An Update from AQRU

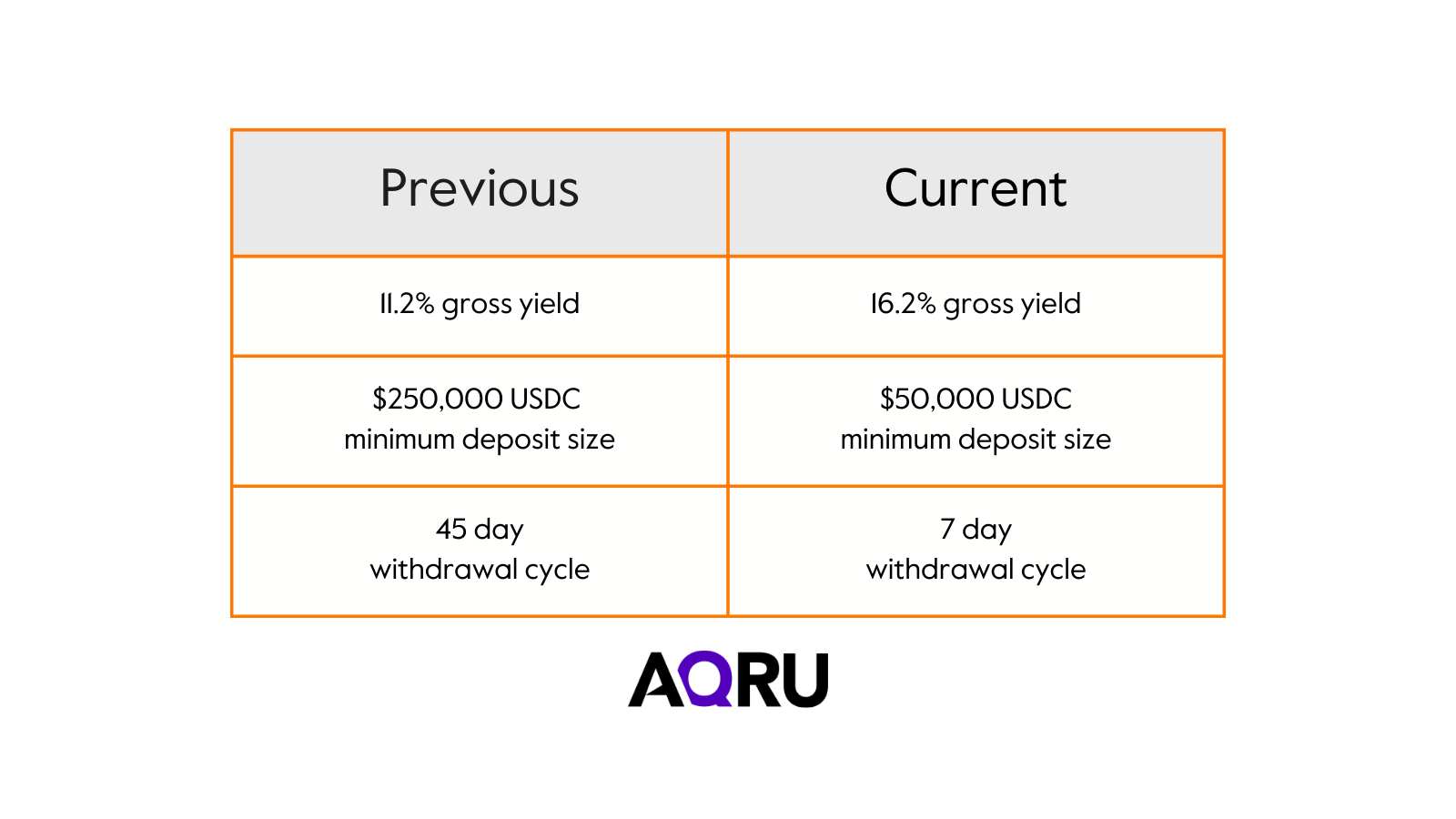

The AQRU Receivables pool has performed exceptionally through its first 6 months, with the underlying tax receivables being settled by the US Treasury within modeled timeframes. As the pool is now mature and stable cash flows are being maintained, we are thrilled to improve the interest rate and liquidity for Lenders. Interest yield has increased to a gross 16.2% from 11.2%, the minimum participation has decreased to $50,000 from $250,000 and weekly withdrawals are made possible.

