Capping off a Record-Setting Year

Introduction

Q4 2024 was one of the strongest quarters in Maple’s history, capping off a year defined by strong growth across both new and existing products. Highlights from the quarter include continued TVL growth, major product updates, and the exciting introduction of the SYRUP token and staking.

We saw record growth in TVL and revenue; Syrup alone grew nearly 75% Q/Q with successful integrations with Pendle and exchanges like OKX. Building Syrup into a premier DeFi protocol that is widely integrated with the largest players in the space remains a focus for the team heading into 2025.

The data and information in this report are intended for informational purposes only and are subject to change. The data provided are based on the status of the Maple Treasury on the 31 December 2024. All figures are shown in USD and based on the corresponding CoinGecko closing price. For more information, see the disclaimer linked below.

Closing the Year Strong

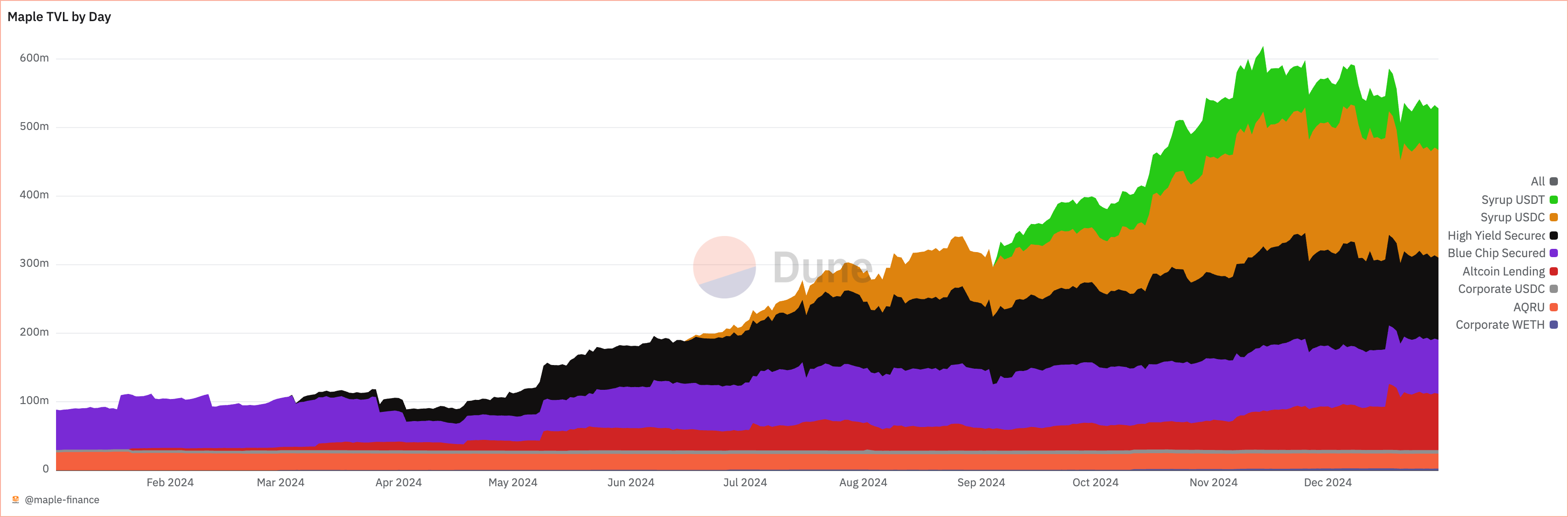

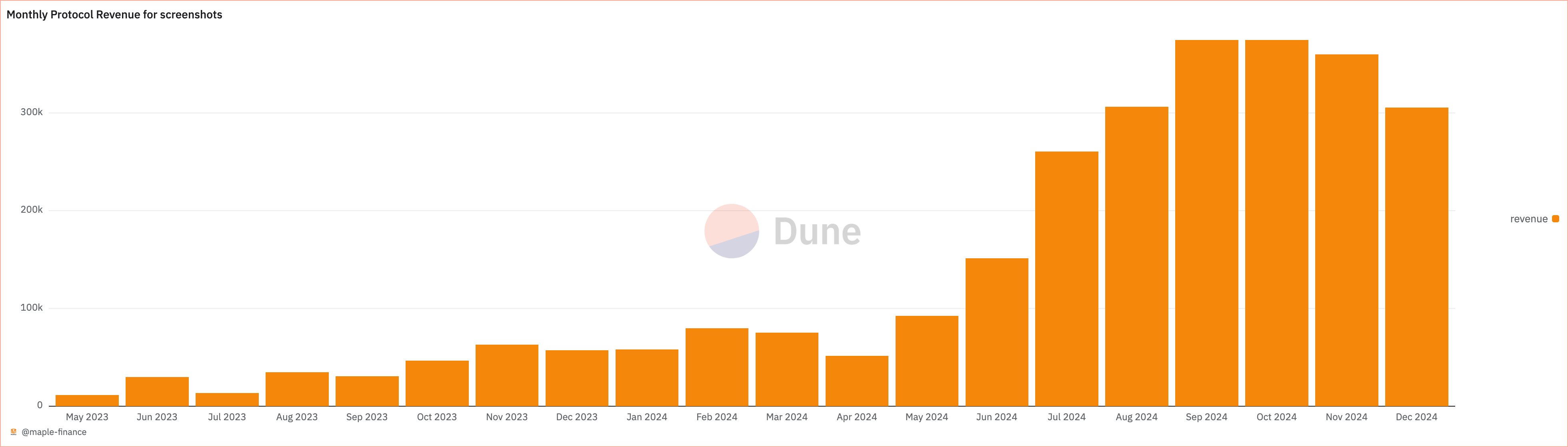

After re-finding product market fit in 2023 with Secured Lending, 2024 saw Maple turbocharge growth across all products. Q4 was a fantastic cap to an outstanding year, with TVL reaching as high as $600M after starting the year under $100M. Following the US election in November, excitement built around the potential growth for the industry over the next 4 years, and we believe Maple stands to be a massive beneficiary of this. In Q4 we shipped new products and improvements to our infrastructure, and most importantly - the new SYRUP token galvanized the community around the entire Maple protocol heading into the new year.

- TVL grew by 32% in Q4 (+500% Y/Y)

- Revenue grew 11% Q/Q (+630% Y/Y)

- Loans outstanding grew +23% Q/Q (181% Y/Y)

- Introduced the new SYRUP token, with staking crossing >50% of circulating supply

SYRUP Launch

By far the most important development for the Maple ecosystem in 2024 was the November launch of SYRUP, Maple’s new governance token. Migration from MPL began and we quickly saw >60% of all MPL tokens migrated to SYRUP ahead of the deadline at the end of April 2025. Even more exciting, we re-introduced staking with stSYRUP allowing users to share in the growth of the Maple protocol as a whole. By quarter end, more than 50% of circulating SYRUP supply had been staked.

