In a significant move, Maple Finance will return to the Solana blockchain and launch its established Cash Management Solution in the next few weeks. The launch is a game-changing moment for corporate treasuries, DAOs, and high-net-worth individuals operating on Solana, who for the first time will be able to access yield backed by U.S. Treasury Bills on their chosen blockchain.

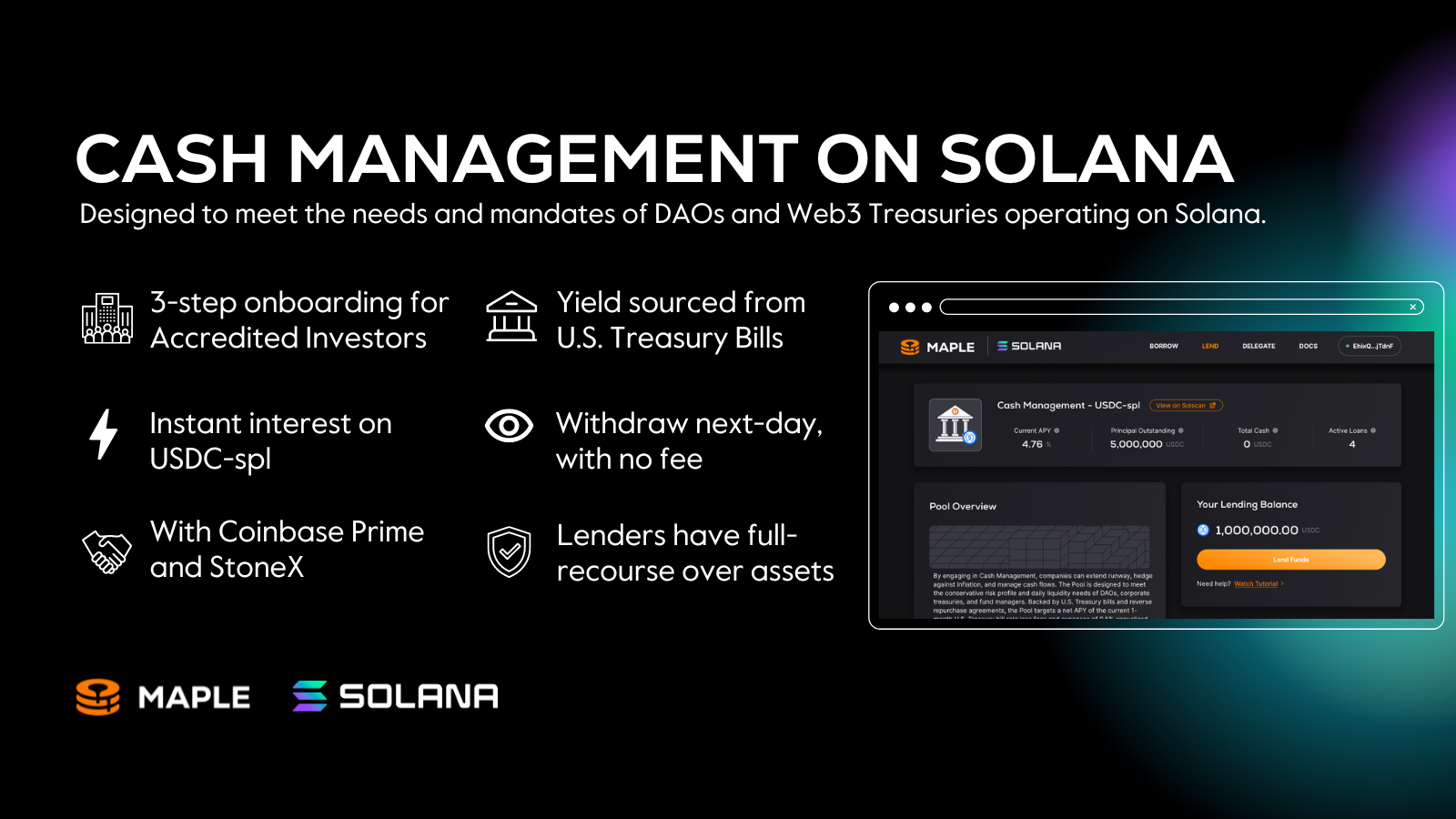

The Cash Management Solution is designed to meet the needs and mandates of DAOs and Web3 Treasuries operating on Solana. The Pool accepts deposits of USDC-spl, targets a net APY of the current 1-month U.S. Treasury bill rate less fees, and offers daily liquidity without additional deposit or withdrawal costs to lenders.

If you are a corporate treasury on Solana or looking to allocate in to this innovative product then sign up here.

The established opportunity on Ethereum has attracted $27 million in deposits from UXD Protocol, Relm Insurance, Altitude Finance and more Accredited Investors. In the case of UXD Protocol, their $10M USDC deposit from idle insurance funds is now earning interest, Relm Insurance were motivated to participate because their “capital is safe and accessible to meet potential claims”, and for Altitude.fi “the peace of mind offered by the pool means they (we) can focus on building”.

Key features of the Cash Management USDC pool on Solana:

- No in or outbound fees: The Pool accepts deposits of USDC-spl, and passes the 1-month U.S. Treasury Bill rate, less fees totaling 0.5% annualized, to Lenders. There are no in or outbound fees and fees of 50bps are annualized and paid on interest earned.

- Immediate interest and next-day withdrawals: Interest accrues from the time of deposit which differentiates the Cash Management Solution from most other offerings. The pool is designed with its customers’ needs in mind - so Lenders can manage cash flows there’s no lock-up period and withdrawals are serviced the next U.S. banking day.

- Established, transparent infrastructure: Maple’s superior smart contract infrastructure has processed billions in transaction volume and provides constant, verifiable, on-chain information not subject to manual input or manipulation.