Year to Date Recap

It’s been an eventful six months since we launched the US Treasury Receivables Financing Pool (focused on IRS Tax Credits) in partnership with Intero Capital on the Maple platform in late January. At the time, real-world-assets (RWAs) in the digital asset lending space were more of an idea; however, their popularity has since exploded with over $500 million active loans in the Private Credit space and $600 million of US Treasuries moving on-chain.

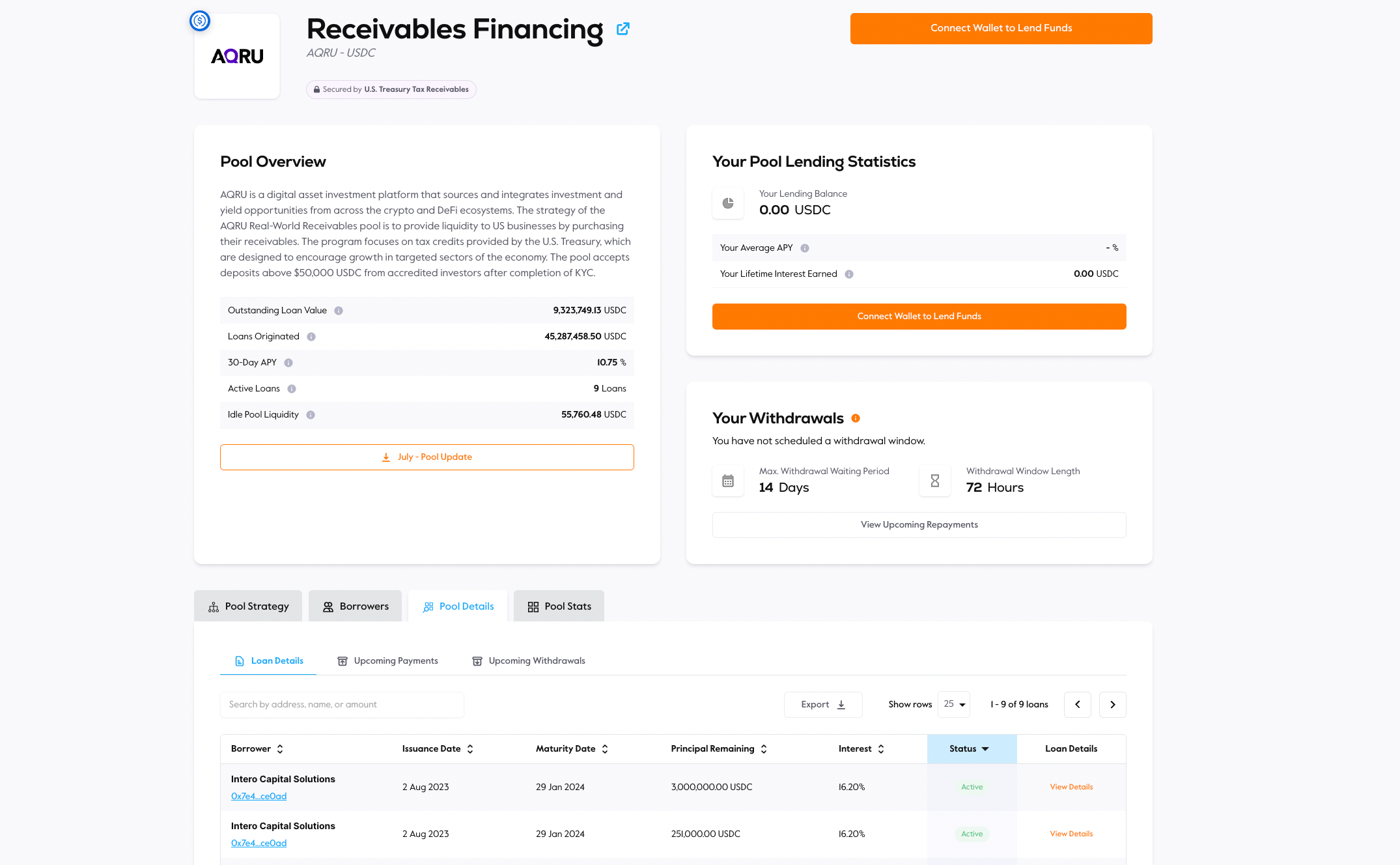

The AQRU pool has benefited from this growth, issuing and refinancing over $45 million of loans, earning lenders $386,000 in interest and, most importantly, the underwriting processes and strategy in place have resulted in strong operating performance.

Diving into the details, 382 receivables have been purchased for a total of $18.02 million in value. Of the receivables purchased, 54.8% were repaid within 90 days, 31.25% between 91 and 120 days, 12.5% between 121-150 days, and the rest were over 150 days. No applications have been rejected to date from the receivables purchased using the pool’s funds. These payback times are subject to change depending on the efficiency of processing at the IRS.

These data points are significant for two reasons. Firstly, in a receivables financing business, the purchaser’s success (in this case Intero Capital Solutions) is tied to a combination of the percentage of receivables collected and any potential loss rate, and secondly, it depends on the speed at which they’re collected.

For example, if I buy a $11 receivable for $10 that collects in 1 year, I earned a 10% implied annual return. But if I buy an $11 receivable for $10 that collects in 6 months, I earned that same 10% return in half the time, implying a 20% annual return if I can repeat that for the second 6 months.

