2024 was the breakout year for Maple Secured Lending. The strategy grew more than 16X, whilst delivering market-leading yield outperformance and principal protection at all times to our lenders. This article covers the yield generated, collateralization levels throughout the year, liquidity metrics and overall growth of Maple's flagship products.

Secured Lending Growth

At the start of 2024, the majority of Maple's TVL was concentrated in Cash Management and Tax Receivables, with only $32M allocated to Secured Lending. By the end of 2024, total TVL skyrocketed by 1,656%, reaching $562M. This growth was driven by Maple Insto, which scaled to $310M, and Syrup.fi, which impressively reached $252M in its first six months after launch.

Alongside this surge in TVL, the number of active lenders on the platform also grew exponentially, increasing by 1,430% year-over-year to 796 institutional lenders. This significant expansion not only underscores the growing entry of institutions into the crypto space but also highlights Maple's exceptional product-market fit within this segment. Many institutions initially "dip their toes" before committing larger allocations—a trend we anticipate continuing in 2025.

A common question arising with such growth is about the scalability of Maple's yield performance, given its rigorous underwriting and borrower vetting processes. In 2024, Maple successfully expanded its pool of eligible and active borrowers from just 4 to 28. As the crypto space continues to mature, the number of high-quality institutional borrowers is steadily increasing, with borrowing demand far outpacing the available capital supply.

This strong growth trajectory positions Maple to further capitalize on the increasing appetite for Maple's secured lending products in 2025.