- Familiar structure provides the most direct access and recourse to Treasury Bills: Lenders are attracted by the most direct access to U.S. Treasury Bill rates on-chain and recourse to Treasury Bill collateral.

- Managed with leading 3rd parties: Room40 Capital, an institutional crypto hedge fund, has established a stand-alone SPV to be the sole borrower from the pool. The team has decades of operational and trading experience in the US Treasury market. The Room40 Capital team trade, custody and clear from an account with regulated broker StoneX. Maple has a track record in providing secure and scalable products on top of best-in-class smart contract infrastructure and was recently awarded a 92% Safety Score by DeFi Safety [full report].

- Speedy onboarding: So Lenders have more time to focus on their core business, Maple has simplified onboarding down to 3-steps and just 15 minutes to complete the application. If you are a corporate treasury on Solana or looking to allocate in to this innovative yield solution then sign up here.

“The Solana DeFi ecosystem has demonstrated resilience and with continued high levels of VC funding we believe Solana's ecosystem is poised for growth. We’re proud to return to Solana to offer the Cash Management Solution, so Solana based protocols can, for the first time, lend their idle cash in a pool collateralized by U.S. Treasury bills”. Sidney Powell, CEO and Co-Founder, Maple Finance.

Maple's initial foray into Solana in early 2022 saw over $125 million loans issued in partnership with Genesis, Circle and Credora. Maple paused development on Solana late 2022 to focus development on Maple Ethereum, and its return to Solana is a nod to the ecosystems continued promise and potential.

Maple is committed to providing access to financial products on-chain and continues to launch new and diverse yield opportunities to suit the risk, liquidity, and compliance needs of institutional and individual investors across the globe. Expanded access to Cash Management for Solana based Accredited Investors, comes quickly after Maple opened access to Cash Management on Ethereum for U.S. based Accredited Investors, and launched a USDT denominated iteration of Maple Cash Management where non-US lenders can earn yield backed by U.S. Treasuries directly in their preferred stablecoin.