Now offering an Increased Yield, Weekly Liquidity and Broader Access

In evaluating the strong performance of Intero and the successful repayments of the underlying receivables, we have agreed a higher interest rate on loans made in the program. This work was undertaken jointly with Intero, to create an enhanced and compelling offer for on-chain capital allocators, focused on high returns at low risk. All outstanding loans were refinanced to a new rate of 16.2% on August 2nd boosting the yield received by investors by around 50%. The higher interest rate is reflected in the current loan book and can be viewed in the Pool Details section on the Maple WebApp.

In speaking to lenders, we received feedback that the existing recurring 45 day withdrawal cycle is longer than ideal. With this in mind we have reduced the withdrawal cycle to weekly with lenders able to withdraw every Monday to Thursday subject to liquidity.

With this change, lenders should still expect an approximate 6 month duration of their capital when they lend into the pool, but the reduction in cycle times will provide the flexibility for more frequent redemptions as capital becomes available when payments are made by Intero and made available within the pool.

And finally, we have reduced the minimum USDC deposit size to $50,000 from $250,000, to welcome more Accredited Investors to the pool after completion of KYC.

The structure of the loans and strategy remains unchanged with a target loan duration of 6 months to Intero and the pool aims to keep the average duration of receivables to be within 6 months.

Begin onboarding here.

Visit the pool.