Maple Institutional

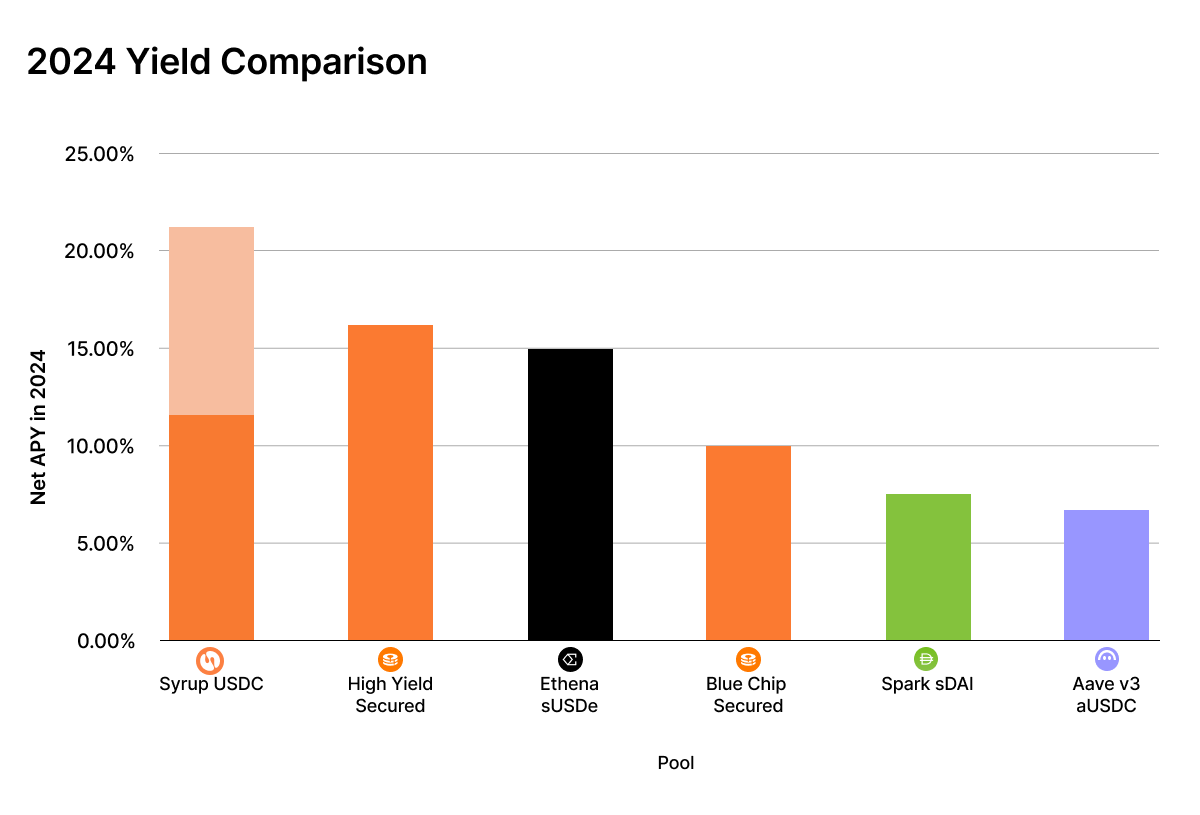

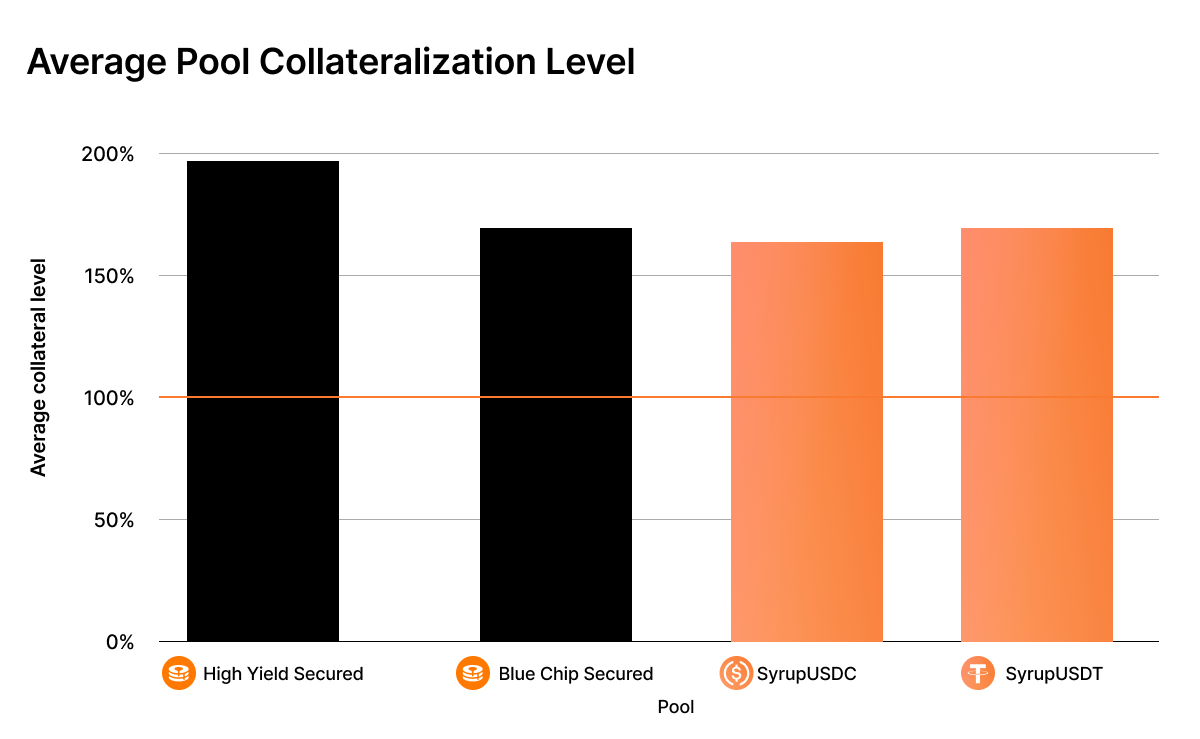

Following the US election, institutional interest in digital assets is surging, driven by regulatory clarity, infrastructure maturity and a widening yield gap between traditional and crypto markets. Maple is perfectly positioned to capture the enormous opportunity at the confluence of institutional markets and DeFi. In Q4 we continued to see an uptick in institutional interest and Maple aims to be the trusted partner for institutions entering the space. We are working on new structured products with institutions in mind, allowing lenders to get higher yields with upside to the market. Q4 saw dozens of new lenders seeking to take advantage of the best risk-adjusted yields around, with High Yield Secured in particular outperforming all other onchain comps

Syrup.fi

Maple’s DeFi-facing arm saw >70% growth in Q4 as TVL crossed $250M at the peak - and continues its path towards being a mainstay in the DeFi ecosystem. The Drips campaign incentivized depositors further and maintained the pace of TVL growth through additional yield-boosting rewards and capital commitment bonuses, paying the highest yields to lenders onchain whilst remaining overcollateralized >150% at all times. The Syrup <> Pendle integration, was introduced in October, and was large factor in the protocol’s growth as it broadened the scope of what lenders can do with Syrup’s market leading yields. It lets depositors lock fixed yield through Pendle and speculate on the value of Drips through Pendle’s unique PT / YT mechanism.

Roadmap

