pMaple is thrilled to open access to Cash Management solutions for USDT holders. There’s no reason idle cash shouldn’t be earning a conservative yield in today’s interest rate environment, and by opening a new Cash Management pool to accept USDT, participants can remain in their stablecoin of choice and access yield sourced from U.S. Treasury bills and reverse repurchase agreements.

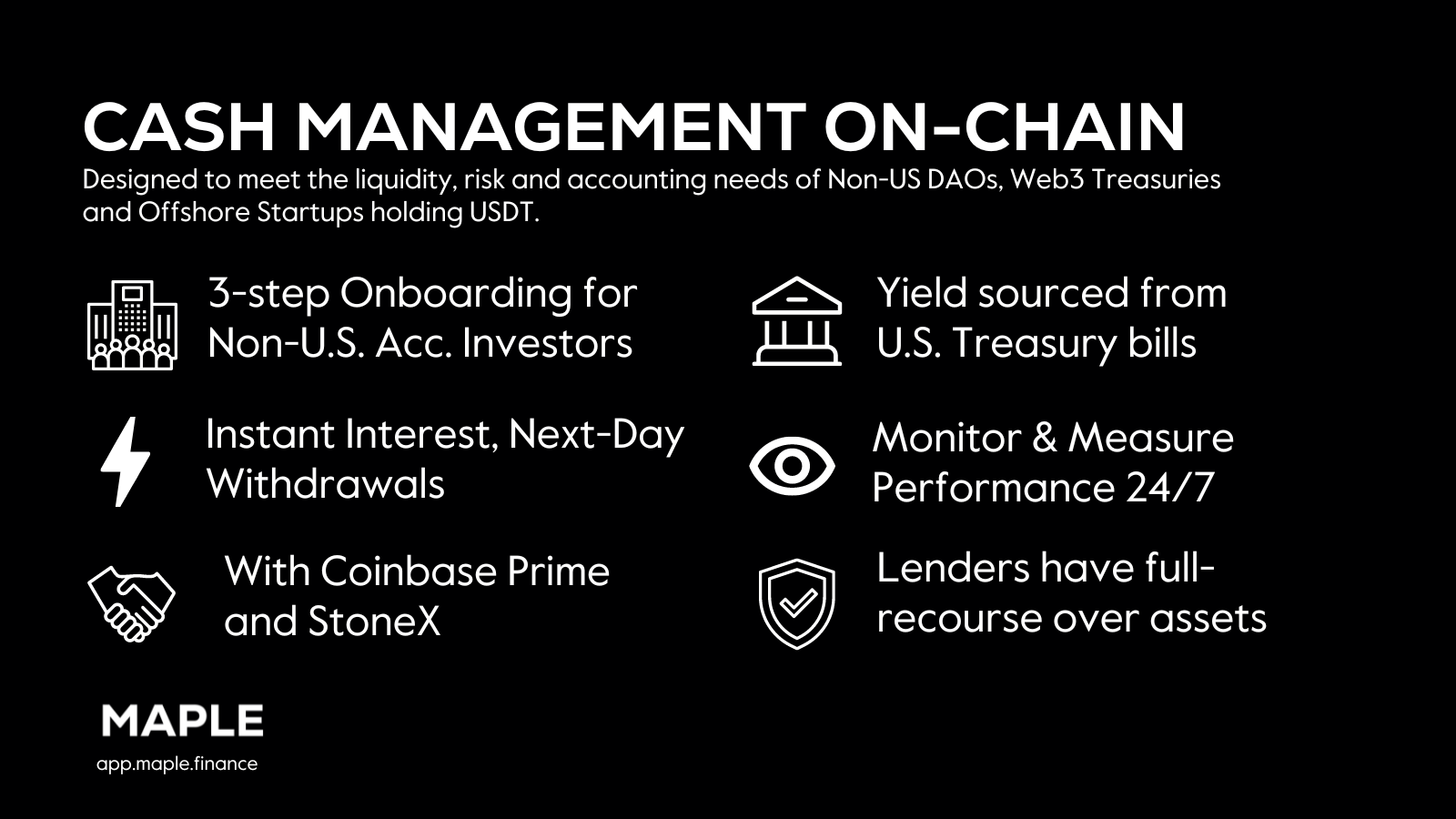

Designed to cater to the liquidity, risk management, and accounting requirements of Non-U.S. DAOs, Offshore Companies, Web3 Treasuries, and HNWI, the Cash Management Pool empowers lenders with access to the 1-month rate, next-day withdrawals, and complete transparency regarding the collateral held in the borrower's prime brokerage account.

