- syrupUSDC delivered excellent performance of 8.93% average total APY, outpacing all of its peers.

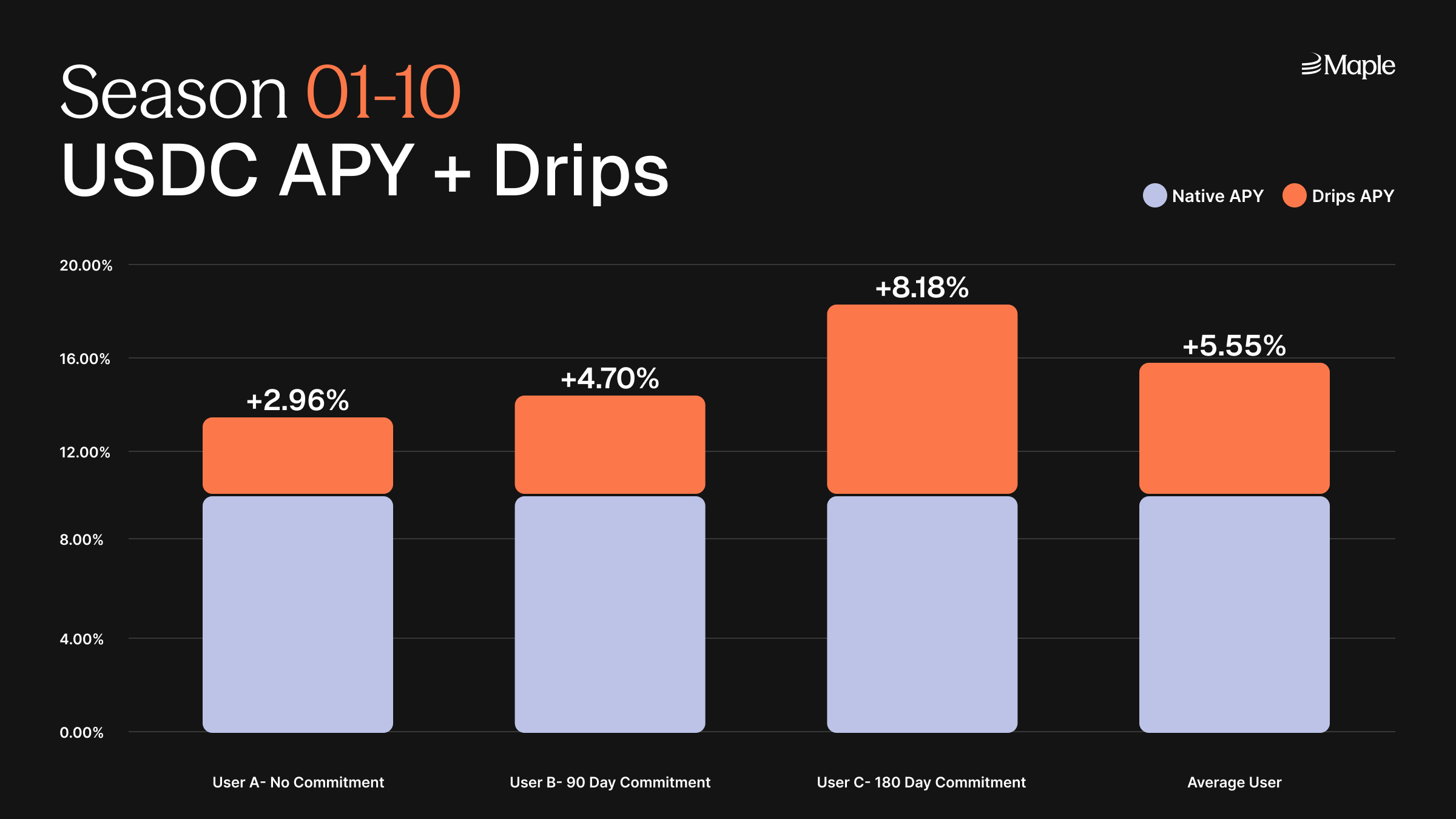

- Users got rewarded for Maple ecosystem growth, with Drips APY going up season-over-season for all users.

- Season 10 marked a period explosive growth for syrupUSDC. Its AUM reached $1.8B+, a 9x increase from Season 9.

- syrupUSDC expanded significantly into DeFi, becoming a top 3 yield bearing dollar asset.

syrupUSDC in Q2

syrupUSDC is now a top 3 yield bearing dollar asset with almost $1B in circulation. It is listed on many of the large money markets, and is going through the review process to be listed on Aave.

syrupUSDC has solved the yield trilemma in Q2, by becoming instant liquidity with a strong $200M+ liquidity buffer. Withdrawals have been serviced in under 5 minutes, making syrupUSDC instantly liquidity. This is due to syrupUSDC running a withdrawal bot to verify withdrawal transactions.

