In Q1, the team continued scaling Maple Direct amidst changing market conditions. We shipped and shipped some more. The High Yield Secured Lending Pool targets a 20% return for our lenders. Our brand new account system offers users a completely revamped login and onboarding experience. We unveiled our brand new marketing website, reflecting our institutional focus as we aim to become the home of digital asset lending.

The data and information in this report are intended for informational purposes only and are subject to change. The data provided are based on the status of the Maple Treasury on the 31st of March 2024. All figures are shown in USD and based on the corresponding CoinGecko closing price. For more information, see the disclaimer linked below.

Q1 HIGHLIGHTS

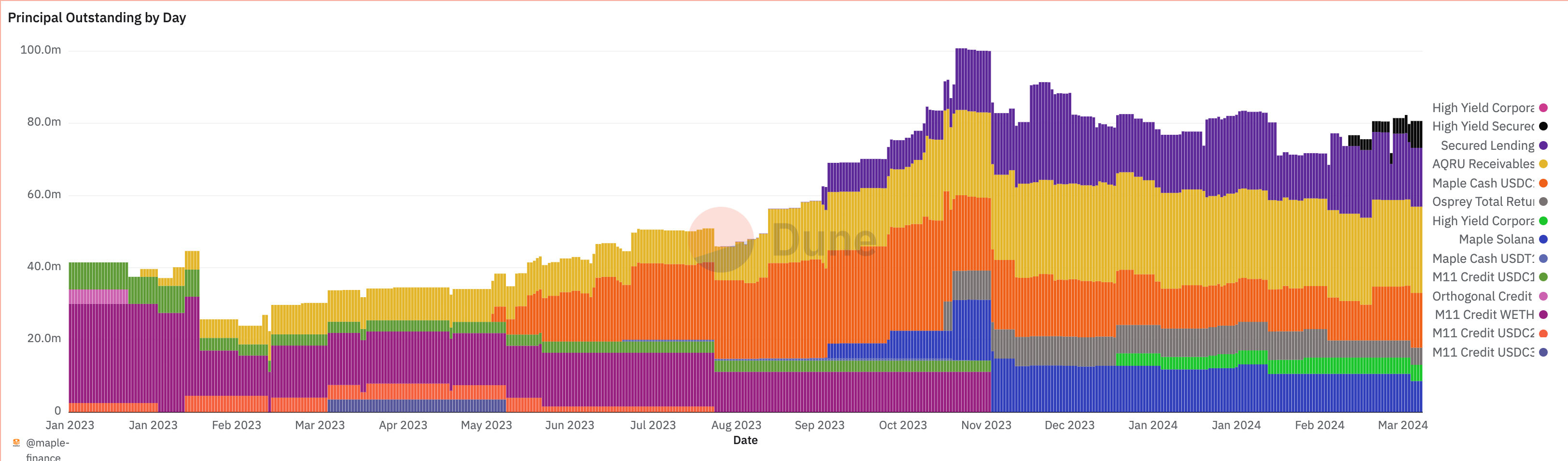

The first quarter of 2024 saw the team narrow its focus on Maple Direct as we aim to become the home of digital asset lending onchain. T-bill products continued to see outflows while outstanding loans for Direct grew 19% Q/Q.