Operated by trusted third parties, the USDT Cash Management Pool ensures the same level of security and reliability as Maple's established Cash Management product. Since its initial launch in April, over $21 million USDC has been deposited. Impressively, nearly 60% of lenders have increased their positions, with an average position increase of approximately 360%. All withdrawal requests have been processed within 24-hours so participants can take advantage of market opportunities or meet operational expenses.

Previously, USDT holders encountered the inconvenience of swapping their holdings to USDC or off-ramping to access U.S. Treasury bill yields. However, with the introduction of the new Cash Management pool, accredited USDT holders can now access this opportunity and enjoy maximum capital efficiency without the need for any additional conversions. The USDT pool passes the 1-month U.S. Treasury bill rate, less fees and expenses of 1% or 100 bps annualized, to Lenders. The fee is 50 bps higher than the USDC pool due to the higher conversion costs switching USDT to fiat.

Lenders can access the pool by visiting the Maple WebApp here.

Non-US Accredited Investors can complete onboarding directly here.

Lenders who have benefited from Maple's Cash Management Pool have shared their positive experiences:

- "Maple’s Cash Management product means Relm can transparently verify conservative investment opportunities on-chain rather than slowly off-ramping and losing interest income. As a licensed and regulated insurance firm, our top priority is ensuring capital is safe and accessible to meet potential claims." Joe Ziolkowski, Co-Founder and CEO, Relm Insurance.

- “We wanted to put our on-chain capital to work while minimizing risk. The pool aligns with our risk/reward criteria and it is highly efficient, as it allows us to keep our assets on-chain without the need for off-ramping. With the launch of Altitude on the horizon, the peace of mind offered by the pool means we can focus on building." Tobias van Amstel, Co-Founder, Altitude.fi.

Key features of the Cash Management USDT pool:

- Simple and fast access for non-U.S. Accredited Investors and Entities: The pool passes yield sourced from U.S. Treasury bills and reverse repurchase agreements, less fees fixed at 1% or 100 bps annualized, to Lenders. It takes between 10-15 minutes to complete onboarding. Begin onboarding here.

- Immediate interest and next-day withdrawals: Interest accrues from the time of deposit, and so Lenders can manage cash flows there’s no lock-up period and withdrawals will be serviced the next U.S. banking day.

- Monitor and measure performance 24/7: Lenders have a real-time view into the borrower’s portfolio of assets held with regulated broker Stone X and interest statements can be downloaded at any time.

- Managed with leading 3rd parties: Capital is off-ramped using Coinbase Prime, and all trades are custodied and cleared from an account with regulated broker StoneX. Maple has a track record in providing secure and scalable products on top of best in class smart contract infrastructure and was recently awarded a 92% Safety Score by DeFi Safety [full report].

- Risks managed on behalf of Lenders: The sole use of proceeds is to purchase U.S. Treasury bills and reverse repurchase agreements. Treasury bills are backed by the full faith of the U.S. Government, and are considered one of the safest forms of debt around. Lenders have full recourse over all assets held with a regulated broker.

For more information:

Watch the Cash Management Pool Launch Event.

Deep dive and find answers to frequently asked questions on Gitbook.

ABOUT MAPLE FINANCE

Maple provides the infrastructure for credit experts to run on-chain lending businesses and connects institutional lenders and borrowers. Built with both traditional financial institutions and decentralized finance leaders, Maple is transforming debt-capital markets by combining industry-standard compliance and due diligence with the transparent and frictionless lending enabled by smart contracts and blockchain technology. https://maple.finance/