Maple's Secured Lending product has seen tremendous growth in recent months. Total loan originations across Blue Chip Secured and High Yield Secured have surpassed the 150MM mark, and aggregate TVL has grown by over 70% in the last 30 days. The number of active lenders has nearly doubled, with new institutional lenders seeking yield, as well as existing lenders upsizing or diversifying allocations across multiple Maple products. Demand for these products has increased significantly in recent weeks as on-chain yields have decreased across the ecosystem following BTC’s peak in mid-March.

The growth and performance of both pools have been strong, but how do they compare to other offerings in the DeFi ecosystem? This is a question we have started to explore. And it turns out, quite well!

What the Data Shows

Aave USDC pools currently have north of $1 billion in deposits, and v3 is often viewed as the “base” rate in DeFi for stablecoins. By looking at onchain activity related to each protocol, we can piece together a historical comparison between performance of the two. Aave was the obvious first protocol for us to take a look at - and it turns out, so far so good for Maple’s two Secured Lending Pools!

On the Maple side, our Pool_v2 smart contracts have a sophisticated accounting system where the Pool’s total_assets is comprised of idle cash, outstanding loans, and all accrued interest. This value is used to find the Pool’s current exchange rate for every share (i.e. the amount of $ that each share, or LP token, is currently worth). This is as precise as it gets! And the steady increases of exchange rate over time, based on the issuance rate of the underlying loan contracts, results in the stable yield seen in our pools.

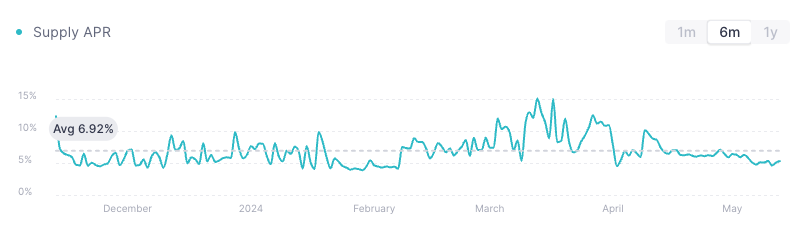

On the Aave side, the supply rate fluctuates based on borrow utilization in each pool (among other factors, including the proportion of borrows that are stable / variable, the reserve factor, etc.). Suffice it to say, this can lead to unpredictable returns for lenders over time. We quantified this by using the ReserveDataUpdated event, which is fired when the supply rate changes (e.g. upon deposit of USDC into the pool). By taking an average of all updates to the supply rate on each day, and converting to APY, we can back into a rough daily yield on the supply side historically. The number is slightly higher than Aave’s frontend display, but directionally correct. Take a look at the chart from the last 6 months in the v3 USDC pool.

Aave supply rates (APR) have averaged just under 7% over the past 6 months (source)

Notice the first few weeks of March: supply rates on Aave hovered around 15% for a few days as BTC ran up towards 70k and above. Since then, USDC rates (like much of the DeFi landscape) have compressed down to less than 6%. This is just a touch above the current SOFR rate!