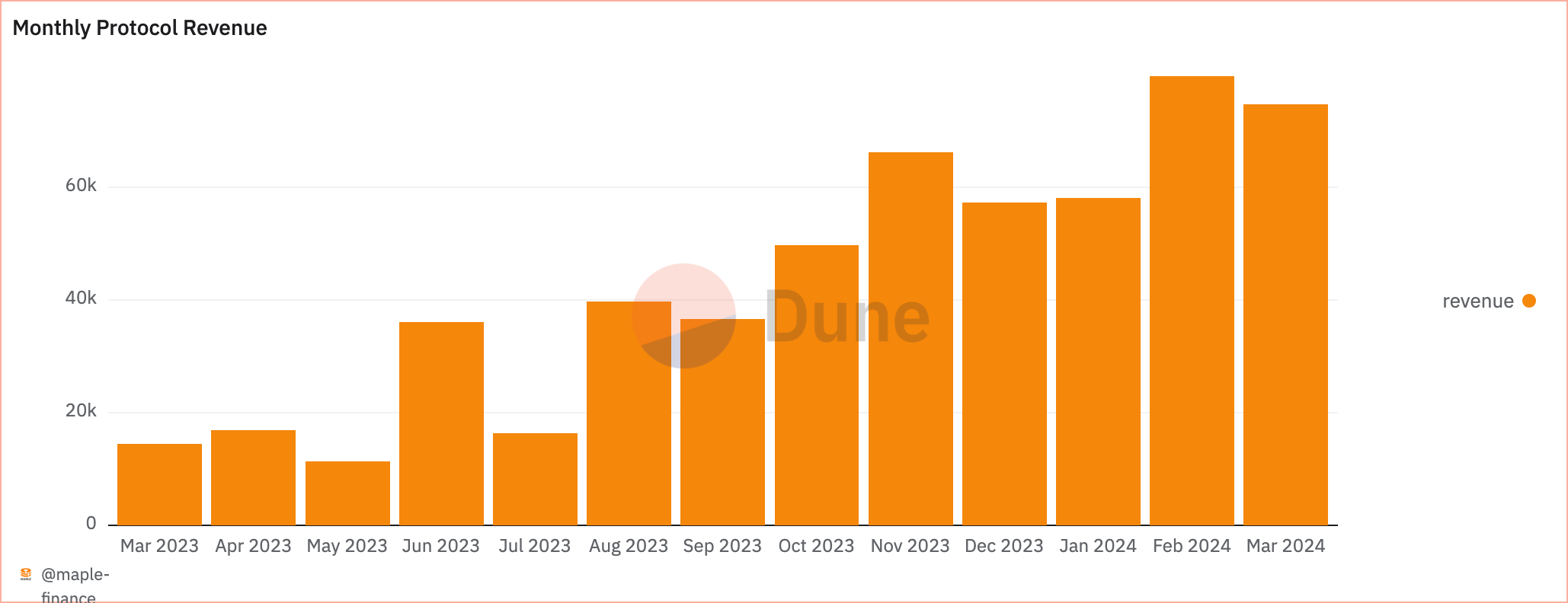

Revenues have continued to grow as margins for Maple are materially higher from Direct Pools. Q1 was the strongest quarter of the trailing 12 months, with revenue up +32% Q/Q. Annualized revenue numbers finished the quarter up 15% Q/Q and 271% Y/Y, and Maple Direct Pools now make up ~70% of our ARR.

Strategic Commercial Focus

7 months ago, we launched the first overcollateralized loan in our Secured Pool for $75,000. Fast forward through the end of Q1 and that Pool alone has facilitated more than $100,000,000 in loans originations and refinances. This was confirmation that both sides of the market appreciated the transparency and structure of this product. The team decided to lean into our Secured offerings and firmly believes we can fill the gap left by CeFi while improving on all the mistakes made in 2021-2022. Given the changing market conditions, it was also clear that another risk-adjusted higher yielding product was needed to complement the blue chip Secured offering.

Launch of the High Yield Secured Lending Pool

Following the success of our blue chip Secured lending Pool, it was clear the market demanded / market conditions required a higher yielding risk adjusted Pool that edged closer to 20%. In March, we unveiled our High Yield Secured Lending Pool, targeting a net APY to lenders of ~20%. Again featuring only overcollateralized loans, the Pool increases yields for Lenders through loans collateralized by alternative digital assets like SOL, where the collateral is then staked and returned to lenders as USDC.

Brand New Maple User Experience

This quarter we shipped a brand new account system, completely revamping the lending experience on the Maple platform. Institutional clients can manage their allocations, adding multiple wallets and users with a seamless new login system. Our new notification system provides crucial status updates and new opportunities for our lenders. The effort we put into these releases was reflected in the astronomical growth in new accounts. Last but certainly not least, we unveiled our brand new marketing website, designed to reflect our institutional and professional focus.