We are entering 2025 with the momentum to redefine institutional lending markets. The objective for Q1 and beyond is to continue supercharging both Maple and Syrup through TVL growth and product improvements. Our key goals for the year include:

- Community and tokenWe will continue to focus on growing, engaging and rewarding our community. We will expand $SYRUP’s staking rewards, introduce a tiered reward program, and roll out more community initiatives.

- Maple InstitutionalMaple Institutional will be turned into the most trusted originator of institutional loans. We will scale adoption, launch new lending products, expand our TradFi partnerships, and deliver even more advanced risk management.

- SyrupSyrup will see expanded integrations, a streamlined product experience, more transparency, and additional DeFi utility. We’re aiming for at least $2B in Syrup deposits.

- InfrastructureWe’ll optimize our technology stack and infrastructure, expand the asset selection to include a much wider range of assets including RWAs, and encourage third-party integrations by building comprehensive SDKs and APIs.

Conclusion

After a transformative Q4, Maple enters 2025 with the momentum to redefine institutional lending markets as a trusted partner for institutional capital entering the space. With the launch of the SYRUP token, Maple has taken a big step forward, laying the groundwork to unite the ecosystem and scale towards our collective goals. Continuous growth showcased by both Maple Institutional and Syrup confirms the effectiveness of the current secured lending product offerings.

Join us as Maple continues on the road to transform institutional lending markets in 2025 and beyond.

