Introduction

Q3 marked a watershed moment for Maple, with Syrup redefining DeFi yields and reshaping the way institutions and DeFi natives earn yield on their assets. We saw unrivaled growth across the board, with active users soaring by 1,300% and deposits rocketing up by 1,176%. This isn't just growth—it's Maple leading the revolution in institutions coming onchain. Syrup began as a new DeFi product and in one quarter became a juggernaut, embedding its yields across the DeFi ecosystem.

The data and information in this report are intended for informational purposes only and are subject to change. The data provided are based on the status of the Maple Treasury on the 30 September 2024. All figures are shown in USD and based on the corresponding CoinGecko closing price. For more information, see the disclaimer linked below.

Relentless Growth

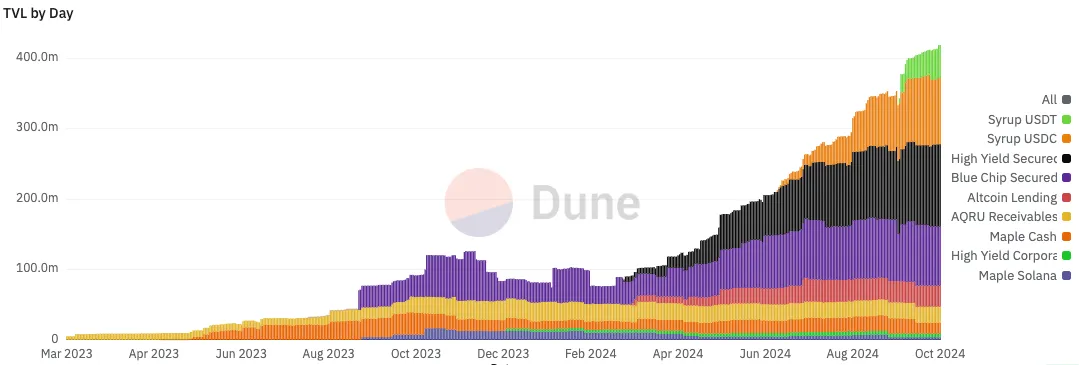

Maple continued to scale throughout the summer as asset prices ranged for months. Our Secured Lending products saw large inflows as those pools markedly outperformed the onchain yield landscape all summer long. Meanwhile, Syrup grew rapidly with strong traction and partnerships; in fact, both Syrup USDC and Syrup USDT were the fastest growing pools in Maple’s history since launch.

Not only did we deliver a 10x growth in TVL, but we did so with remarkable consistency, despite all of the market headwinds over the summer. The consistent and exponential nature of the growth speaks volumes about the strength of the platform and accelerating demand for Maple’s secured lending products. We've built something unstoppable.

- Grew TVL throughout the summer with Maple & Syrup up 69% Q/Q

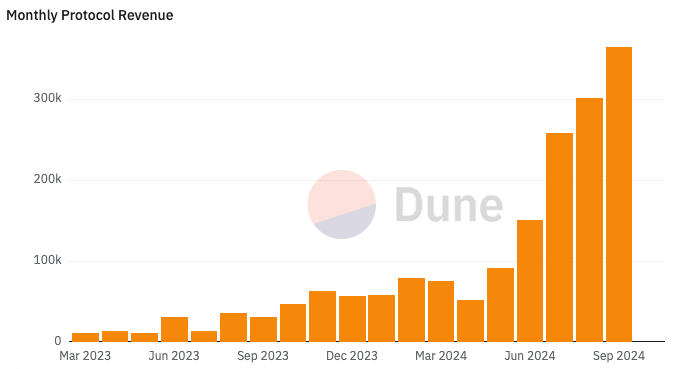

- Revenue paid grew 230% Q/Q to ~930k

- Total deposits increased by 106% Q/Q crossing 107M

- Active LPs on the platform grew 436% Q/Q following the success of Syrup

Maple’s TVL growth over the last 12 months was apparent as revenues caught up over the past 3 months. This was the strongest quarter of protocol revenues since launching the Secured Lending product back in 2023. Annualized revenue grew 106% Q/Q with paid revenue up 231% Q/Q. Strong revenue growth in Q3 further strengthens Maple’s position and allows us to continue investing in growth over the coming quarters.

Maple Institutional

Institutions are no longer just dipping their toes in the DeFi waters—they’re diving in. Maple has become the preferred destination for corporate treasuries and native DeFi yield funds, solidifying its position as the leading institutional yield platform.

