Introduction

Much of our focus at Maple is on building a top notch user experience, while developing the protocol in a way that is scalable into the future. Institutions are slowly entering the space and looking to deploy capital in a compliant way. We expect that pace to pick up over the coming years as regulation is refined and clear guidelines put in place. We’ve seen the growth in permissioned protocols and chains (e.g. Kinto), as they recognize these institutions have their own strict set of compliance standards.

Last week we released Global Permissioning, an innovative new feature that sets Maple apart from its competition by facilitating seamless deposits across all of our lending pools for compliant sources of capital. It's an exceptional collaborative engineering endeavor between our onchain and offchain teams that is unlike anything else available in the space. This article will cover what the new permissioning system is, how it works, and why it’s such a monumental improvement for users to enable access and compliance at scale.

First of its Kind Global Permissioning System

Users on the Maple platform are KYC’d, which has created operational bottlenecks and frictions to ensure all depositors remain compliant. As we are aiming to become the home of digital asset lending for institutional capital, adherence to KYC / AML standards are critical. Maple Pools previously had a distinct allowList that held the list of wallets eligible to deposit into that specific Pool contract. This required manually adding new addresses to the whitelist each time we had a new lender (or if an existing user wanted to try a new product). Lenders earning 5% in our Cash Management solution did not have a seamless way to transition to our High Yield Secured pool earning 20% as market conditions changed over the past few months. It was a frustrating lender UX as well as a serious operational bottleneck for the team.

The global permissioning release is a complex technical system built as a combined effort from our onchain and offchain teams. It required smart contract improvements as well as material infrastructure development from an offchain perspective. As always, from an architectural standpoint, the team designed this to be flexible and upgradable to support a very dynamic ecosystem that will certainly look different in the coming years.