Consistent yield outperformance

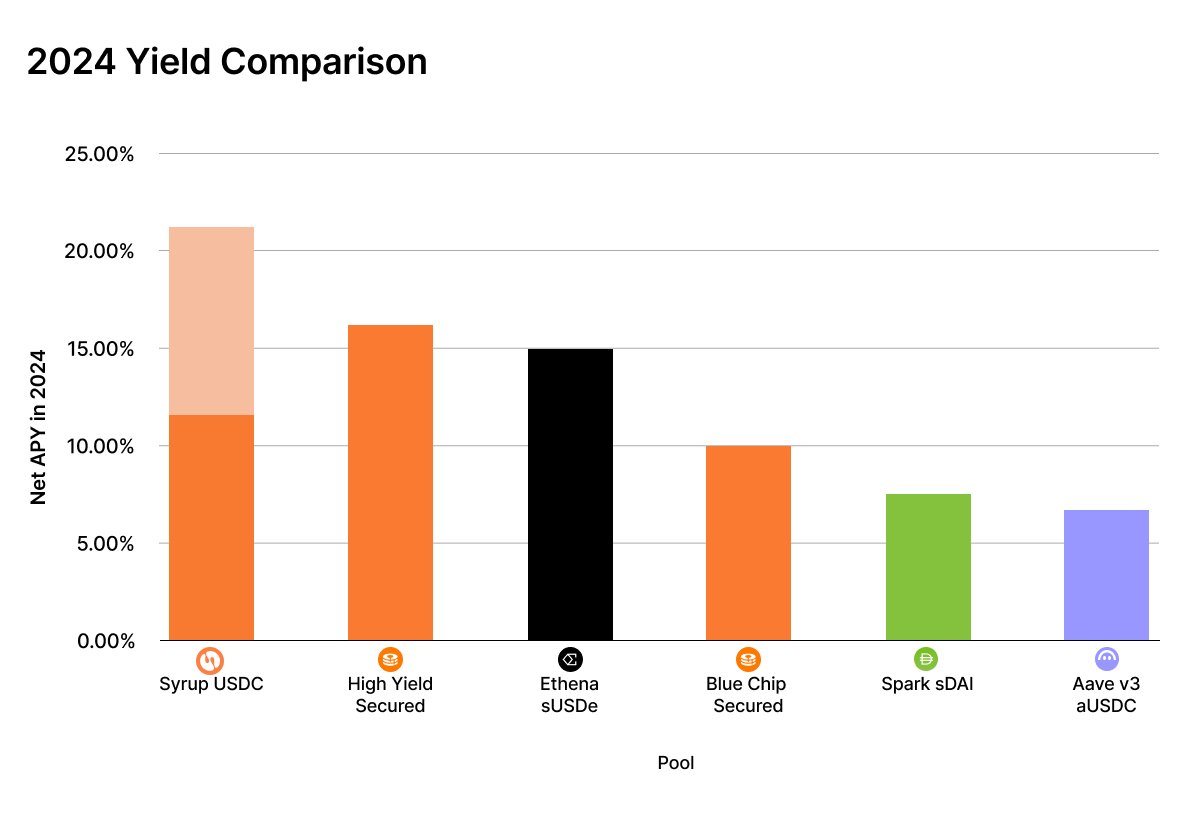

High Yield Secured delivered a net APY of 16.83%, unmatched in the crypto space for an overcollateralized lending product at this scale — all without token incentives. The yield is derived from providing overcollateralized loans to institutions and using the collateral to enhance the yield through liquid staking.

Blue Chip Secured delivered a net APY of 10.2%, strong double digit yield generated by providing overcollateralized loans to institutions. The pool consists of BTC collateral held idle in segregated custody.

Syrup.fi delivered a total APY of 21.3% composed of a native yield of 12.4%, with an additional average Drips APY of 8.9% on top. Syrup's strategy is a mix of High Yield and Blue Chip, accepting a variety of high quality collateral assets.

The yield on all of Maple's secured products is not only high in absolute terms, it also significantly outperforms other large yield sources in DeFi.