It is not just the crypto-native institutions diving in, we see robust demand coming from TradFi institutions as well and a notable trend of more DeFi yield funds spring up across the board - all engaging with Maple and Syrup.

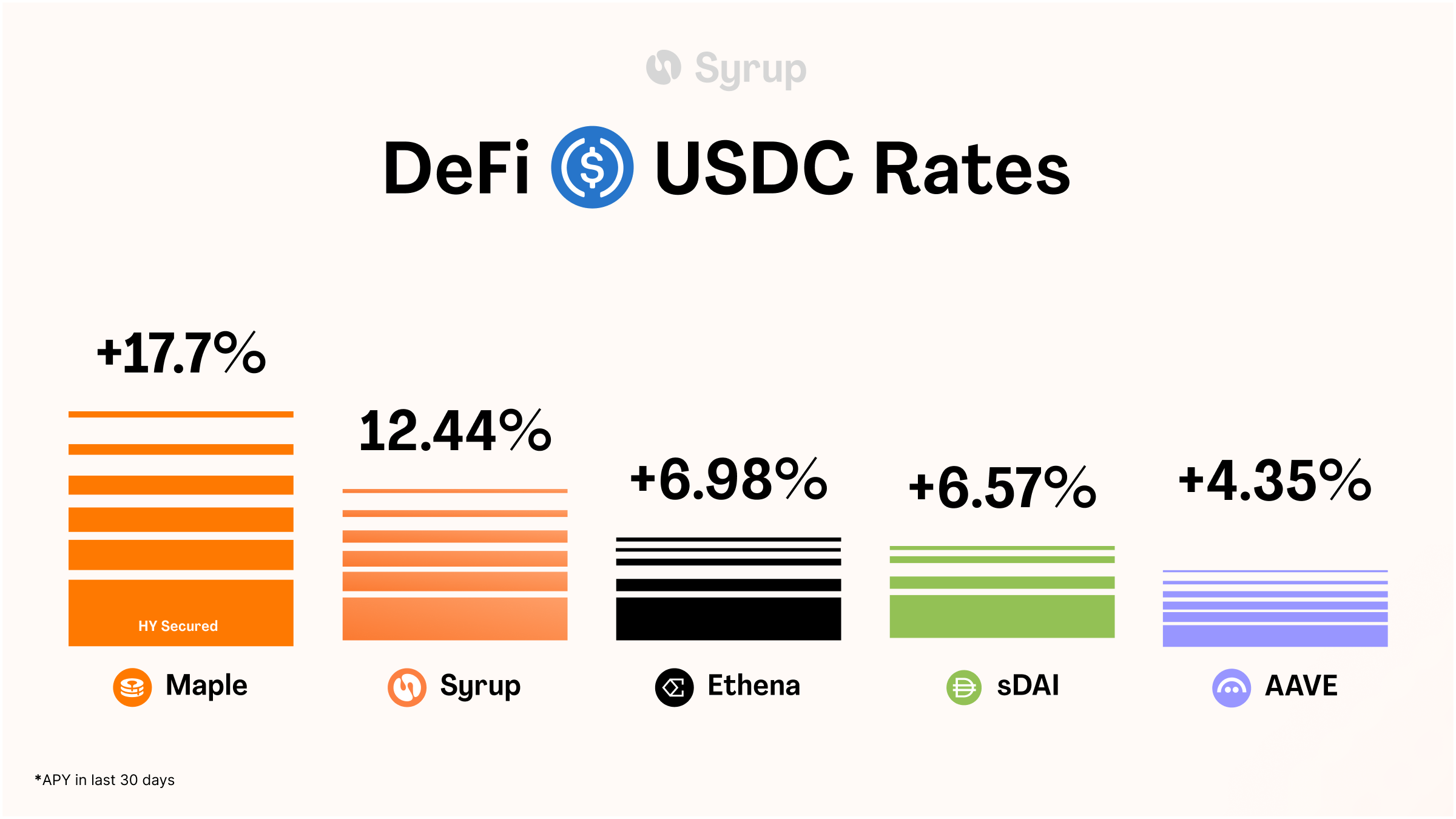

This graphic showed trailing 30 day yields as of 28 August across many yield protocols.

In September a couple of team members attended Token 2049, one of the most anticipated conferences to date. It was amazing to catch up with both existing users, partners and the wider community. Most notable was the strong demand from institutional players, we further solidified relationships with the leading institutions in crypto and have deepened our relationships to continue the accelerating growth of deposits and loan originations.