Closing

Sid and Joe hosted a webinar at the end of March to celebrate Maple’s progress, unveil our new website, and dive into the roadmap for the rest of 2024. The team is more focused than ever on refining the platform as we scale Maple into the home of digital asset lending. Expect to see the pancakes launching in new places, the return of staking, and many other exciting announcements this quarter!

Create your Maple Account here.

Q1 2024 HIGHLIGHTS

- Grew outstanding Maple Direct loans by 19% Q/Q

- Deposits into Maple Direct up 50% Q/Q

- Active LPs on the platform grew 29% Q/Q, with LPs active in more than one Pool +67% Q/Q

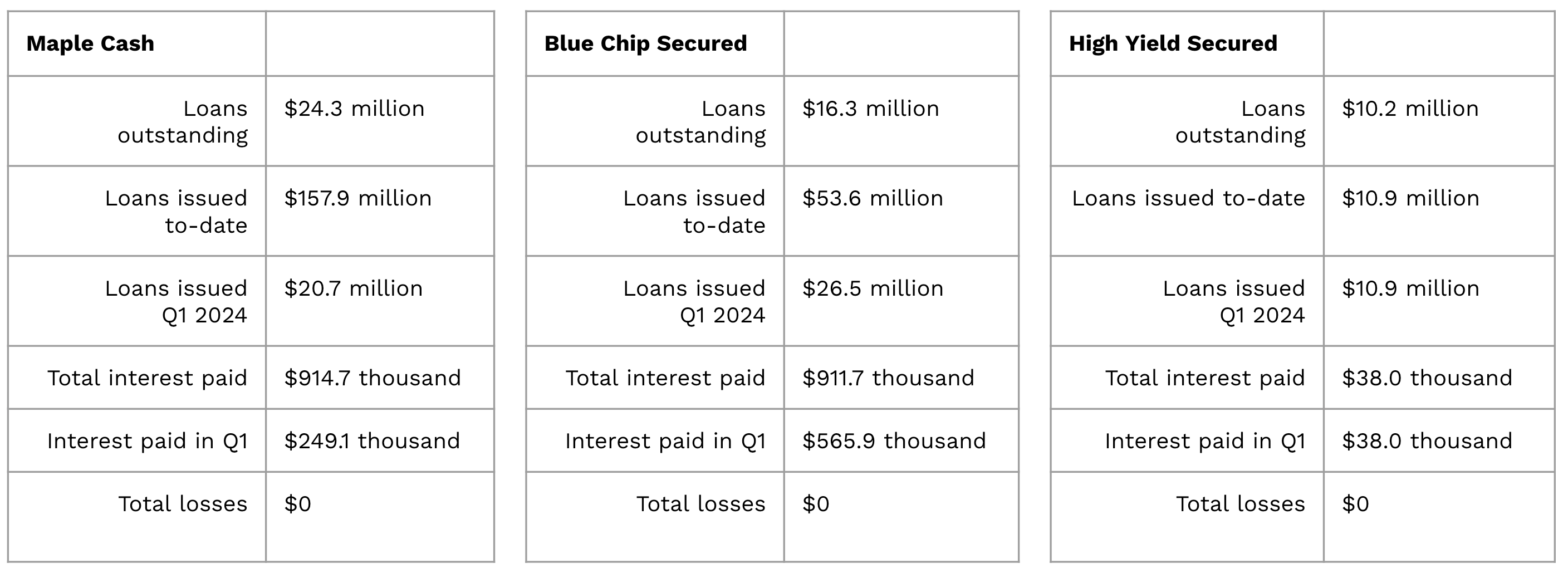

Table 1: Q1 Liquidity and Total Loan Originations

Table 2: Maple DAO Revenue & Expenses

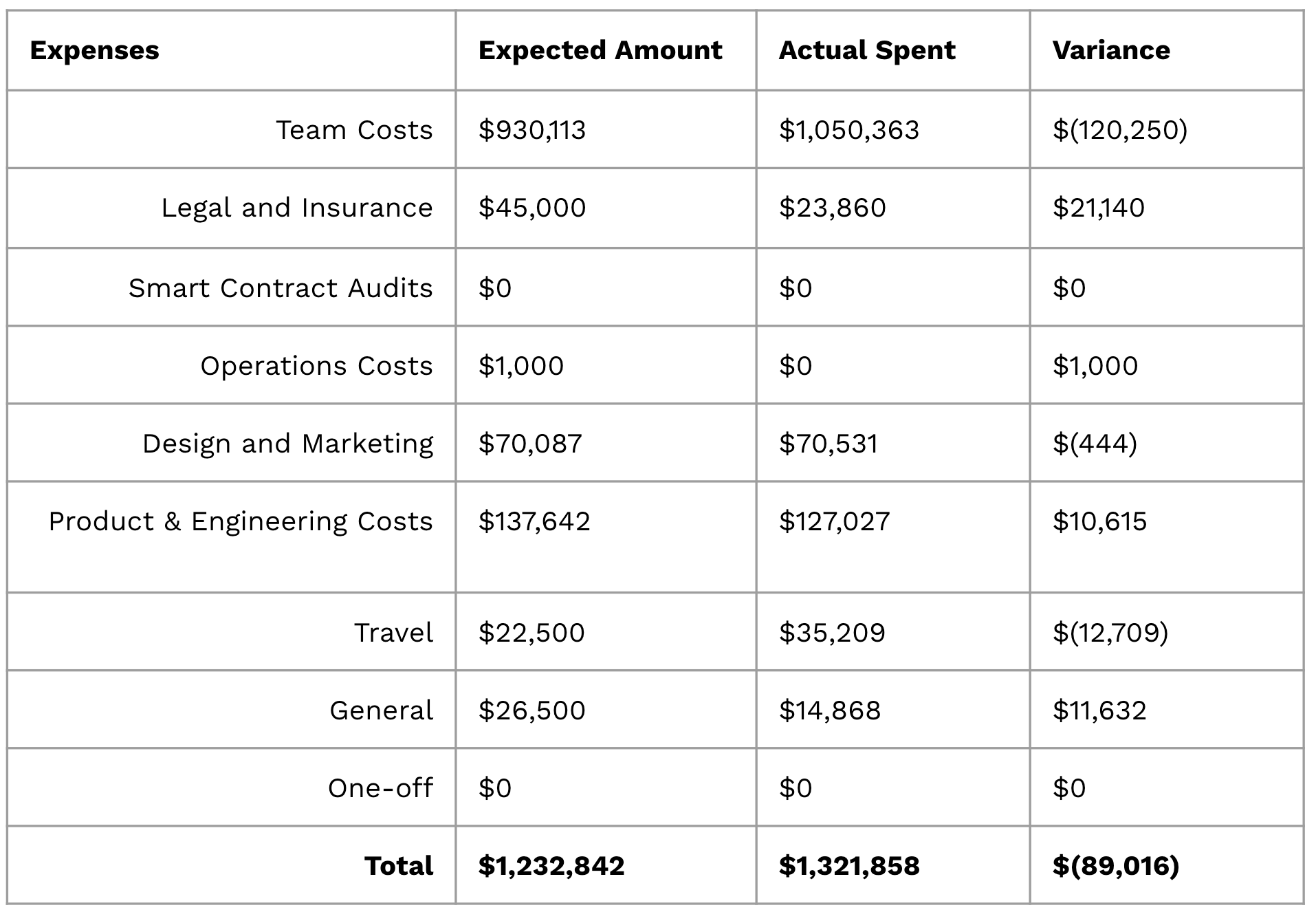

Q1 2024 EXPENSES

Table 3: Maple Labs Q1 Actual vs Budget Variance

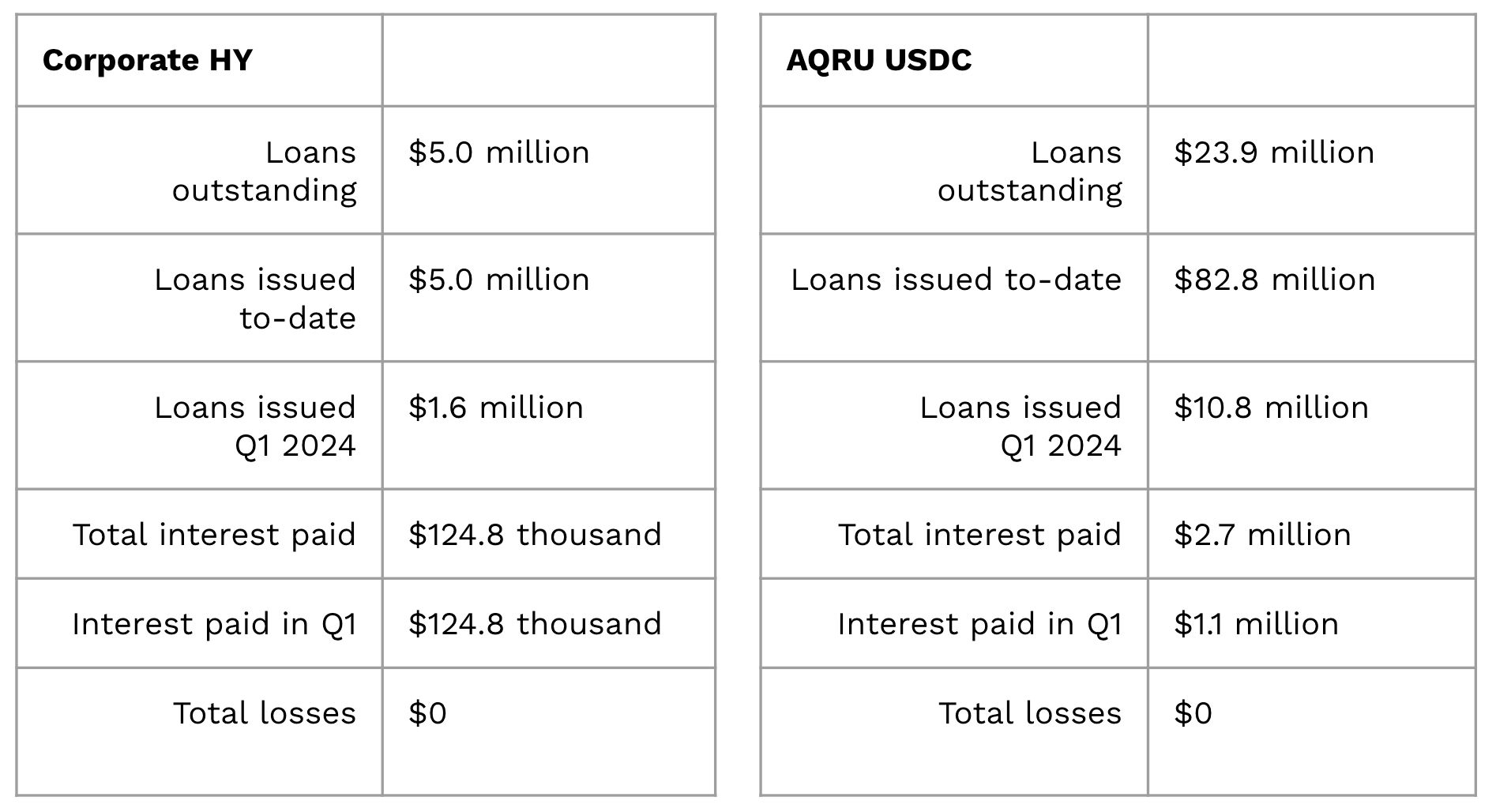

Table 4: Q1 Pool Statistics