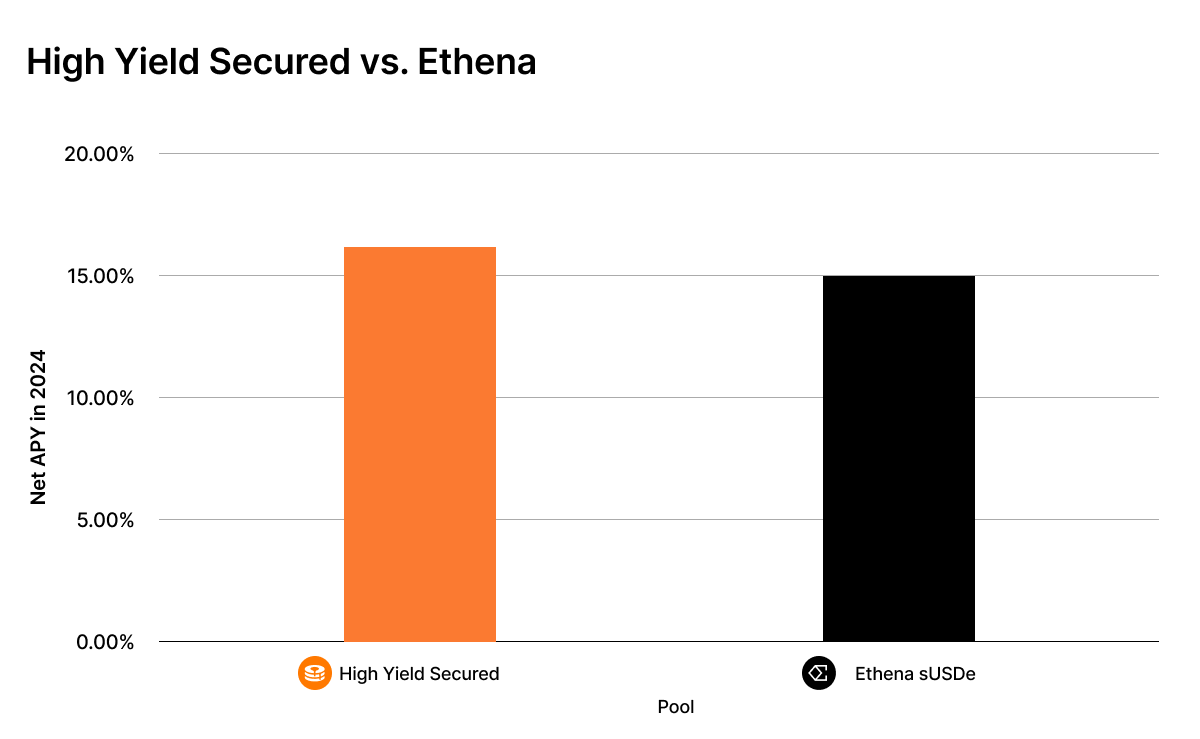

High Yield Secured vs. Ethena sUSDe

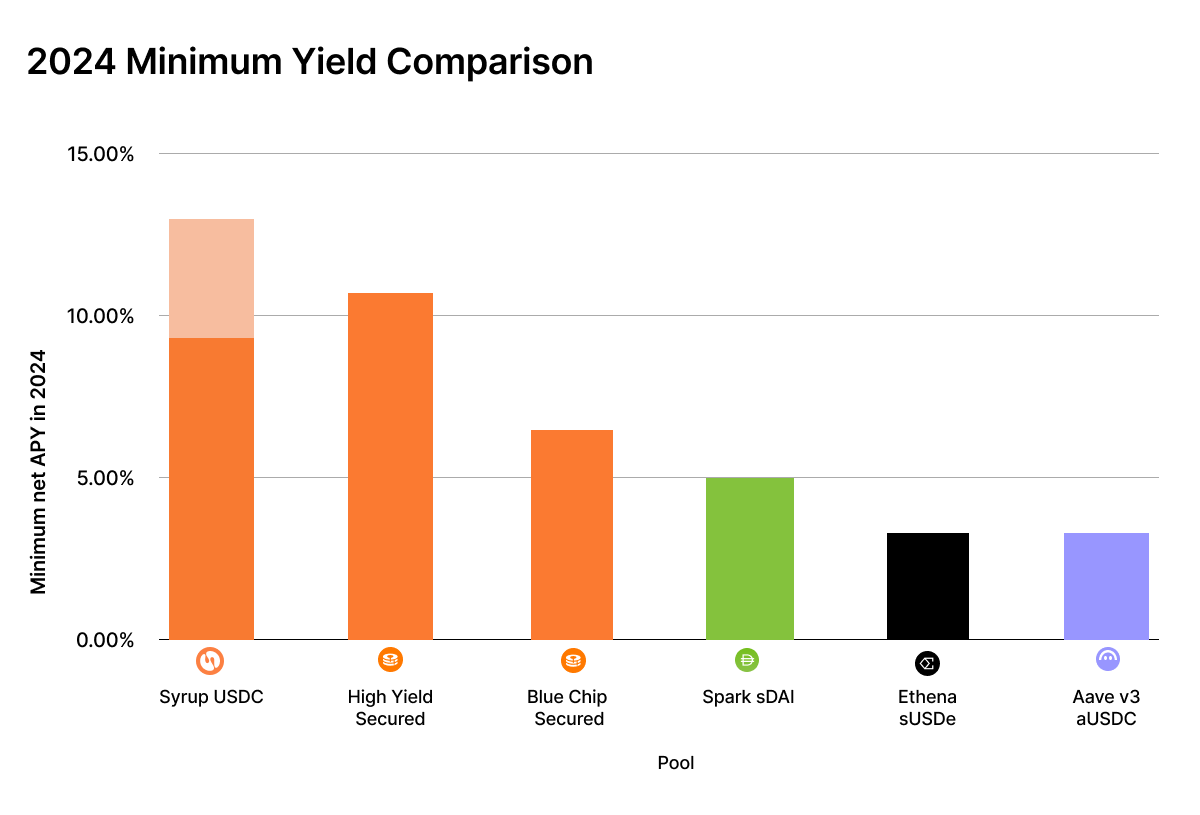

The best comparable for High Yield Secured is Ethena's sUSDe. Over the course of 2024 High Yield Secured generated 16.83% with sUSDe yielding 14.97%, delivering significant outperformance in absolute terms. sUSDe’s lowest yield was 3.84%, whilst Maple’s High Yield pool bottomed at 10.6% — making Maple's yield much more consistent over time.