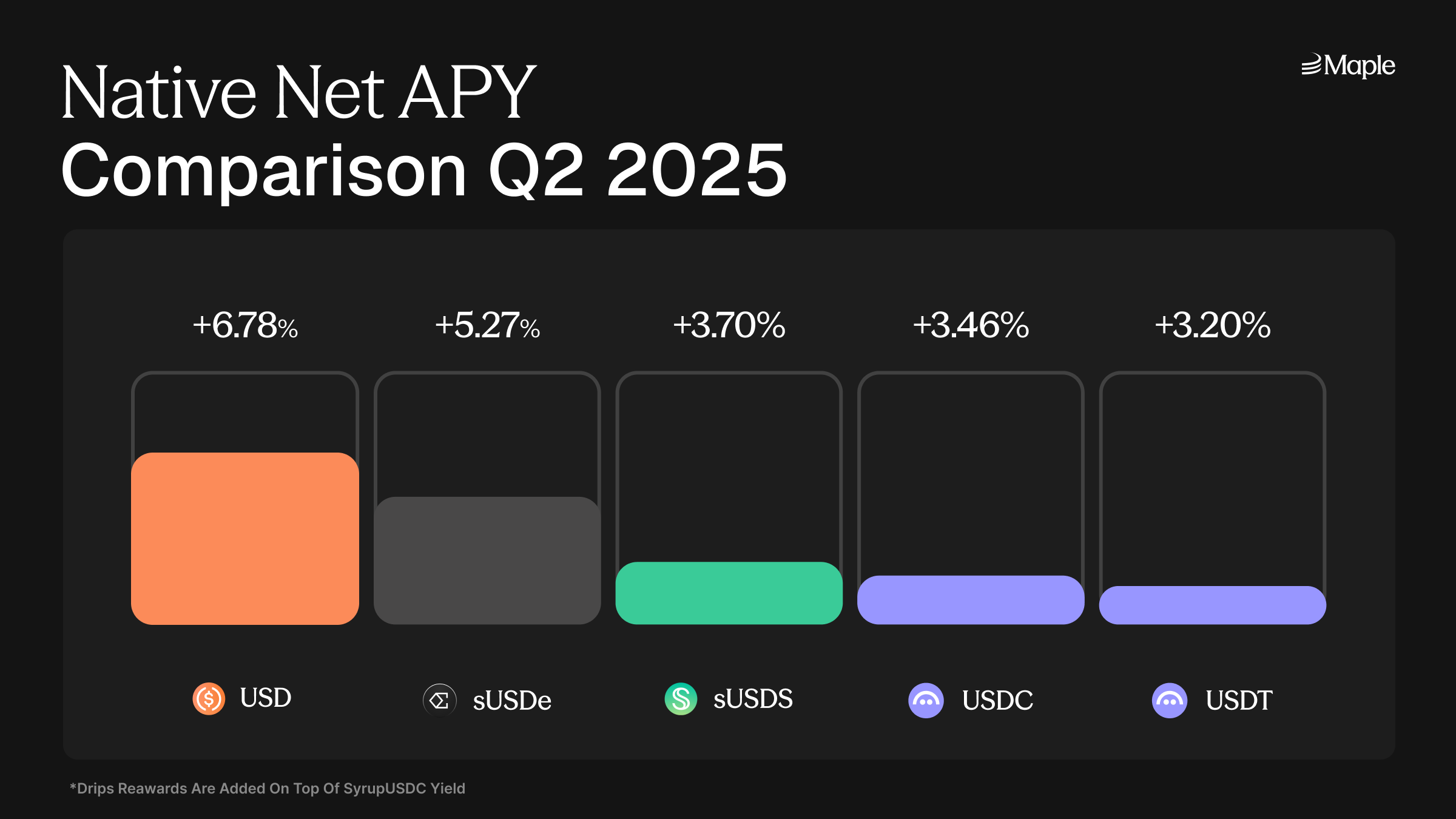

syrupUSDC has the highest yield at scale in the ecosystem, while being the most consistent and having institutional risk management underpinning its performance.

