Executive Summary

The analysis below compares Maple, Syrup, Ethena, and Aave - some of the most trusted yield sources in DeFi - and makes a case for why Maple and Syrup are differentiated by their:

- Sustainable and consistent source of yield

- Relative outperformance

- Higher collateralisation levels

Introduction

Demand for diversified, sustainable yield has underpinned recent growth in TVL on Maple and Syrup, but innovative yield opportunities exist elsewhere in DeFi. Ethena Labs, for example, has designed a synthetic dollar, USDe, which can be staked for yield-bearing sUSDe. Meanwhile, blue chip DeFi lending protocol Aave also provides yield for USDC depositors. As such, an analysis that unpacks the benefits and drawbacks of each yield source for USDC lenders is appropriate.

Source Analysis

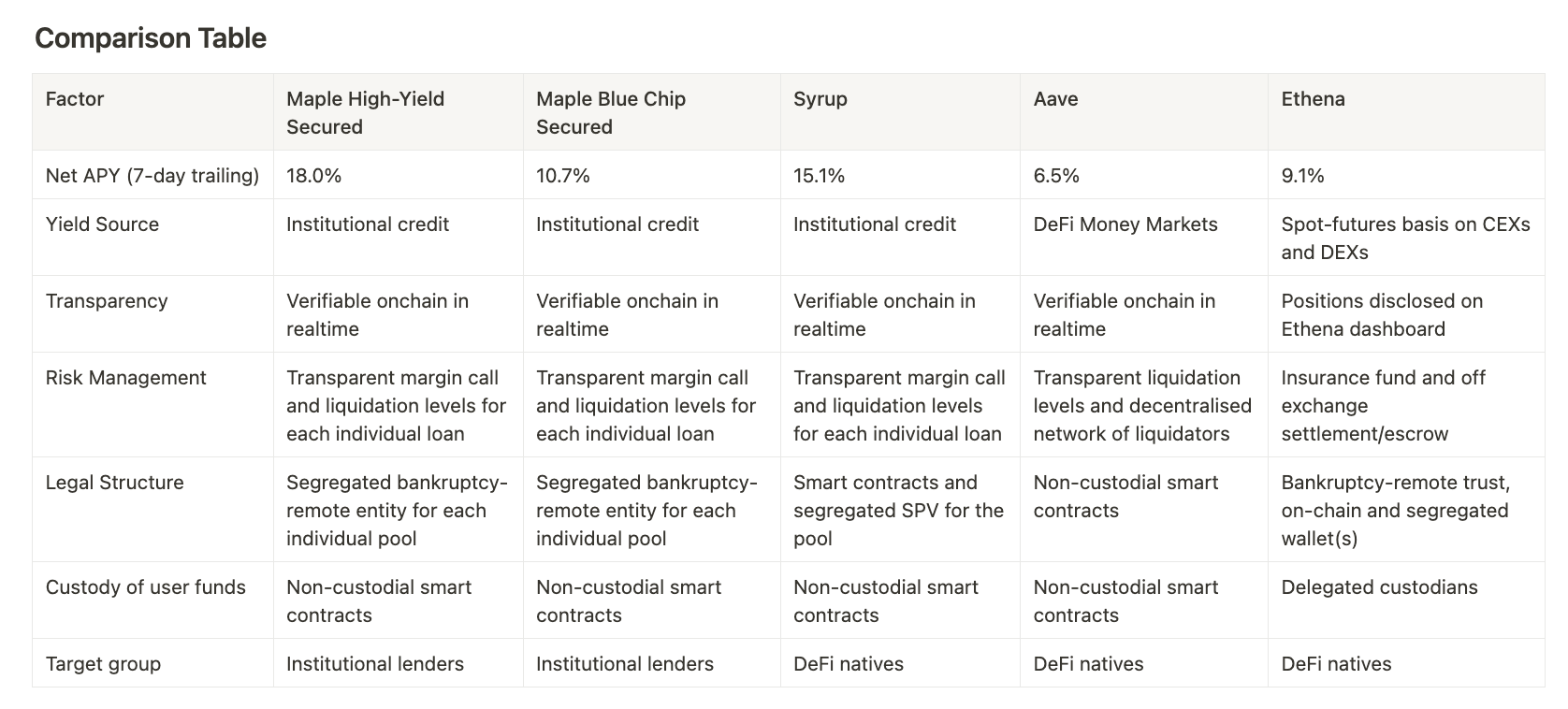

Maple’s digital asset lending platform sources yield from secured loans to institutions, and the Syrup protocol provides broader access to these institutional yield opportunities. All loans from Maple and Syrup pools are fully backed by select digital assets, which undergo rigorous risk assessment, and the permissioned nature of the yield source ensures both security and quality. Maple Blue Chip Secured pool provides the security of only accepting BTC and ETH collateral, held in qualified custody. Maple High Yield Secured generates a higher yield by underwriting loans backed by select digital assets and reinvesting the collateral in staking and/or secured lending opportunities; Syrup yield is derived from a blend of both.

Aave, also a decentralised lending protocol, primarily offers variable-rate loans with permissionless borrowers. Compared to institutional borrowers, these borrowers’ higher demand sensitivity contributes to greater volatility in yield for lenders, and these loans are non-recourse (i.e. a shortfall in collateral is not made-whole by the borrowers).

Ethena’s mechanism for generating yield is quite different, as it is not a lending strategy. sUSDe primarily accrues yield from the difference between spot and perpetual futures on BTC and ETH on centralised exchanges. These funding rates are highly variable and are correlated to market sentiment.

In this way, yield from Aave and Ethena is more closely linked to market movements, whereas Maple’s multi-strategy yield source, from lending to trading desks, funds and exchanges, tends to be more stable and consistent.