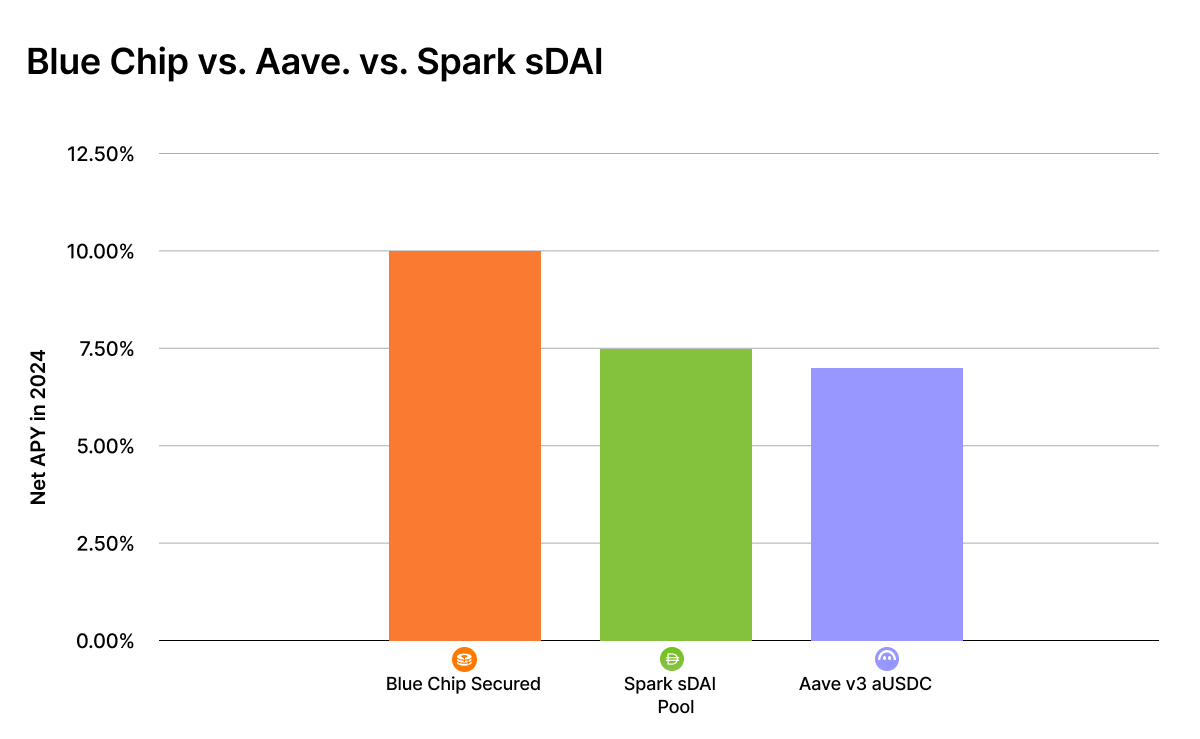

Blue Chip Secured vs. Aave and Sky/Maker

The best comparable for Blue Chip Secured, due to the highly conservative nature of the strategy, are Aave and Sky (previously Maker). Over the course of 2024, Blue Chip generated a yield of 10.2%, compared with 7.2% for Aave v3 aUSDC and 7.84% for Spark sDAI. Not only was the total APY a lot higher over 2024, it was also much more consistent. Blue Chip's low for the year was at 6.9%, with Aave at 3.3% and Spark sDAI at 5%.

