Summary

- Both Maple Direct & Syrup lending pools offer above-market yields through secured lending to institutions

- Rigorous borrower underwriting and detailed collateral analysis ensure robust risk management and capital preservation.

- Continuous monitoring and advanced alert systems enable swift margin calls and collateral liquidation to protect lender funds.

- Yield generation is enhanced through liquid and native staking, with full transparency provided to lenders.

- Liquidation processes involve collaboration with leading OTC desks and potential use of CEXs or DEXs, ensuring swift execution even when collateral is used to generate additional yield.

Introduction

Both Maple Direct & Syrup lending pools generate above-market yields for lenders by issuing secured loans to institutions, overcollateralized by liquid digital assets.

As part of these strategies, the collateral pledged may be used to generate additional yield that is passed back to lenders.

In this article, we will take a deeper dive into our institutional-grade collateral management process employed to protect lender funds. The Maple Direct team has leveraged extensive traditional finance experience to create robust procedures and controls with a focus on risk management and capital preservation.

Prior to any loan being issued, there are two key pieces of analysis that are always completed first:

Borrower Underwriting

Before any borrower is approved to access financing on Maple or Syrup, they must complete KYC/AML checks and go through a rigorous underwriting process. This includes a review of financials, interviews with management to understand use of proceeds, and an analysis of their operational capabilities. The key elements we look to identify are:

- Strength of the borrower’s balance sheet - i.e. are there assets on hand to meet multiple margin calls in a row if the value of collateral falls?

- Does the borrower have the operational sophistication to meet margin calls quickly in a falling market environment?

Collateral Analysis

Before any collateral is accepted as eligible, the asset itself also goes through an in-depth approval process. At this stage we consider three main items:

- Liquidity: what are the available venues to liquidate a given digital asset, what are historical daily trading volumes, and how liquid are these markets?The answers to these questions guide the team on appropriate collateral ratios, liquidation workflows, and position limits. Assets without acceptable liquidity are not eligible, and concentration limits are applied across the loan book so that Maple will never be too large a portion of a given market (minimizing slippage).

- Historical volatility: what is the maximum 24 hour historical drawdown of a given asset in various market conditions (e.g. COVID or FTX type crash)? How does the market price future volatility in this asset today? (looks at options market) Are there any relevant unlock schedules to consider? (this may change the behaviour of a market going forward). This is an important input into acceptable LTV thresholds - i.e. more volatile assets require higher collateral-to-loan ratios

- Technical review: particularly in the case of DeFi tokens (e.g. LSTs, LP tokens etc.), Maple’s industry leading smart contracts team completes a detailed analysis of the underlying protocol (e.g. Lido, Pendle), including a review of previous audits and code architecture.

Once internal approvals on the underwrite and collateral type have been met, the team sets tailored terms for the borrower. These terms include eligible collateral asset, LTV thresholds etc.

All collateral is held with institutional grade custody solutions (e.g. Anchorage, BitGo, Zodia), and Maple provides on-chain addresses for lenders to verify the collateral details for each outstanding loan.

Once a loan is live, ongoing risk management is critical. Both of the items above are monitored throughout of the life of the loan to ensure there are no significant changes to borrower financial health or collateral liquidity.