syrupUSDC performance

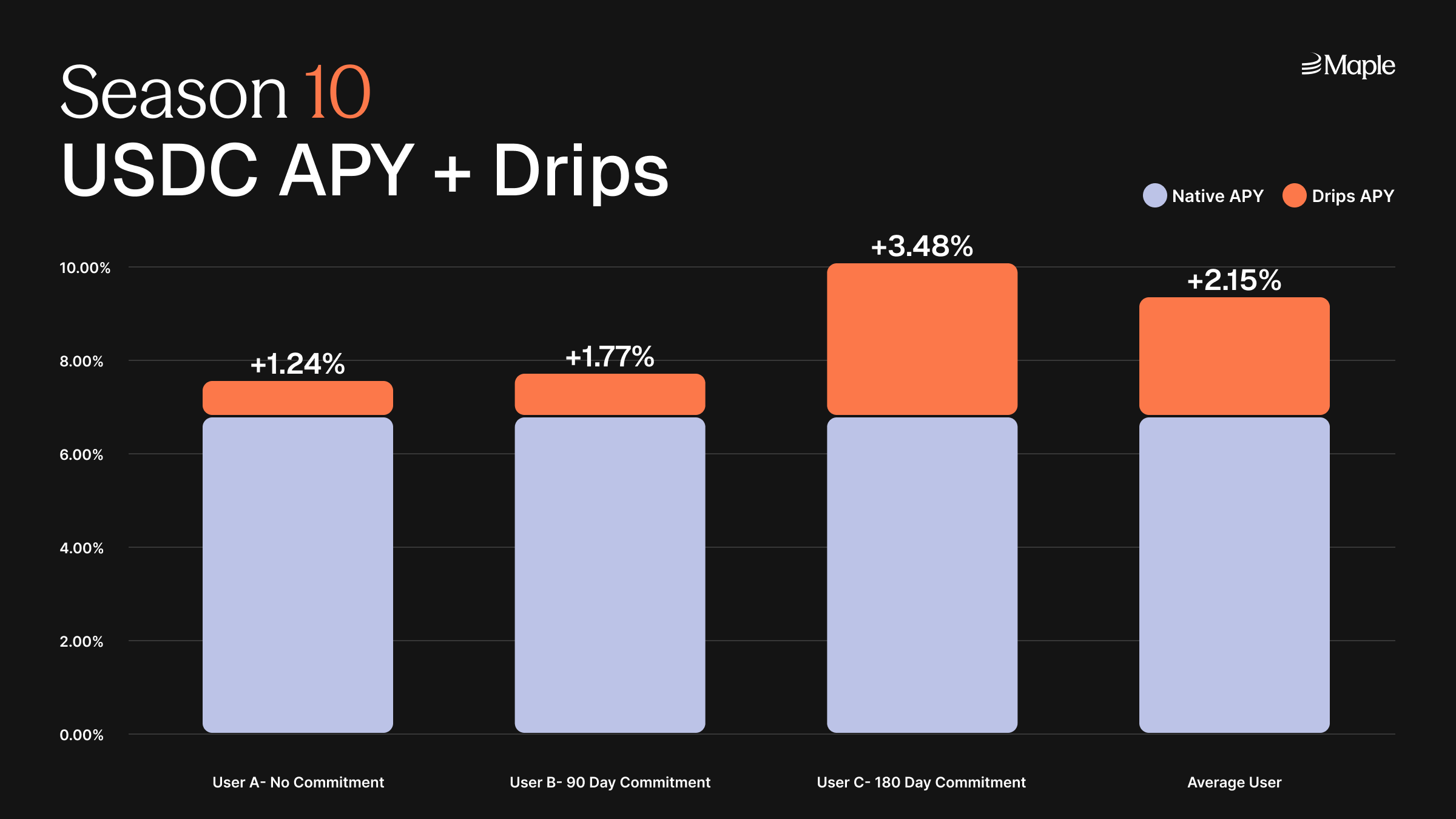

The native yield in season 10 was 6.78% net APY, outpacing peers by ∼2% resulting in a 30% outperformance. This is excluding Drips, which added another 2.15% on top for the average user for a total of 8.93%.