Protocol Financials

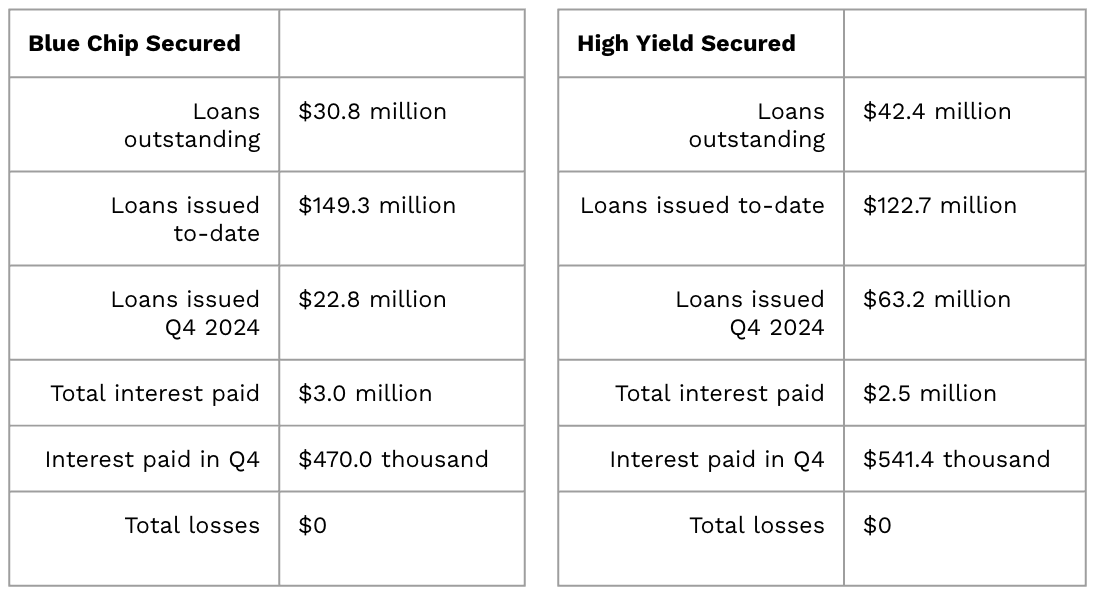

Table 1: Q4 Liquidity and Total Loan Originations

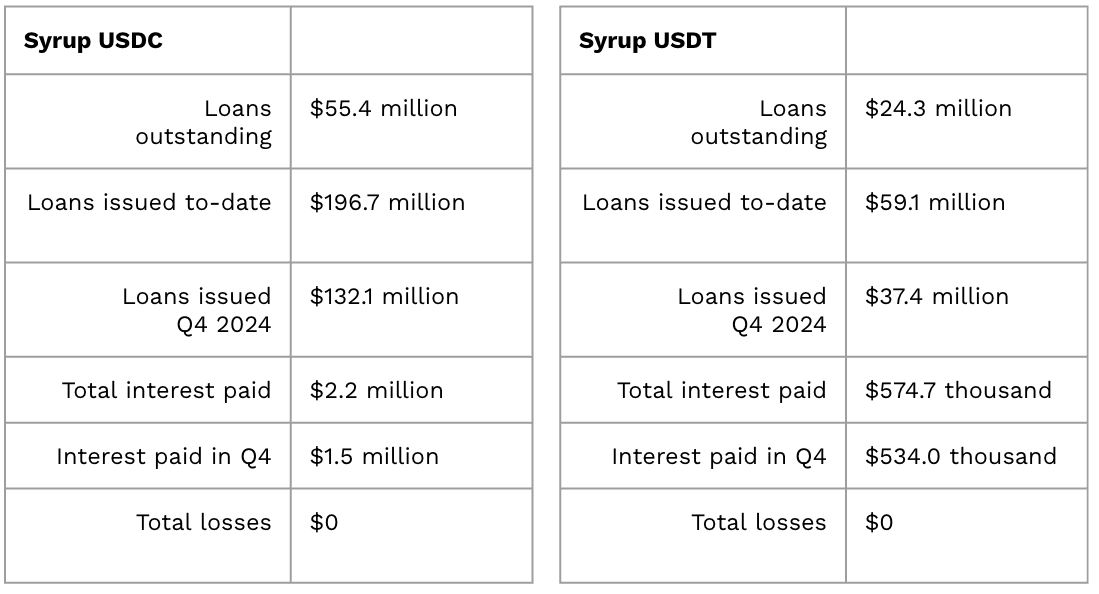