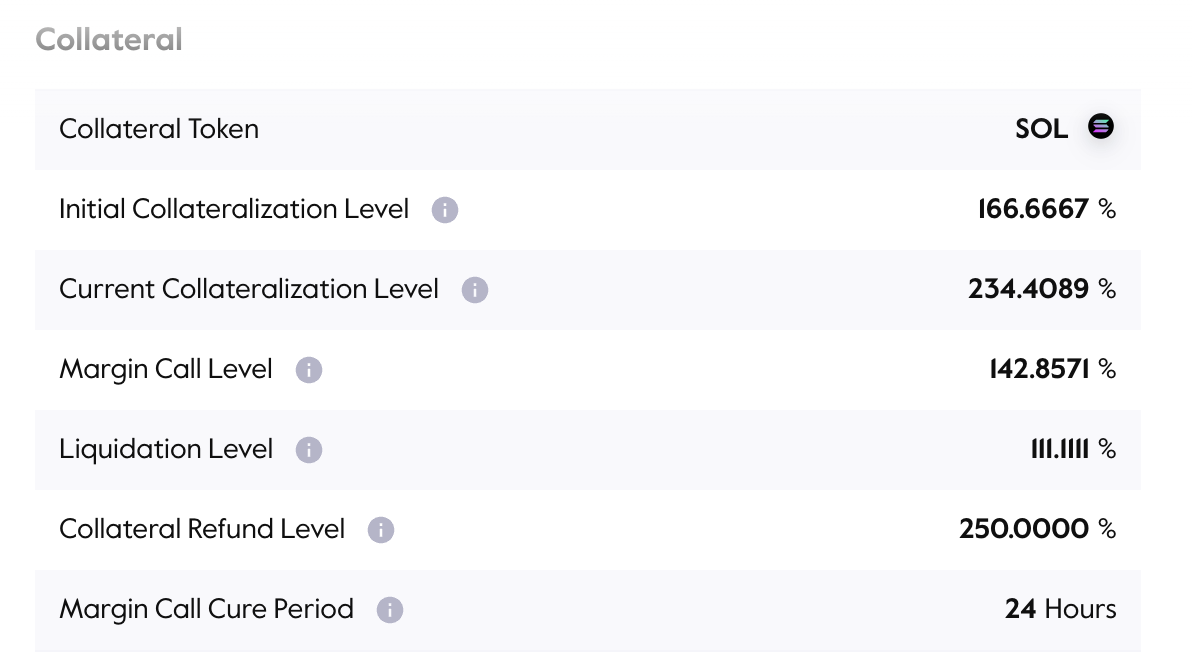

The Maple Direct team actively manages the health of the loan book through margin calls and liquidation levels, always set conservatively above 100% collateralization to protect lender funds (example below).

Margin Calls

The Maple Operations team has a proprietary alert system in place with three separate sources for price feeds, and a 24/7/365 live monitoring process.

If collateral value falls to the Margin Call Level, the borrower is automatically notified and has 24 hours to top up and restore collateralization to the Initial Collateral Level.

If they fail to do so in time, Maple liquidates their collateral as part of the legal agreement with the borrower.

Liquidation Levels

At any point, if collateralization reaches the Liquidation level, even if a margin call is in process, Maple has full rights to liquidate collateral to protect lender principal.

How Liquidation Works

Maple has partnered with a number of leading OTC desks to enable swift execution in a falling market environment, and this is the preferred method of execution. By using OTC desks, price can be agreed immediately and the trade settled subsequently whilst assets are moved on-chain. If needed, the team also has the ability to withdraw to CEXs or DEXs to liquidate instead.

Liquidations have been rare because of the quality of the underwrite - the borrower’s ability to meet margin calls quickly is checked pre-issuance as mentioned above, and monitored on an ongoing basis. Historically, margin calls issued over the past year have been met in a matter of hours by borrowers, and in many cases they elect to top up in advance of a call being issued.

How is collateral managed in cases when it is being used to generate additional yield for Lenders?

Maple can stake collateral and pass on a portion of the yield to lenders to enhance yield.

- Staking: there are two main ways Maple stakes digital assets to earn rewards:

- Liquid Staking: Large, reputable LSTs are used (following the review and sizing process described above) to enable immediate sale in a liquidation event.

- Native Staking: Given concentration limits apply to LSTs, Maple also uses institutional grade staking providers, such as Figment, to stake assets natively. We only work with compliant staking solutions that have insurance coverage and other necessary protections built into the offering.

- In these cases, careful consideration is given to unbonding timelines (e.g. SOL has a 1 epoch - generally a 2 day period to unstake). Due to our set up with OTC desks, Maple can liquidate natively staked SOL by agreeing a price immediately and settle the trade subsequently when the unstaking is complete.