While Maple’s inflows were steady through the quarter, wider market price action was volatile at times, particularly in early August. In total, this quarter we issued 44 margin calls; receiving more than 35M in additional collateral in less than 3.5 hours on average. Our risk management systems operated as intended to protect lender principal, with all loans remaining overcollateralised throughout and materialising zero losses. This performance underscores the strength and reliability of the Maple protocol, team and tech stack, even in the face of market volatility. Importantly, more than 70% of deposits into Maple this quarter were from existing lenders; demonstrating the trust that our users have gained in the team through volatile times like these.

No new pools were launched on the Maple side, with all the focus being on growing existing pools. During future quarters new opportunities will likely be launched that involve other assets such as BTC, SOL and potentially other alt-coins and stablecoins.

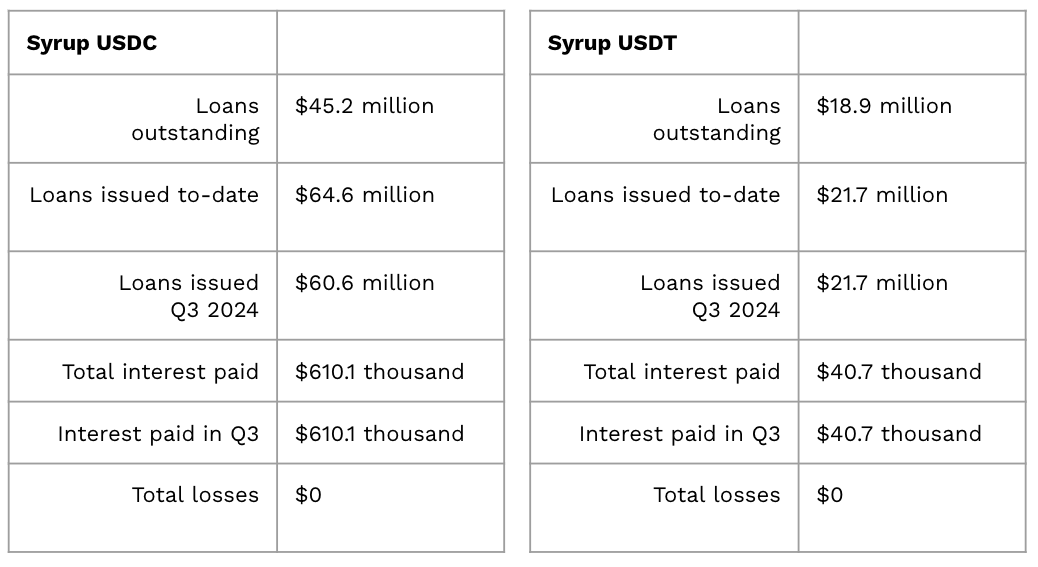

Syrup

After launching in early access in late Q2, Syrup was off to the races in Q3. From $10M in TVL for the USDC pool to start the quarter, Syrup scaled quickly to ~$160M by quarter end. This included the September launch of the second Syrup product, offering the same yields and drips for USDT holders. Syrup USDT eclipsed Syrup USDC as the fastest growing product in Maple’s history, crossing 45M in TVL by month end. Overall, DeFi users have fallen in love with Syrup’s significant yield outperformance and additional Drip Rewards, particularly as rates compressed across the ecosystem.

On the product side, the team shipped an updated Details page which allows users to transparently monitor each loan and its terms, as well as verify its collateral onchain 24/7. Additionally, the updated Drips page now gives insights in Drips accumulated as well as the tokens allocated each season.

One of the main priorities with Syrup is to integrate Maple’s lending engine with the broader DeFi ecosystem. Throughout the quarter, the Syrup team announced several key partnerships that further drive growth and utility for Syrup users and participants in other ecosystems. Some notable announcements include:

- The Ether.fi x Veda Labs partnership, where Ether.fi has now allocated 6M from their liquid stablecoin vault into Syrup.

- The Summer.fi x Ajna proof of concept and Balancer AMM integration to enable SyrupUSDC as collateral across DeFi.

- Wallet partnerships with OKX Web3 Wallet, Binance Web3 wallet and Exodus, allowing users to earn additional Drip rewards.

But — we are just getting started. Q2 is when Syrup was built, Q3 is when it launched, and Q4 is where Syrup will further solidify itself as a bedrock yield source across the DeFi ecosystem.

Roadmap

Looking ahead, the objective for Q4 is to continue scaling Maple Institutional with several key goals the team is looking to accomplish:

- Scale Institutional Lenders. We will continue scaling the number of institutional lenders both on-platform and through a rapidly growing deal pipeline. The appetite for secure, high-yielding products is only increasing, and we’re committed to capturing that demand by onboarding more significant institutional players at a record pace.

