Q2 marked a significant turning point for Maple. Amidst the slower market conditions, we launched our Cash Management Pool, signaling Maple's adaptability and resilience. This quarter also saw Maple returning to growth, demonstrating our unwavering commitment to innovation and excellence. Sidney Powell, CEO and Co-Founder, Maple.

The data and information in this report are intended for informational purposes only and are subject to change. The data provided are based on the status of the Maple Treasury on the 30th June 2023. All figures are shown in USD and based upon wETH closing price of $1,934.05. For more information, see the disclaimer linked below.

Q2 IN REVIEW

The launch of our Cash Management Pool was a significant milestone in Q2. This, combined with the introduction of Open Term Loans, has positioned Maple for growth even in challenging market conditions. Open Term Loans have been a game-changer, offering unparalleled flexibility to borrowers and enhancing liquidity management for lenders.

Our product team, in collaboration with the technology division, has been relentless in their pursuit to elevate the user experience to the next level. The continued build-out of the platform's user interface and features ensures that our lenders and borrowers have a seamless and intuitive experience.

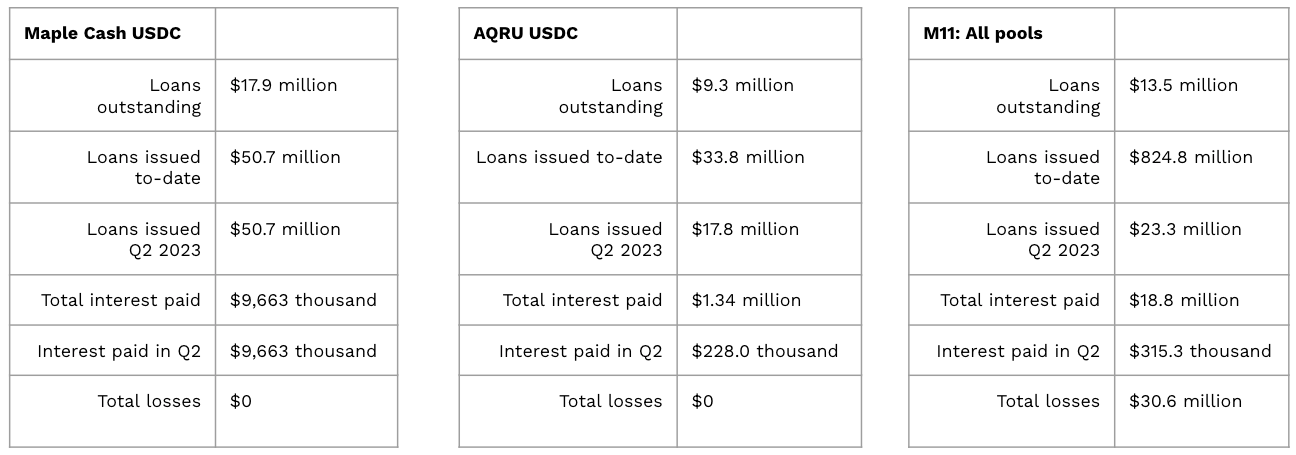

Q2 2023 LENDING ACTIVITY

In Q2 2023, Maple's lending activity showcased a diversified portfolio with various pools.

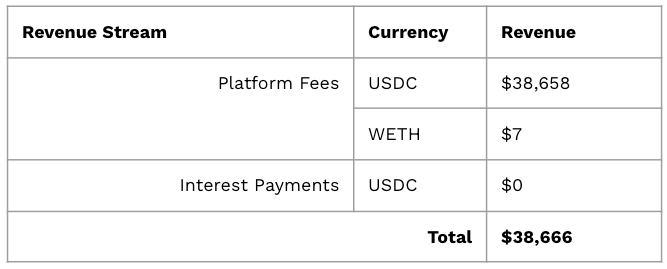

Q2 2023 REVENUE

Table 1: Maple DAO Liquidity and Loans

The market conditions in Q2 2023 showed signs of recovery, with Maple witnessing an uptick in both lender and borrower activity. Detailed figures and insights are provided in the tables below.

Table 2: Q2 Maple Treasury Protocol Revenues

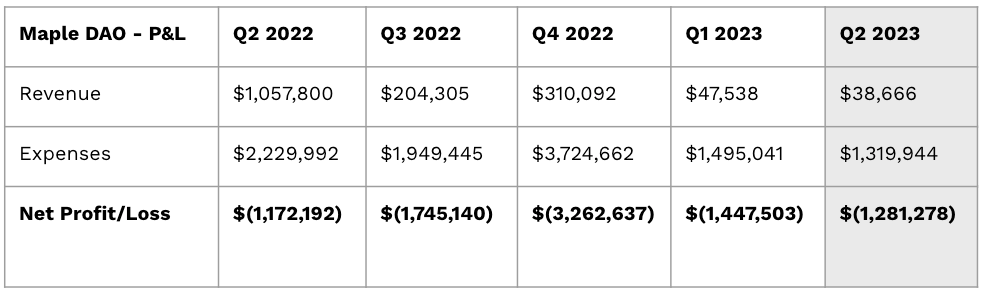

Table 3: Maple DAO P&L

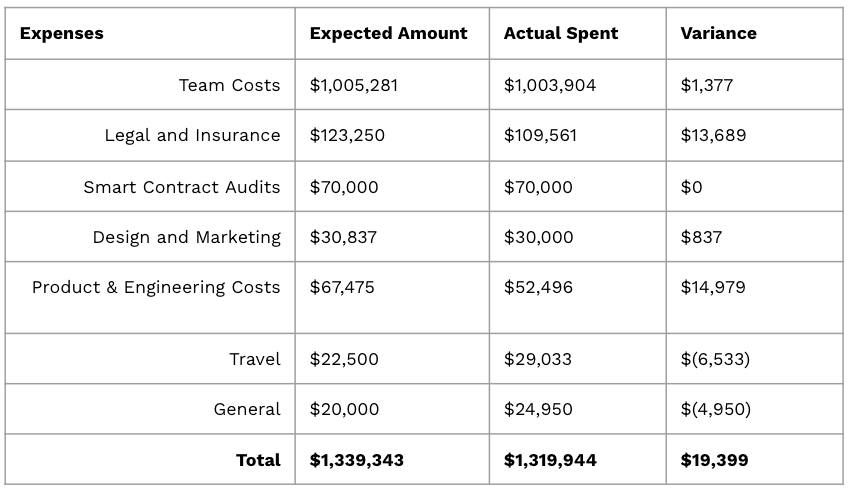

Q2 2023 EXPENSES

Q2 2023 expenses are detailed below, showcasing a comparison between budgeted and actual expenditure:

Table 4: Maple Labs Q2 Actual vs Budget Variance Analysis

In conclusion, Q2 2023 was a pivotal period for Maple. Our strategic initiatives, combined with the dedication of our team, have set the stage for returning to growth for the second half of the year. We remain committed to our vision of becoming the leading on-chain debt-capital marketplace and are excited about the opportunities that lie ahead.