Introduction

As we enter the final days of summer, with lower trading volumes and choppy price action, DeFi yields across the space have compressed as a result of reduced borrower demand.

Despite this, Maple’s Secured Lending strategies, including Syrup, have continued to see strong inflows as a result of significant yield outperformance.

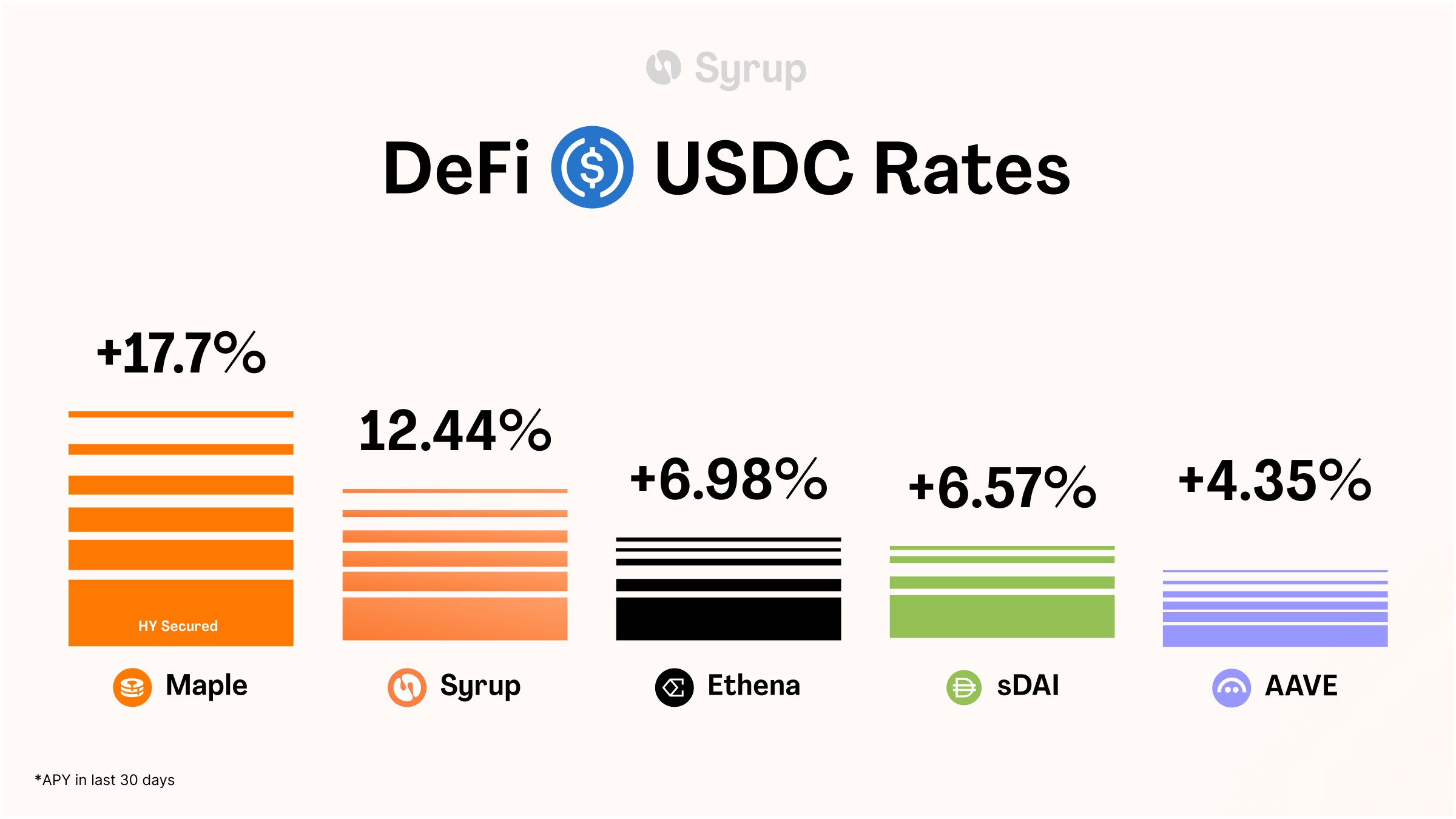

*Chart above based on trailing 30d USDC net yield on Ethereum as of 28 August 2024

Why do Maple’s offerings outperform?

Maple's Secured Lending strategy outperforms due to 4 key reasons (for a comprehensive review of our track record read this article ):

- Fixed rates. Maple and Syrup generate yield by issuing short-duration, overcollateralized fixed-rate loans to institutions. The Maple Direct team dynamically adjusts the composition of the loan book to offer the best sustainable yields available on-chain.

- High utilization. Maple and Syrup have consistently high utilization across the secured lending products. This is both driven by actively sourcing deals as well as tampering deposits when borrower demand is subdued, driving higher and more consistent yields for participating lenders.

- Consistent spread to onchain rates. We define relative targets, so our risk management strategies can withstand different market conditions. Our Blue Chip Secured pool targets yields ~4-5% higher than variable rate DeFi lending protocols (like Aave or Morpho). The High Yield Secured pool targets ~5-7% above Blue Chip Secured, and Syrup, as a hybrid of the two strategies, will sit in between the two.

- Clever duration management. When there is lower borrower demand, and market rates fall, we issue shorter term loans. This means we can enforce borrower repayment within 7-14 days, setting up flexibility to re-issue loans at higher rates when market conditions change. Shorter tenor loans also improve liquidity in a time when withdrawal needs are naturally more elevated than average. When the market is ‘hot’ and rates across DeFi are elevated, the team shifts tact to thinking about sustainability and long term outperformance. We begin issuing loans with longer time frames to lock in the higher yield environment.

These transparent, market-anchored targets coupled with our risk management frameworks described above prioritise long-term, sustainable outperformance, ensuring lenders on Maple and Syrup peace of mind they’ve chosen the best all-weather platform for their capital. We have the ability to say no to a borrower when the rate isn't high enough.

Conclusion

Maple and Syrup have a track record of consistently outperforming their DeFi overcollateralized lending peers through a combination of active management, high utilization and fixed borrowing rates.

To participate and start earning yield select the option below that is suitable for you.

For Institutional Users, create an account and complete a short KYC and accredited investor check at maple.finance to get access.

For non-US and non-Australia users, access syrup.fi simply by connecting your wallet, and earn USDC yield from overcollateralized loans with additional Drips rewards for committed capital.