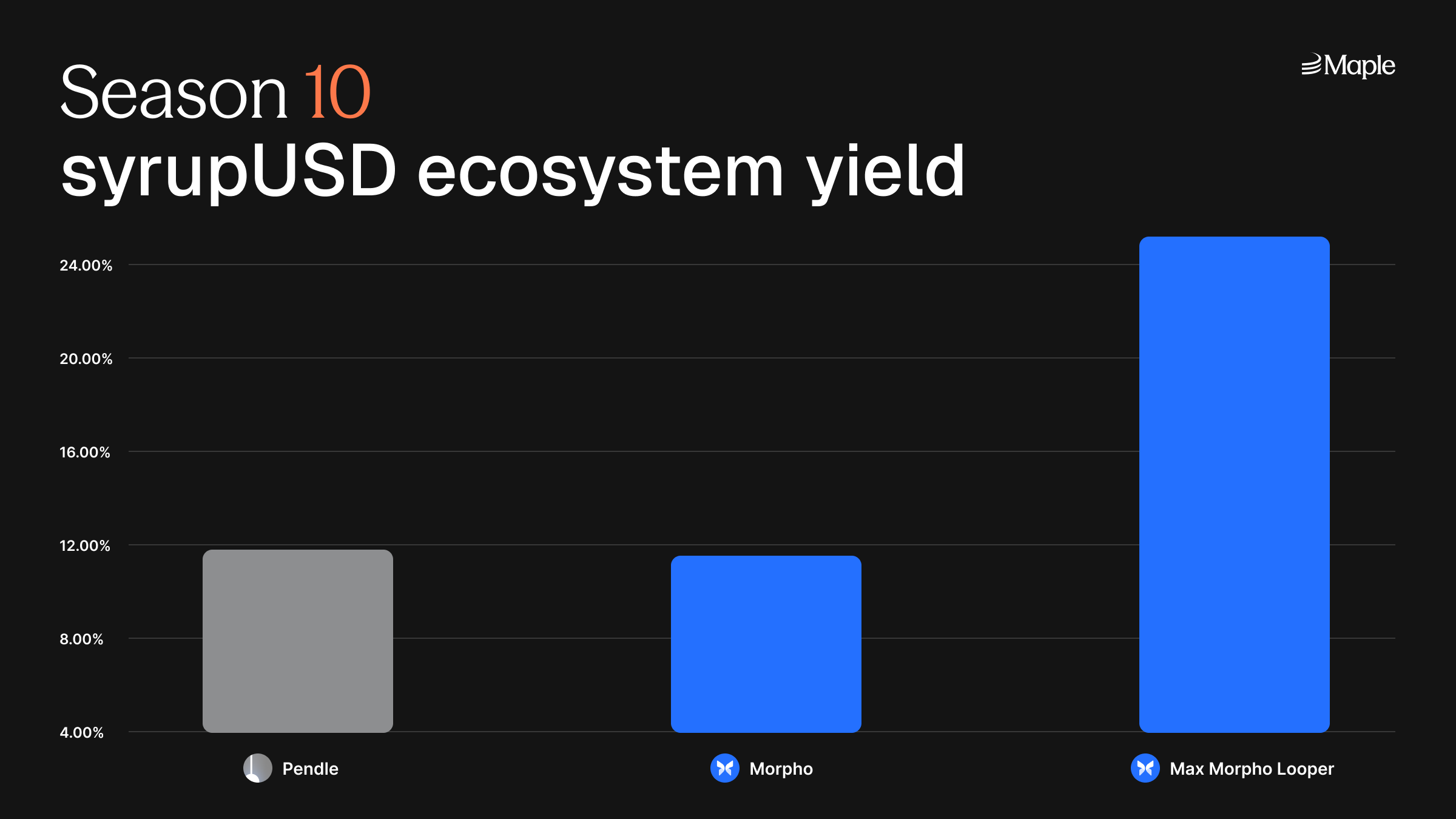

Some users earned substantially higher than that by using their syrupUSDC in DeFi and enhancing their yields, more about that in the section below.