Table 2: Maple DAO Revenue & Expenses

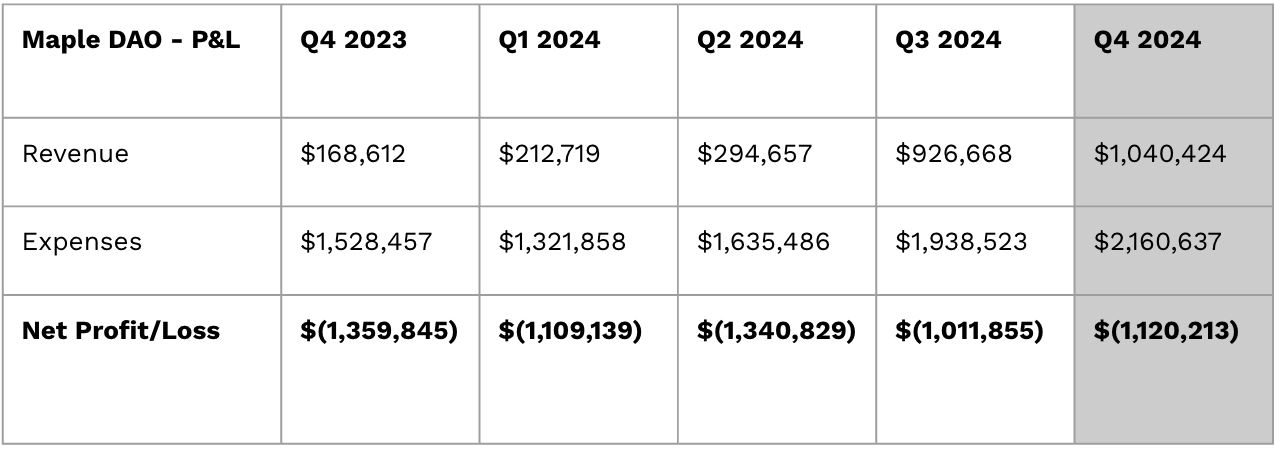

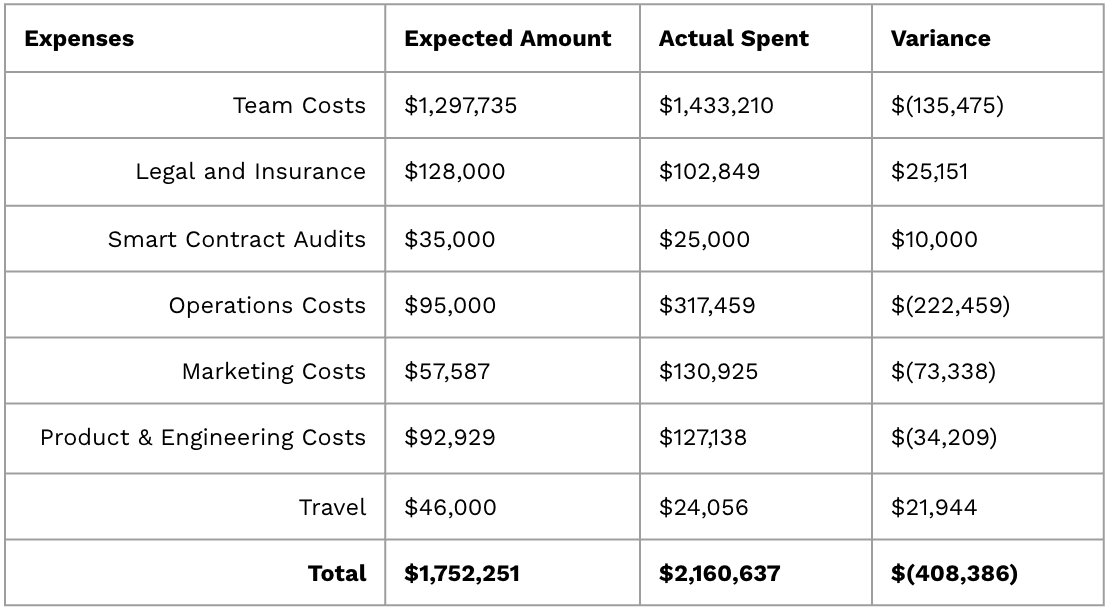

Table 3: Maple Labs Q4 Actual vs Budget Variance