Syrup.fi's outperformed all of the above, generating a total APY of 21.3%, with a native stablecoin APY of 12.4% and an additional average Drips APY of 8.9% on top.

The yield for lenders is not only higher than market peers, it is also far more consistent. The best way to show this is to look at the ‘minimum’ yield generated by its product throughout the year. Here again Maple Secured products outperformed all of its peers.

Principal protected at all times

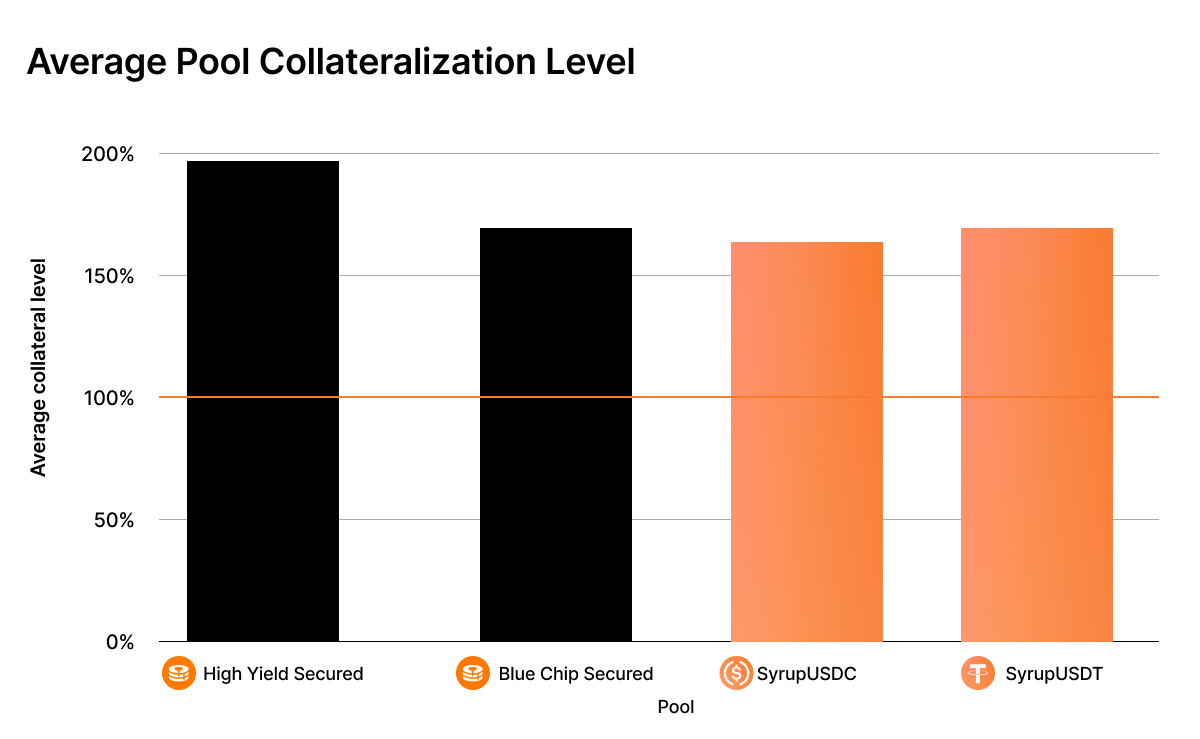

Throughout the year, all secured lending pools including Syrup.fi, have remained overcollateralized at all times , including the significant volatility events in April and August.

Before collateral is made eligible on the platform, it undergoes a rigorous review process performed by all functions of the Maple team, evaluating it from multiple perspectives including, legal, technical, liquidity, market indicators, operational factors and more. A detailed guide on how collateral is reviewed and monitored can be found here.

To protect the loans, a partial liquidation of one borrower was conducted in August, with the loan remaining overcollateralized during the process. This validates the rigor of Maple’s liquidation process in a real time stress event.

