Comparison: Maple Direct Secured Lending vs. Abra

Maple's Secured Lending product continues to see tremendous growth, with total loan originations across Blue Chip Secured and High Yield Secured surpassing the 200MM mark. As institutional demand for yield increases, it's important to compare Maple's offerings with other platforms in the market. One such platform is Abra, which recently pivoted to a registered investment advisory (RIA) model. Let's explore how these two solutions stack up for USDC lenders.

Summary

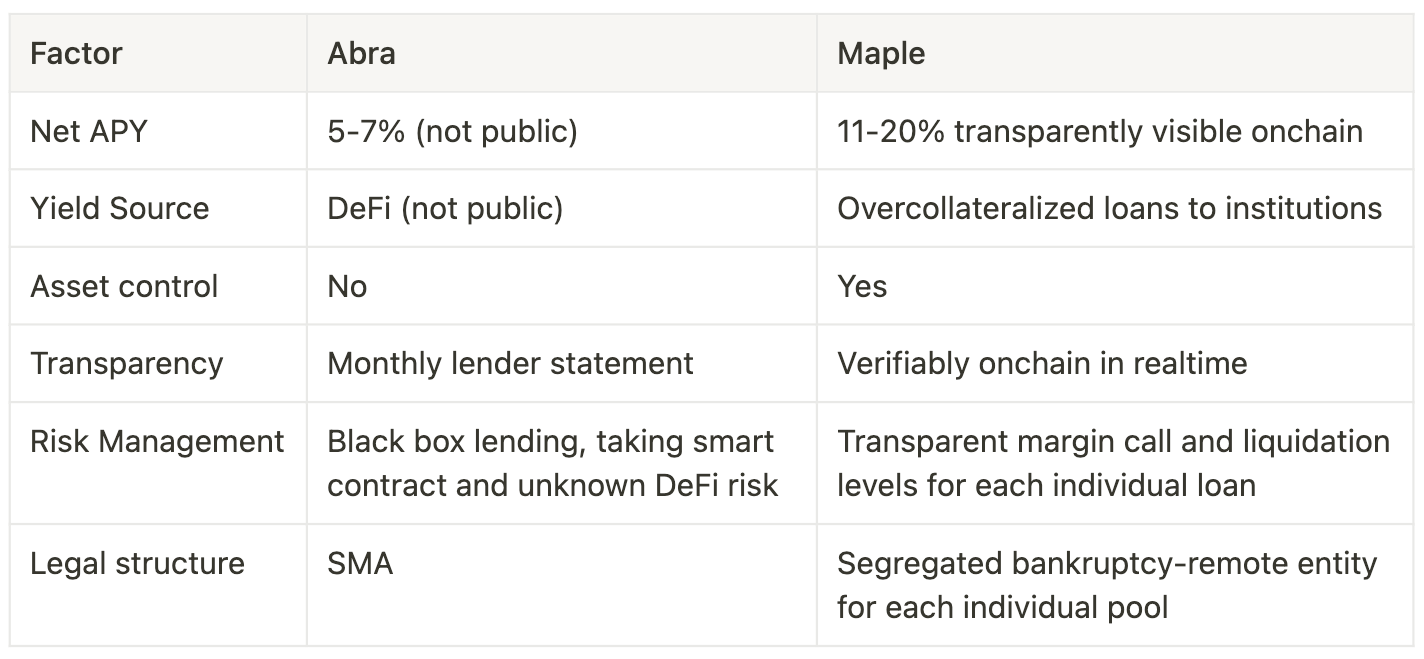

Comparison Table showing Abra to Maple

What the Data Shows

Maple Direct's Secured Lending pools have consistently outperformed many DeFi lending protocols, including Aave v3 and Compound. Now, let's compare Maple's performance to Abra's new yield product:

On the Maple side, our Pool_v2 smart contracts continue to provide a sophisticated accounting system where the Pool's total_assets comprise idle cash, outstanding loans, and all accrued interest. This results in stable, predictable yields for lenders.

Abra, on the other hand, uses a CeFi model. While they deploy funds to DeFi protocols such as Aave v3 and Compound, the custodial nature of their separately managed accounts (SMAs) introduces an additional layer between the lender and the yield source. This impacts both returns and transparency for lenders.

Yield Comparison

Maple's High Yield Secured pool is currently targeting ~18-20% yields for USDC lenders, while Maple’s Blue Chip Secured pool has delivered ~10% net APY since its inception in August 2023 and is currently targeting 11-12% net APY. These yields are highly differentiated and not available anywhere else, as they are a direct result of Maple’s unique commercial offering and robust network of borrowers.

Abra's yields are likely significantly lower that Maple’s for a couple of reasons—first, because of additional overhead from their custodial structure and RIA compliance requirements; second, because they are sourcing DeFi yields primarily from Aave and Compound, as stated recently by Abra CEO Bill Barhydt on the Empire podcast. Exact figures are not publicly available, but it's reasonable to assume that net yield delivered to lenders on Abra would be lower than Aave v3 (roughly between 6-7%), which Maple Direct has meaningfully outperformed over the last year. Given the fact that Abra accesses yield from Aave and Compound , it’s reasonable to assume that Abra’s USDC yields fall in the mid single digits, significantly lower than comparable double digit yields available via Maple’s secured lending pools.

Risk Management and Transparency: On-chain lending vs. Black box lending

Maple offers several advantages in terms of risk management and transparency:

- KYC'd borrowers: All Maple borrowers are fully vetted institutions.

- Transparent collateralization: Loans across Maple's Secured pools are collateralized >150% on average, visible on-chain.

- Fixed mandate strategies: Lenders can choose their risk exposure (e.g., Blue Chip only accepts BTC & ETH as collateral).

- On-chain verification: All loans and collateral can be verified in real-time.

Abra, despite generating yield from DeFi, introduces a layer of opacity due to its custodial nature. Lenders don't have direct visibility into the underlying DeFi deployments, relying instead on Abra's reporting. This is what is often referred to as a ‘black box lending’ arrangement, typical of CeFi lending platforms that were popular in prior cycles.

Legal Structure and Asset Control

Maple provides a clear legal structure where lending positions are governed by legal documentation. Importantly, lenders retain full control of their assets in Maple's non-custodial model.

Abra's RIA model, while compliant, means that lenders don't retain direct control over their assets. The SMA structure, while familiar to traditional investors, limits the DeFi-native benefits of self-custody and direct asset control.

Final Thoughts

While both Maple and Abra offer white-glove yield platforms, Maple's non-custodial, fully on-chain approach offers several advantages:

- Higher, more stable yields

- Full transparency and on-chain verifiability

- Direct asset control for lenders

- A true DeFi native solution without intermediaries

Abra CEO Bill Barhydt recently stated on The Pomp Podcast, "I'm not familiar with any other pure-play yield service that is 100% based on DeFi now." However, Maple offers exactly this - a fully DeFi-based yield platform that has been successfully serving institutional clients with white-glove service for years.

For USDC lenders seeking to maximize returns while maintaining control and transparency, Maple's Secured Lending pools continue to offer the best risk-adjusted yields anywhere — in CeFi or DeFi.