Yield Comparison

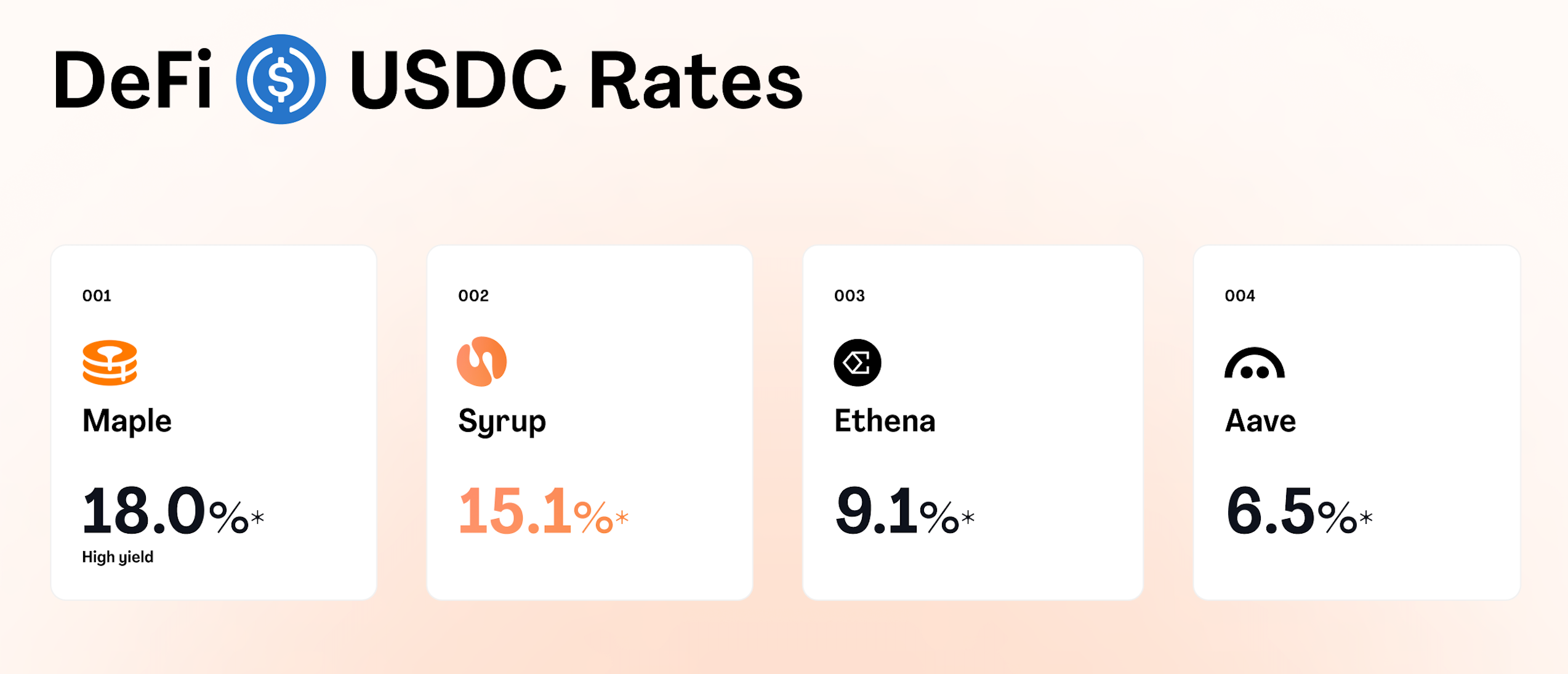

Over the last week, Maple and Syrup lending pools generated higher interest yield APY than other DeFi options including Ethena and Aave.

Maple's High Yield Secured pool returned *18.0%, Maple’s Blue Chip Secured pool delivered *10.7%, and Syrup yielded *15.1% (excluding Drip rewards). sUSDe averaged *9.1% APY, and Aave lenders received *6.5%.

For Ethena, lower perp funding rates have reduced the yield from running the basis trade recently. Meanwhile, Aave’s yield is correlated to short-term leverage in the DeFi ecosystem. In scenarios of deleveraging, pure DeFi lending pools end up with low utilisation (i.e. fewer borrowers and a surplus of capital), so interest rates fall. On-demand liquidity coupled with an ever-changing appetite for short-term leverage results in a volatile yield. Recently, this has led to Maple Blue Chip Secured outperforming (by approximately 4%).

Meanwhile, the fixed-rate, short-term loans that underpin Maple and Syrup’s yield have a stabilising effect on returns over time.

Diversification & Risk Management

High collateralisation with liquid assets held in custodians and onchain transparency are the pillars of Maple’s risk management framework.

- Maple’s network of crypto-native institutional borrowers pass rigorous KYC and credit underwriting. The loans are to capitalised counterparties and Maple's Secured pools are collateralised >150% on average, with loans visible on-chain, ensuring the transparency of the yield.

- Similarly, Maple’s fixed-rate loan terms, often with 30-day duration, reduce the impact of market volatility on lenders. Since all loans are backed by liquid digital assets, margin calls are managed by seamless transfer of collateral from borrowers.

Maple has constructed a segregated bankruptcy-remote entity for each individual pool to prevent commingling between pools.

Final Thoughts

In a more volatile lending and trading environment, there will likely be plenty of attractive yield sources drawn from unique arbitrage and credit opportunities.

What attracts lenders to Maple and Syrup is its diversified yield, sourced from overcollateralised loans to institutions. In recent months, this yield source has not only provided a more prudent alternative in a tepid lending and trading environment, but it has produced higher net APY as well.

The introduction of Syrup, further, is expected to make this institutional yield more ubiquitous in DeFi, contributing to a flywheel of institutional demand for on-chain credit and broadly accessible yields for USDC lenders.

Check it for yourself on maple.finance or syrup.fi

*7-day trailing Net APY