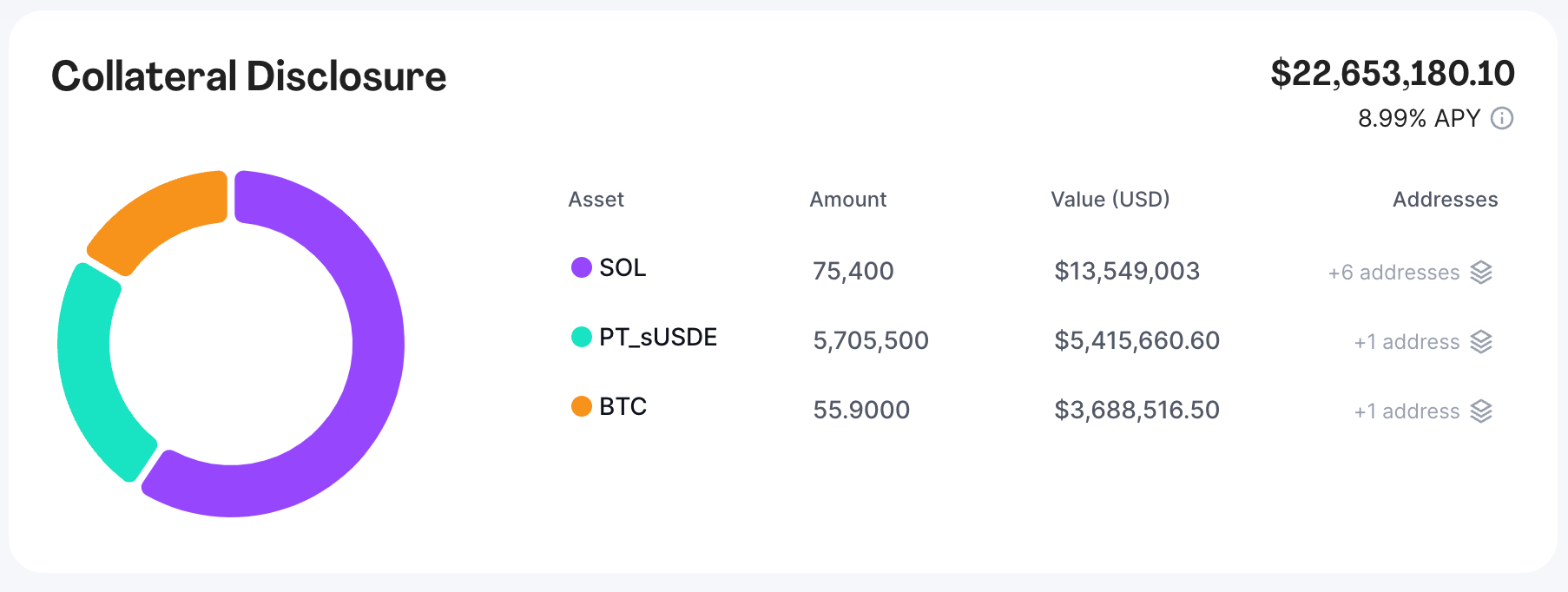

Transparency to lenders is a core value of Maple’s business operations. Lenders always have full visibility into how collateral is being used and how yield is being generated. Let’s take the current Syrup collateral dashboard as a real example of how collateral is utilized and why we’re comfortable:

- SOL: 50% liquid jitoSOL and 50% natively staked with Figment. The jitoSOL component can be liquidated immediately, and the natively staked SOL can be sold to OTC desks whilst unbonding takes place as described above.

- BTC: held idle in cold storage and can be liquidated immediately via OTC desks.

- PT_sUSDe: Approved after rigorous review per outline above, including two separate technical reviews of Ethena and Pendle. Sized to available liquidity in the market and can be traded immediately via AMM pool. The PT token specifically is a fixed maturity discount contract that increases in value as it approaches maturity. Maturity is matched to the duration of the underlying loan.

Conclusion

Maple’s approach to secured lending through rigorous borrower underwriting, meticulous collateral analysis, and active risk management ensures a high level of security and transparency for lenders.By using advanced monitoring systems and collaborating with reputable OTC desks, Maple effectively mitigates risks associated with digital asset volatility.Additionally, the strategic use of collateral to generate yield further enhances returns for lenders, maintaining a balance between security and profitability.Our focus on transparency and institutional-grade processes has been a key driver in positioning both Maple and Syrup as one of the leading venues for attractive risk-adjusted yield strategies in the space - now available for both permissionless users and large institutions.

View the Syrup details page here: https://syrup.fi/details