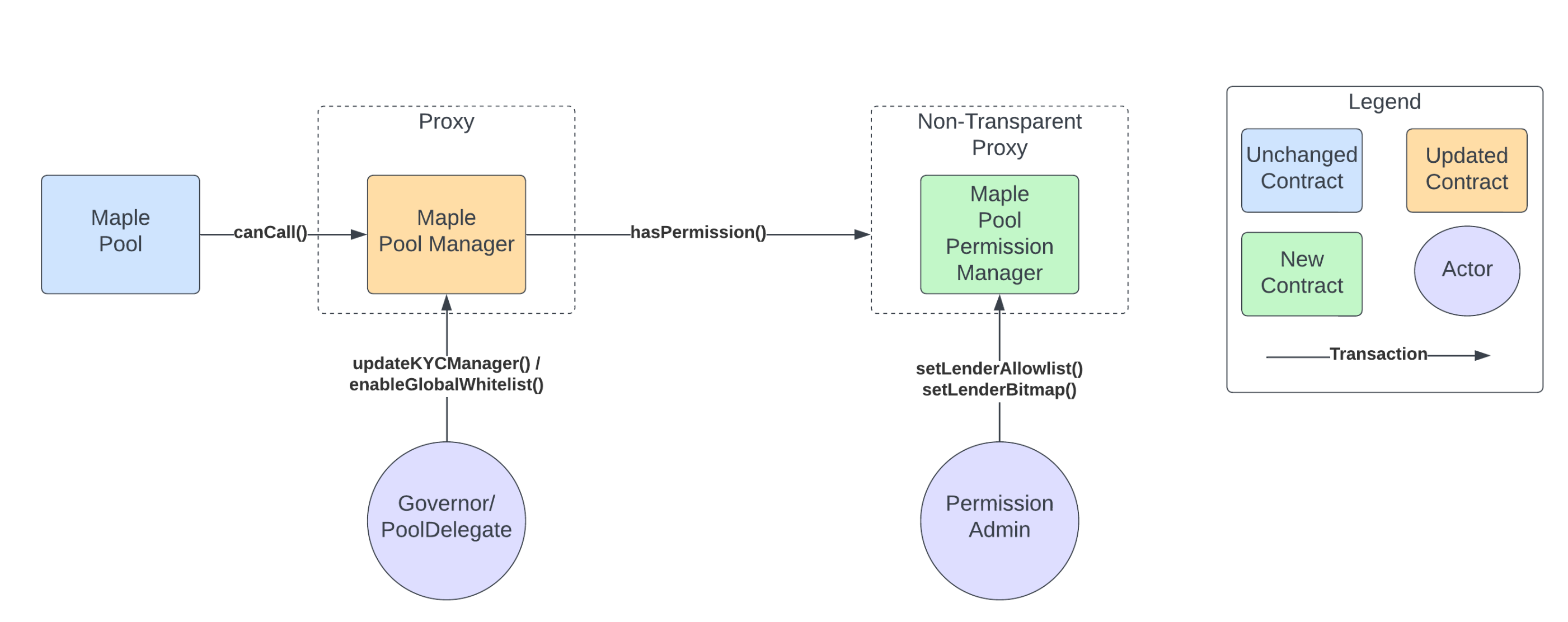

Maple now stores a global allowlist onchain with a bitmap for each wallet. Prior to deposit, each PoolManager now checks with a smart contract called the Pool Permission Manager which confirms that the wallet bitmaps are set to the required value needed to deposit. For example, if the bitmaps for KYC and accreditation on a given wallet are set to TRUE then the Pool Permission Manager tells the Pool that this wallet is good to go and able to deposit.

These bitmaps are stored onchain but can be updated automatically via offchain operations, and are derived from a wallet’s associated Maple account. This connection at the account level is the primary reason why global permissioning is such an unlock for lenders. When lenders add a new wallet to their account, our infrastructure now catches and triggers onchain updates to add that wallet’s bitmaps to the global allow list - based on the account’s compliance levels. This ensures that once a Lender is verified, all current and future wallets that they add have access to all opportunities on the platform.

This is just the beginning though. Additional bitmaps can be added in the future, and Pools can opt to use the global list or a more precise custom set of bitmaps - down to the function level. This provides an anonymized and customizable avenue for Maple to facilitate users into our Pools in a compliant way.

For a more technical dive into how Global Permissioning works at the smart contract level, head over to the docs here!

The Lender Experience of the Future is Here

Institutional onboarding and access to on-chain lending platforms such as Maple often involve complex compliance checks and repetitive verification processes for each lending pool. This leads to inefficiencies, delays, and potential roadblocks for institutions looking to utilize their capital efficiently throughout the DeFi ecosystem. The industry is still very much trying to figure out how to onboard institutional capital in a compliant way. And not only to meet those institutions’ compliance requirements, but also do it with a user experience that is positive - this is hard to do!

Global Permissioning is the second big step towards accomplishing our overarching goal of enhancing the user experience on Maple. The introduction of Maple accounts in Q1 was the first - enabling institutions to manage their positions and the users under their account. Accounts have been a massive success for us - with more than 2,500 created in just a few months (and growing ~10% W/W since launch). But the friction of adding and whitelisting new wallets for the account was still there, until now.

Global Permissioning solves this, creating a much more fluid experience for lenders to navigate between opportunities for all of their wallets - both new and old. Institutions with fresh wallet policies can simply log in to their account, add a wallet, and our tech will add bitmaps for the new wallet onchain so they can automatically transfer positions or deposit into new Pools.

Once onboarded, the user experience on Maple is now more akin to your traditional financial experience, with the ability to seamlessly deposit into available products from your account as needs change or market conditions change. When you log in to your Vanguard account, you are able to invest in all products available on the platform for which you are qualified - Vanguard knows who you are and you do not need to re-verify to purchase a new asset.

Enabling Broader Access to Maple Opportunities

We’re also really excited about the potential for Global Permissioning to help Maple scale in a big way into the future. It opens up all kinds of exciting potential for integrations with custodians, exchanges and other protocols in a compliant way. And this is the bigger picture - Global Permissioning can enable compliant interoperability across the ecosystem, which is something that doesn’t exist yet. Due to the unique combination of our offchain and onchain tech, we can rely on partners’ compliance and KYC processes which opens the funnel for compliant capital to access Maple products. It can break down the walled gardens between different players in the ecosystem and allow for compliant users to flow freely between the products they need and want.

Take a custodian where institutional clients hold and stake their crypto - but may also want to earn yield on stablecoins or other digital assets. We can integrate with this custodian and enable those same users to deposit directly into Maple products without having to go through the verification process again. Eventually this can be a fully automated process and we envision a world where there are dozens of these integrations across custodians, exchanges, wallet providers and other financial applications.

Conclusion

Global Permissioning is an innovative feature that we hope can start breaking down the barriers for compliant capital to move around the DeFi ecosystem in a seamless way. It’s also a large improvement to the user experience and another step towards making Maple the home for institutional digital asset lending. Customizable bitmaps add flexibility into the future as we add new products while the potential for integrations is exciting. The first integration of its kind will be announced soon with a regulated provider in the space - stay tuned!