Opportunities Ahead

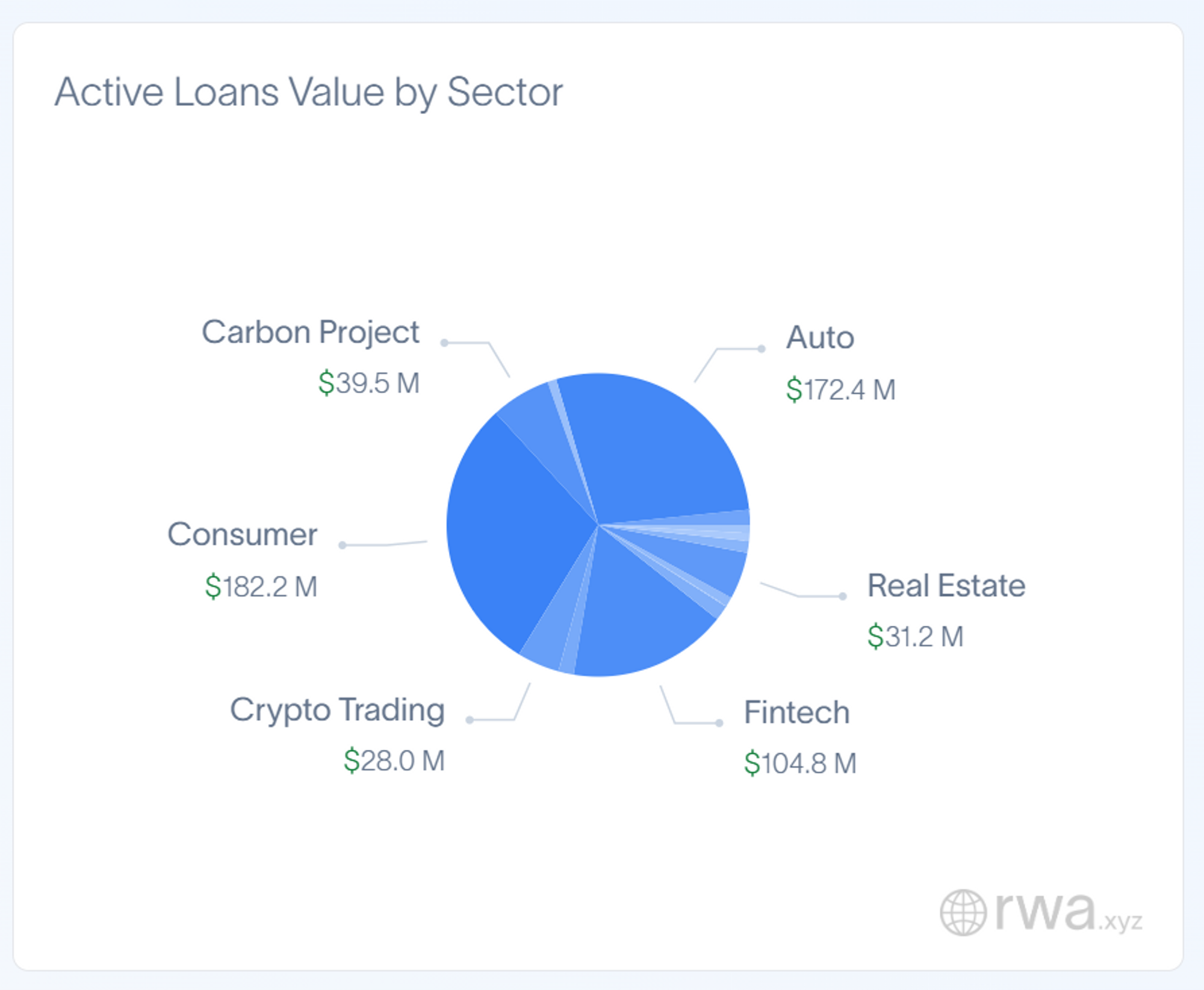

Looking ahead, we remain very optimistic about the prospects for the pool and the RWA sector at large. The RWA asset space within DeFi is experiencing rapid growth in both the private credit and on-chain treasuries space.

Within the private credit space, there are $584.5 million in active loans recorded on-chain, yielding, on average, 10.76%. The majority of these loans finance either consumer or auto loans which are experiencing increased default rates as households come under pressure due to rising inflation.

The AQRU Receivables Pool lends against US Treasury receivables, in the form of tax credits, which is uncorrelated with wider market risk and offers yield almost 50% higher than the average found in the RWA private credit space and 100% higher than on-chain Treasury offerings. Our view is that this presents the most compelling risk reward found anywhere in the DeFi lending space.

Source: rwa.xyz

The US Treasury receivables program providing the tax credits, is expected to continue until the end of Q3 2025 and we see over $1 billion in the pipeline of financing opportunities to be funded.

The partnership with Maple has been a big success (alongside Intero) as we have jointly scaled the pool to ~$10 million and will continue to grow this asset base as we continue on the path to $500 million in Total Value Locked.