- Expand and Diversify the Borrower Network. We're not just growing our borrower base—we’re transforming the way institutional borrowers access capital. By broadening our reach and deepening relationships with high-quality borrowers, we’re creating an ecosystem where overcollateralized lending is the bedrock of sustainable yield generation.

- Launch a High-Demand Lending Product. We are gearing up to launch a new lending product designed to tap into strong institutional demand. This offering will expand our product suite and deliver significant value to our lender base.

On the Syrup side, the key priorities focus on scaling the user base and expanding the utility of the SyrupUSDC and SyrupUSDT tokens across DeFi:

- Accelerating TVL Growth. With TVL doubling each month, Syrup has reached break out momentum to continue its TVL growth by tapping into institutional and individual yield demand.

- Expand the Network. Continue to drive Syrup's reach in various crypto-native communities by collaborating with data providers, research groups and other channels to educate everyone on the unparalleled growth and product offering of Syrup.

- Enhance Utility and Integrations. Continue to foster and develop partnerships with other DeFi protocols and Web3 applications to increase the utility for both existing and new users.

Lastly, we’re extremely excited to launch the SYRUP token in Q4. Existing MPL holders will be able to convert their tokens into SYRUP and stake it to participate in the growth of the Maple and Syrup ecosystem. More information can be found here.