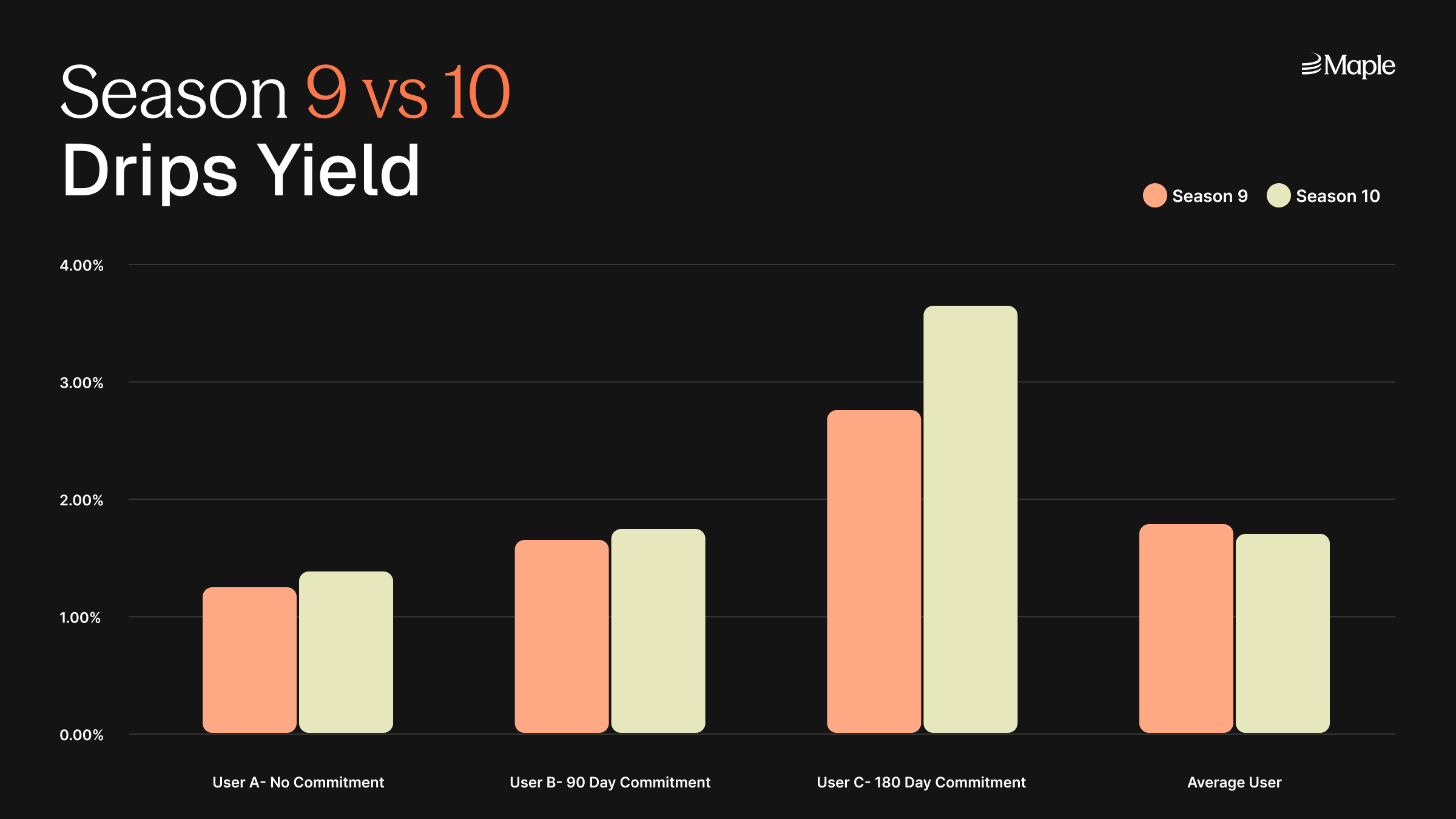

Season 10 Drips performance was higher than season 9, making syrupUSDC one of the very few points programs that actually increased its performance season-over-season, where most of crypto decreases it overtime. This speaks to the positive flywheel behind syrupUSDC with the Maple ecosystem growing and users directly benefiting from that.

syrupUSDC performed best amongst its peers in DeFi due to the consistency of the yield and the differentiated scalable yield source which is overcollateralized institutional lending. Please note that the additional Drips rewards are on top of the native net APY shown in the chart below.

syrupUSDC in DeFi

Q2 marked the true expansion of syrupUSDC in DeFi. Spark has deployed $400M+, over $200M+ is used in Morpho as collateral and the Pendle pool has grown past $125M.

syrupUSDC has also gone multi-chain, expansing to Solana and being the first Ethereum project to have a successful launch with now almost $70M of syrupUSDC circulating on Solana.

syrupUSDC holders have earned up to 30% on their various DeFi strategies, which include looping, liquidity provisioning and fixing or speculating on the yield with Pendle. Some YT buyers have earned upwards of 300% for buying the YT at the right time and due to the strong Drips performance.

syrupUSDC since inception

syrupUSDC has delivered a 10.62% net native APY since inception with an average Drips APY pick-up of 5.55%. This is one of the highest most consistent APYs at scale in DeFi, being recognized by users with the growth of the asset.

Claims and conversion ratio

The claim will go live on July 18 at 12pm UTC. Drips will be claimable on https://app.maple.finance/earn/drips. This is the only claim link. Please don't engage with any other link.

The conversion ratio is 20,000 Drips for 1 SYRUP. The program is focused on sustainable APYs and this ratio reflects the market dynamics while maintaining the yields. As the Maple ecosystem grows, users are rewarded for their participation. This is showcased with Drips APY going up from season 9 to season 10.

Season 11

Drips season 11 is live now with Drips continuing in Q3. Your deposits continue to accumulate drips.