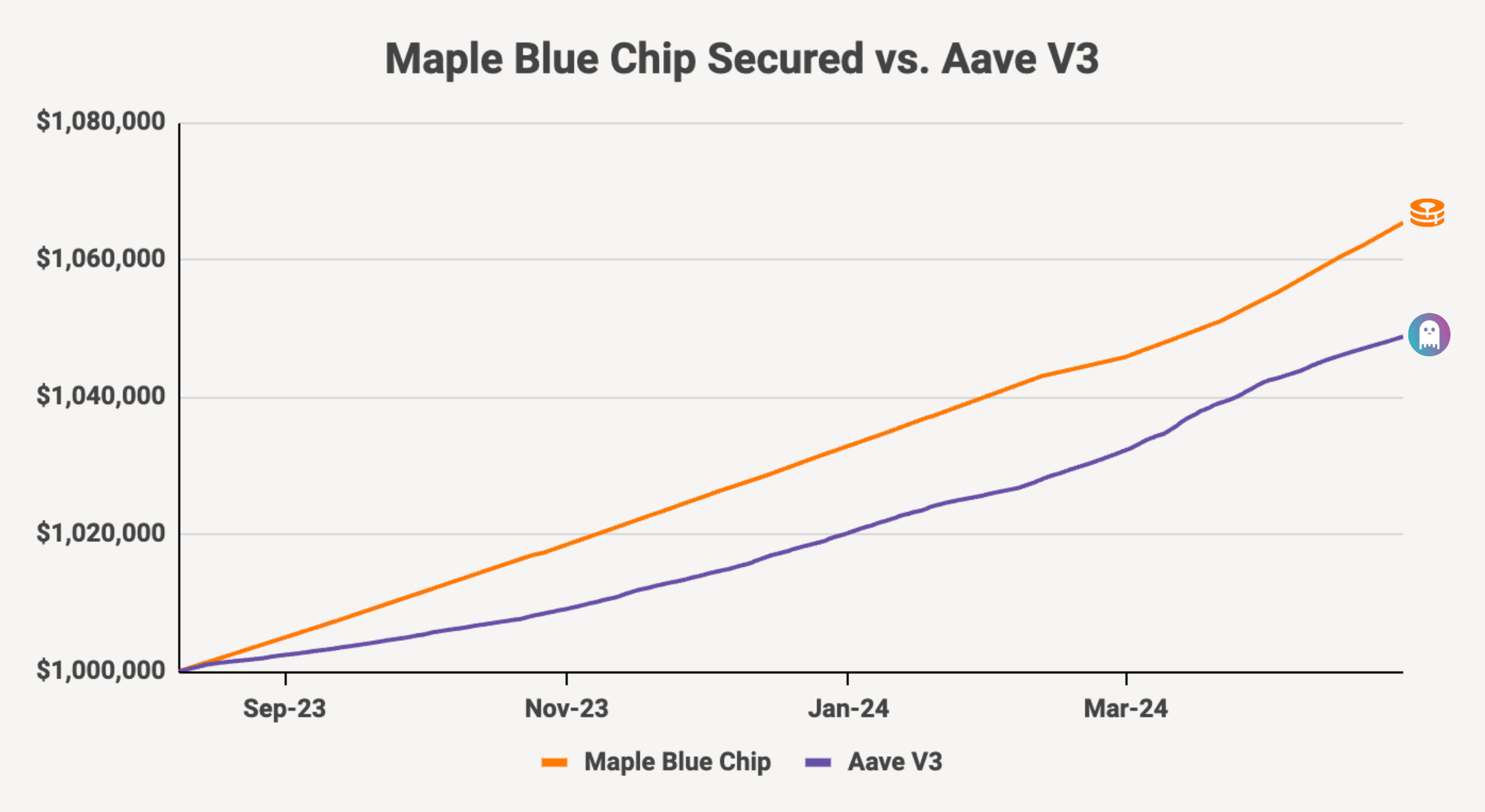

Although the Secured Pool may underperform during periods of high volatility when supply rates spike, averaged out over time results in a much more stable and smooth yield for lenders. And, as we’ve seen with rates coming down across the ecosystem, a higher yield from Maple over longer timeframes! Since inception of the Blue Chip pool, daily APY has been greater than Aave’s 80% of the time and the median daily spread above Aave is ~3%. The trailing 30 day APY in the Blue Chip Secured pool sits right around 12.5% net, with Aave at 6.1%. In Blue Chip, lenders have seen rates >12% over the last month and a ~9% net APY since launch in August of 2023. That’s quite the difference!

Growth of a 1MM USDC deposit since the launch of Blue Chip Secured in August 2023.

