates accelerating demand for secure, institutionally accessible BTC yield as adoption expands beyond spot exposure.

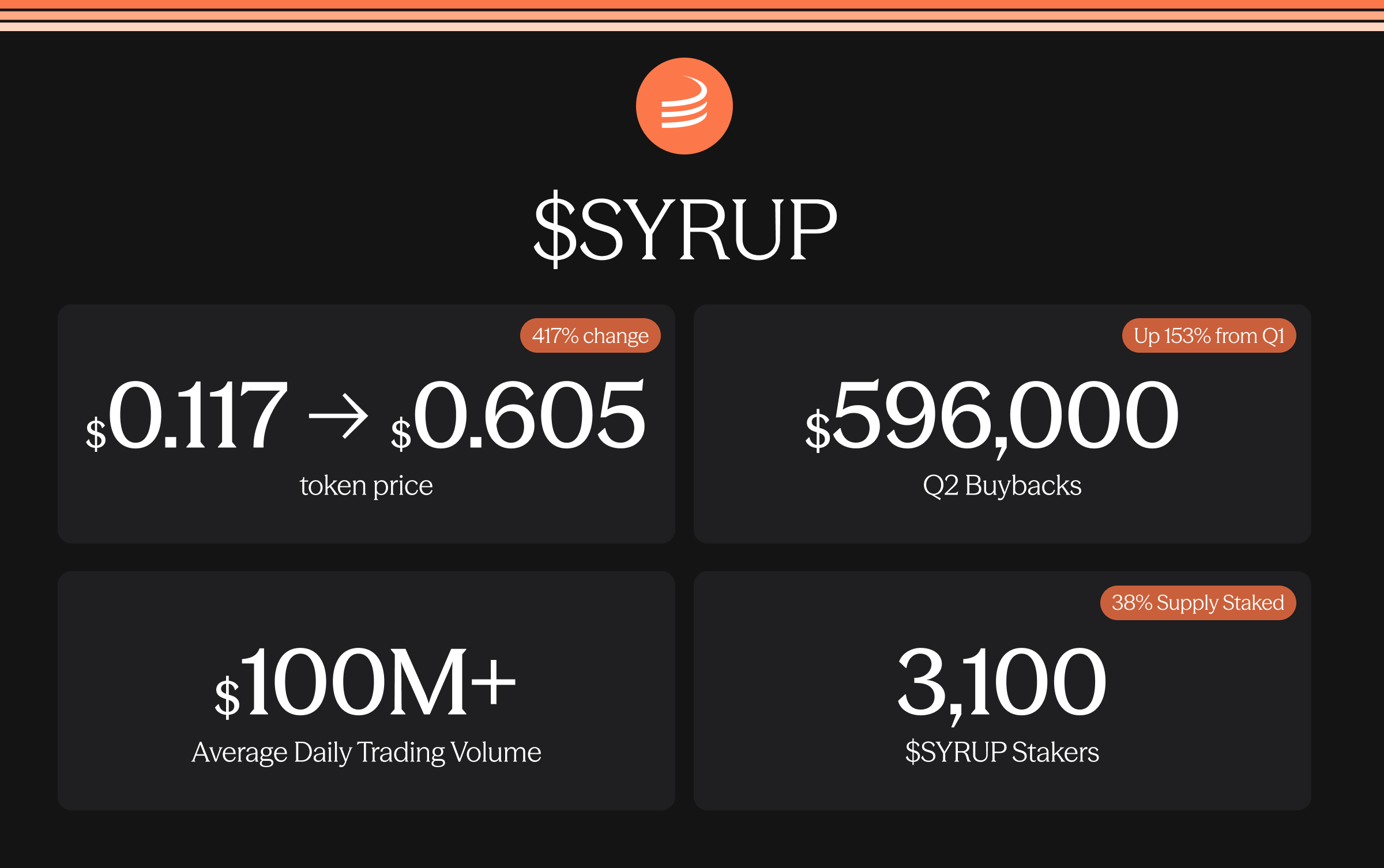

$SYRUP: Token Utility Aligned with Protocol Performance

Q2 marked a significant step forward in the adoption of $SYRUP, driven by new listings on Tier-1 exchanges. $SYRUP secured listings on Binance, HTX, Bitget and Bithumb while also unlocking new perps listings on Hyperliquid, OKX, and HTX. These integrations improved accessibility and broadened participation in the Maple ecosystem.

As a governance token, $SYRUP is directly linked to protocol performance, with buybacks funded by 20% of revenues, generated across the all Maple products. This creates protocol wide alignment as $SYRUP is a signal of ecosystem health while accruing value from performance.

H2 2025 Guidance

Maple exceeded expectations in Q2, surpassing $3B in AUM, doubling ARR to $15M, and achieving 150% QoQ revenue growth. This outperformance sets the tone for the second half: we’re raising targets, expanding product accessibility, and scaling dominance across yield dollar and BTC capital markets.

As the largest onchain asset manager, Maple’s edge lies in its proven ability to deliver institutional finance expertise with DeFi accessibility at scale. With even stronger growth projected for H2 2025, we've revised our guidance upward to reflect this momentum:

- AUM: New $5B target by year-end (raised from $4B), with active inflows and institutional mandates underway.

- ARR: New $30M ARR target for 2025 ($15M currently), driven by continued AUM scale and new product launches.

- syrupUSD Scaling: Positioned to become the #1 yield-bearing dollar with a target $3.5B AUM, Tier-1 listings, and Aave integration pending.

- New Assets: Multiple new onchain structured products launching before year-end to meet allocator demand.

- SYRUP Buybacks: Proposal to raise buyback allocation from 20% to 25% of protocol revenue goes to vote July 25.

Closing

Maple enters H2 2025 with record momentum—surpassing $3B in AUM, tripling ARR, and delivering market-leading performance across institutional and DeFi products.

This growth is reinforced by the strong tailwinds of rising stablecoin adoption, clearer regulatory frameworks, and accelerating institutional migration onchain. The market for trusted, transparent yield platforms is expanding and Maple is positioned at the center of that evolution. In response, Maple has raised its year-end targets to $5B in AUM and $30M in ARR, reflecting confidence in continued demand and execution at scale.

With syrupUSD scaling rapidly and new structured products set to launch, Maple is executing with focus and precision to define the next phase of onchain asset management.

Create your Maple Account Today

Disclaimers: This report is for informational purposes only. All data as of June 30, 2025. Figures shown in USD per CoinGecko closing prices.

*Instant liquidity refers to typical redemption times under normal market conditions. Availability may vary based on market conditions and supported secondary liquidity venues.