Over the course of 2024, 61 margin calls were issued, cured in an average of 3 hours (including weekends) with a total of $75M+ in collateral value received. This speaks not only to the alertness and competence of the borrower set (verified in advance of loan issuance through underwriting), but also to the robustness of Maple's loan book management system and the strength of Maple’s team.

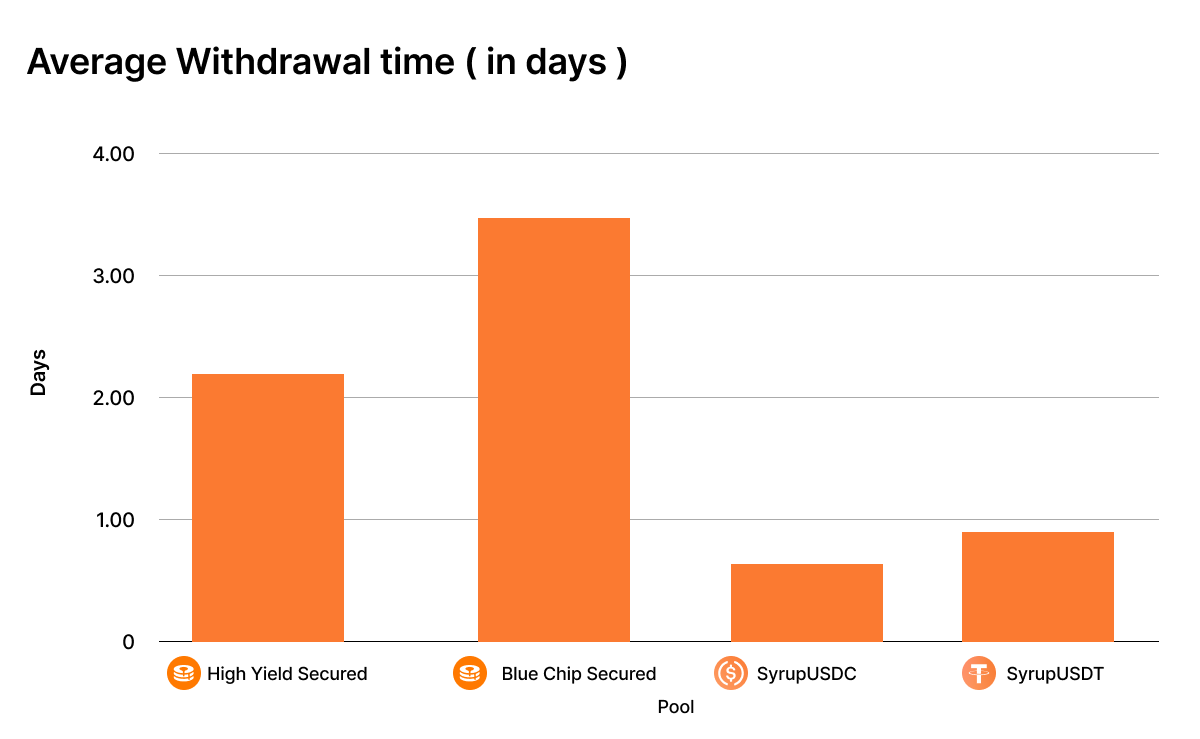

Short term liquidity

Syrup.fi was the most liquid product, due to its broader user base, higher frequency of daily flows and an automated withdrawal system servicing lenders immediately when liquidity is available. Syrup.fi pools also aim to have a liquidity buffer at all times, while Maple pools optimize for max utilization. A more predictable liquidity management system will be rolling out for Syrup.fi in Q1.

Despite that, Maple pools still service withdrawals in an average of 2 days for Blue Chip and just over 3 days for High Yield, which is very fast considering the underlying loan book has a typical duration of 14-30 days for the benefit that brings in term of consistent high yield.