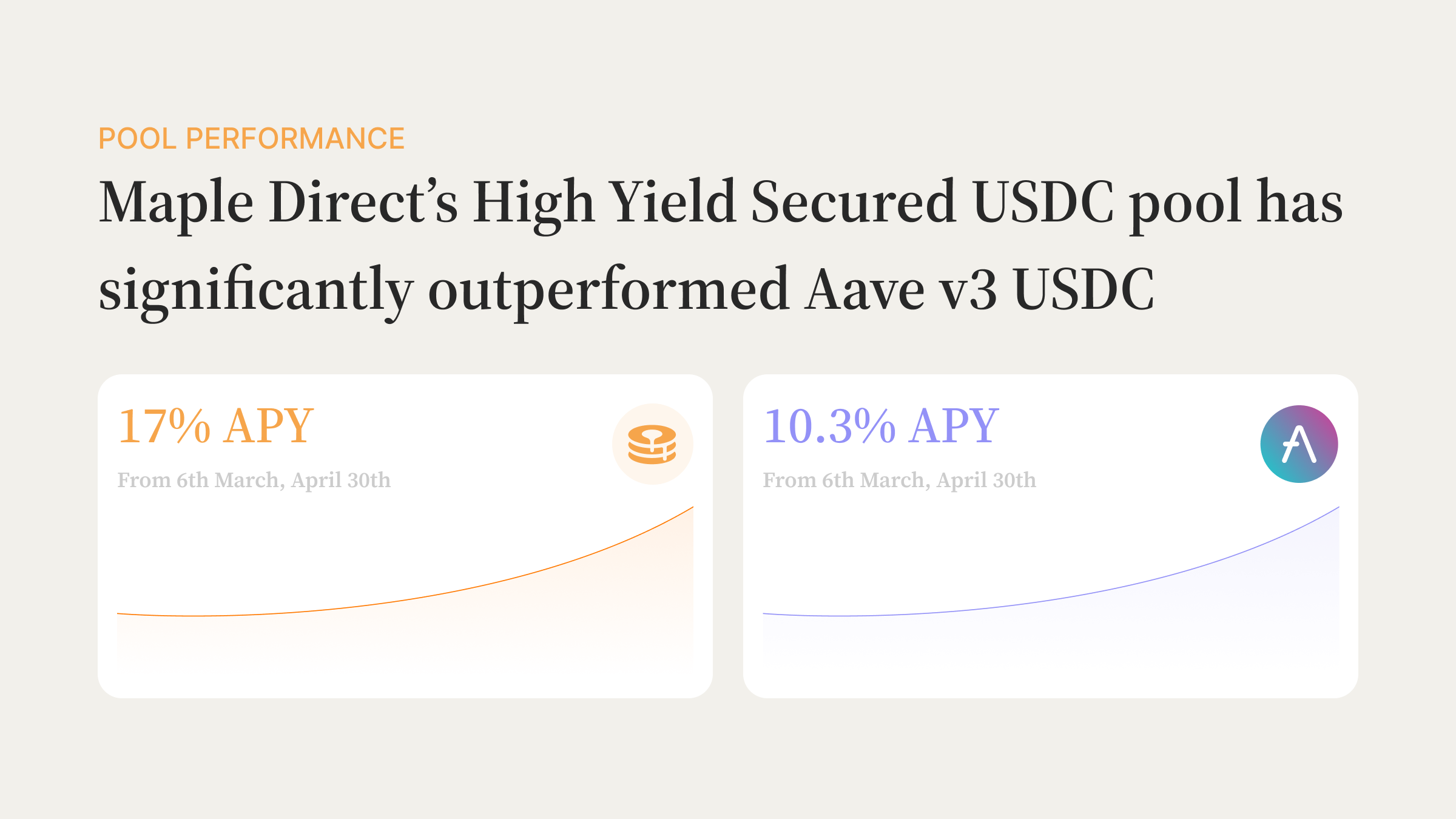

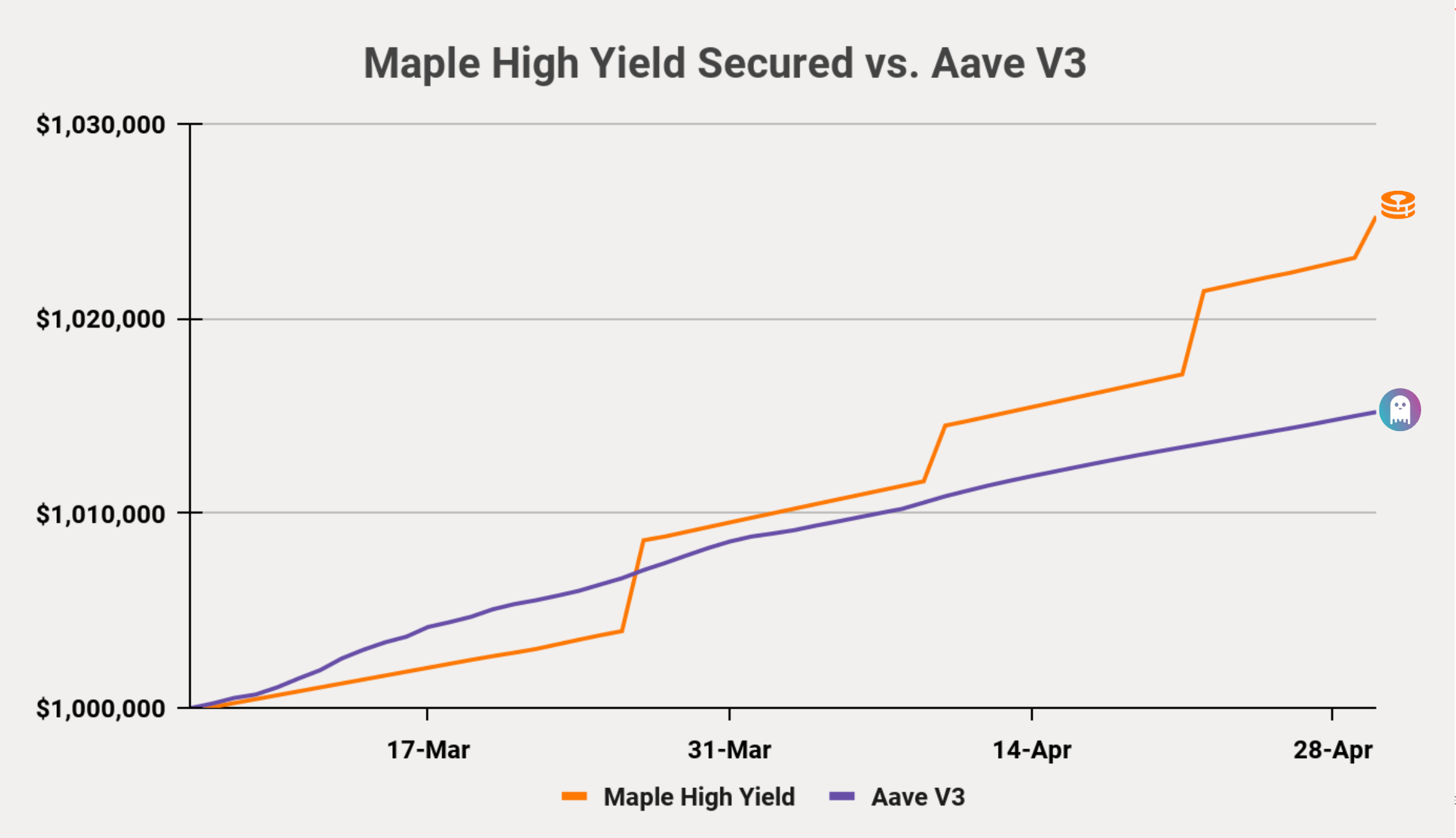

For the High Yield Secured product, these returns are even more stark. Although the Pool has only been live for two months, lenders have earned a net APY of ~17%, compared to Aave’s ~10%. This comes despite Aave rates reaching >15% during the highest volatility through those first few weeks of March. Currently targeting ~20% yields, the very first lenders in High Yield Secured have earned ~17% net APY since launch back in March.

Growth of a 1MM USDC deposit since the launch of High Yield Secured in March 2024.

Final Thoughts

While both of Maple’s Secured pools have demonstrated a track record of higher and more stable yields, there are other considerations from a lender perspective when deciding where to park capital. We believe both pools offer structural differences from Aave that can provide additional comfort for institutional lenders.

- KYC’d borrowers provide peace of mind that the other side of the Pools is a reputable, fully institutional firm that has gone through a full, comprehensive underwrite

- Furthermore, knowing the borrowers provides additional avenues for potential recourse (beyond posted collateral) in the event of default

- Specific loans in the Pool are transparently displayed with the collateral posted by the borrower for each specific loan; e.g. all loans across the two Secured pools are collateralized >150% on average

- Fixed mandate strategies of the Secured Pools allow our institutional lenders to choose in which assets their exposure lies; e.g. Blue Chip will only accept BTC & ETH as collateral

- Aave lenders may be impacted by bad debt on any number of borrow assets approved by the DAO

- Legal structure for the lender whereby their lending position is governed by legal documentation

And lastly, many of our lenders rave about the white glove service and direct 24/7 communication channel available to the Maple team. This leads to what we hope is always an exceptional experience, and one that we are always trying to improve. For example, to date all withdrawals from the Blue Chip Secured Pool have been processed in <1 day! Specifically an average of ~18 hours, from the moment of onchain withdrawal request to receipt of funds in the lender’s wallet.

Checkout the Maple Direct Secured Pools here: https://app.maple.finance