Protocol Financials

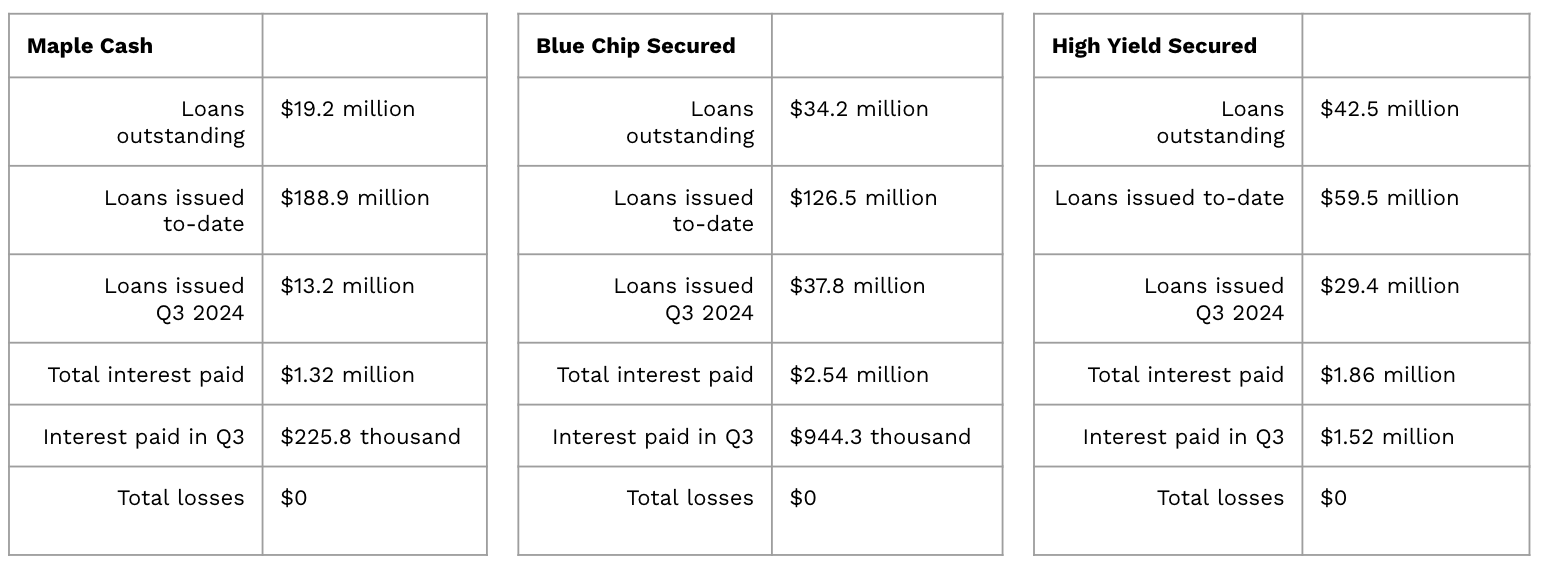

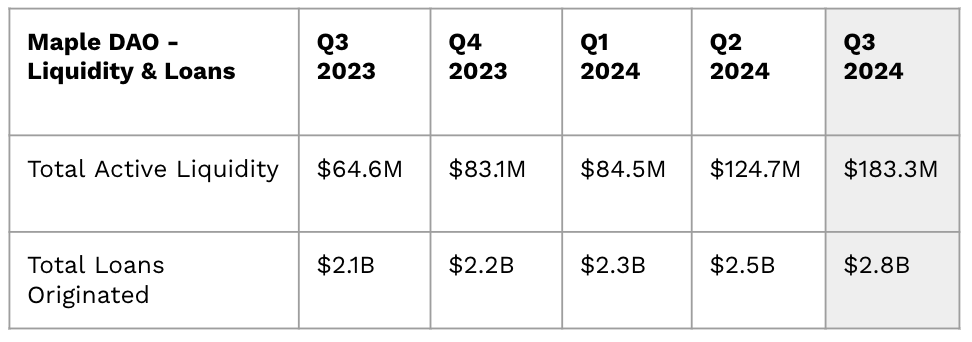

Table 1: Q3 Liquidity and Total Loan Originations

Table 2: Maple DAO Revenue & Expenses

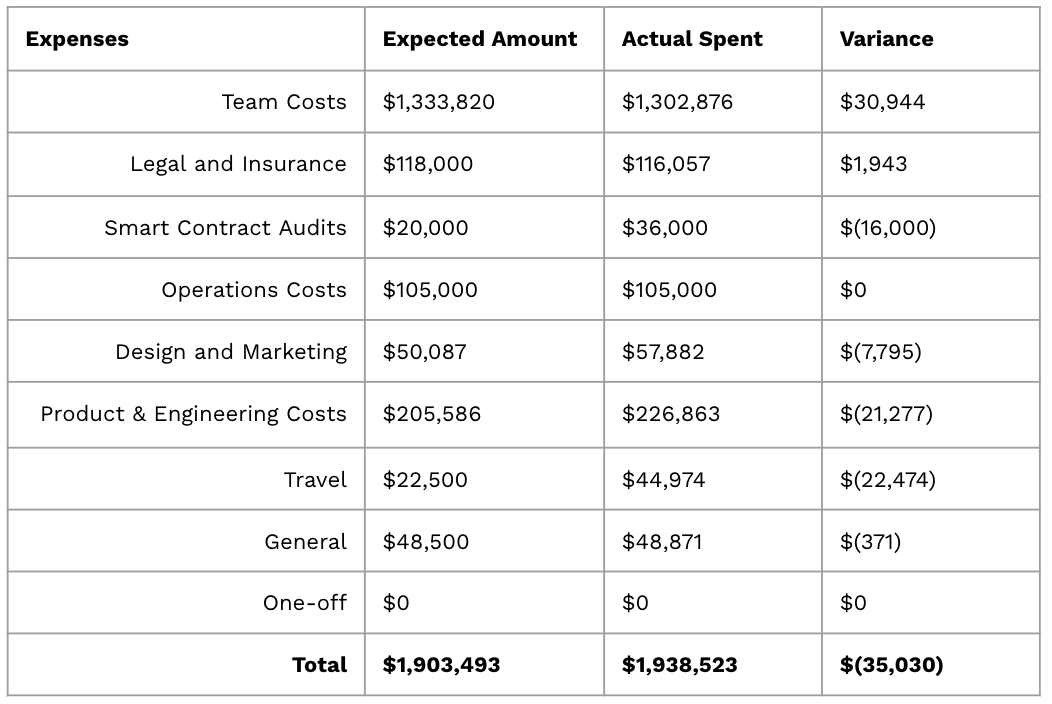

Q3 2024 Expenses

Table 3: Maple Labs Q3 Actual vs Budget Variance

Conclusion

After a Q3 marked by strong product delivery and ecosystem expansion, we are looking forward to a transformative Q4.

Remarkable growth across Syrup pools has fortified our confidence in the unique yield source Maple offers. With Syrup scaling rapidly and Maple's institutional products leading the charge, we're set to push the boundaries and continue to build our reputation for consistency and outperformance.

The SYRUP token launch and implementation of staking will unlock new avenues for community engagement, and our relentless focus on innovation will keep Maple at the forefront of the industry. The future is bright, and we’re just getting started. Join Maple on the journey to become the largest institutional DeFi platform today.

SYRUP Token Launch: November 13

Disclaimer: please note that Syrup is not available in the US and Australia.