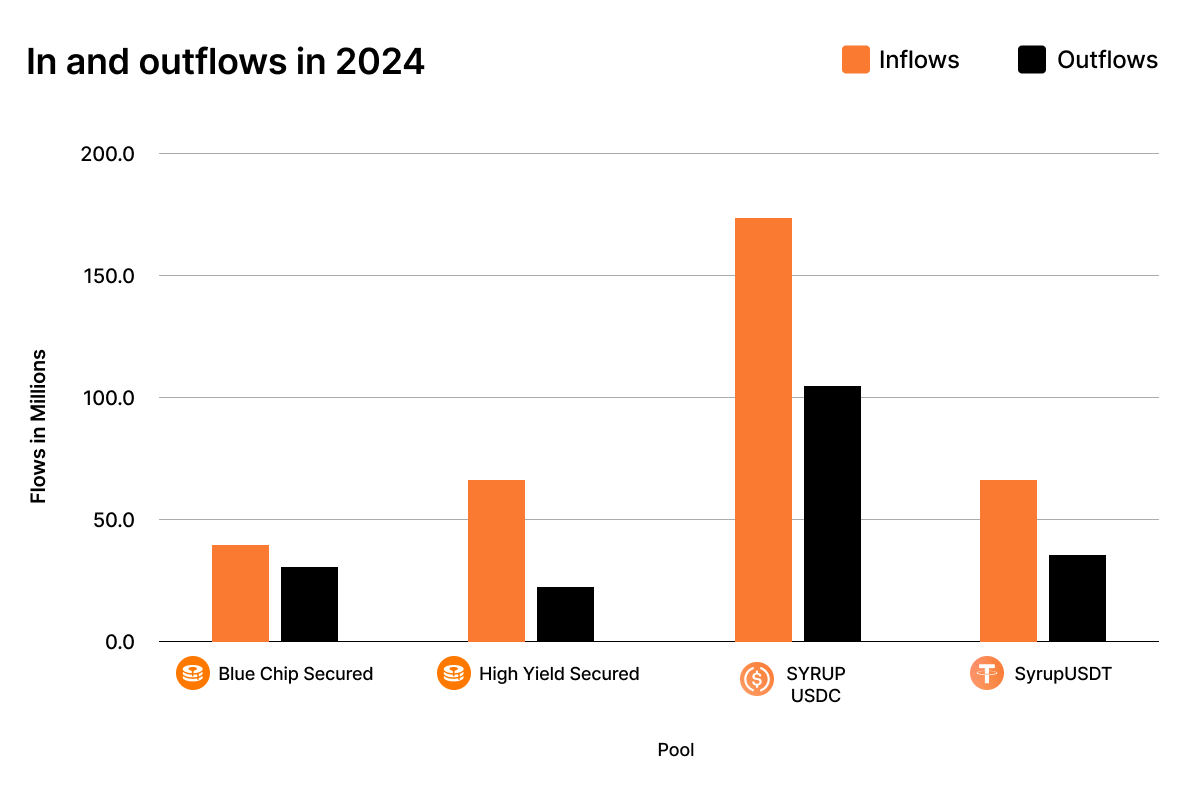

To illustrate the battle-tested nature of servicing withdrawals, below is a table of net inflows and outflows into all of the Maple Secured products, illustrating that they’ve all handled significant inflows and outflows throughout the year with no issues.

Conclusion

Maple delivered a stellar performance in 2024, outperforming all of its peers in absolute yield, retaining greater consistency in rates, while remaining overcollateralized at all times and protecting principal. Alongside this performance, rapid liquidity was realized during periods where lenders needed it, ensuring maximum flexibility for users.

2024 will be seen as the year where Maple proved that consistent yield outperformance is achievable by applying institutional finance practices to DeFi, delivering superior APY for our users. 2025 will be the year where we will scale this success further, continue to bring institutions onchain and bring it to the masses with Syrup.fi. Cheers to another year of delivering consistent, high yield for everyone!

*The data used in the charts above is the earliest available onchain data from vaults.fyi