2025 marked a turning point for Maple and for onchain asset management as a category.

Over the past twelve months, Maple evolved from a lending protocol into the largest onchain asset manager, trusted by traditional financial institutions and neobanks, integrated with leading DeFi protocols, and operating across multiple platforms. Here's what defined the year.

The Largest Onchain Asset Manager

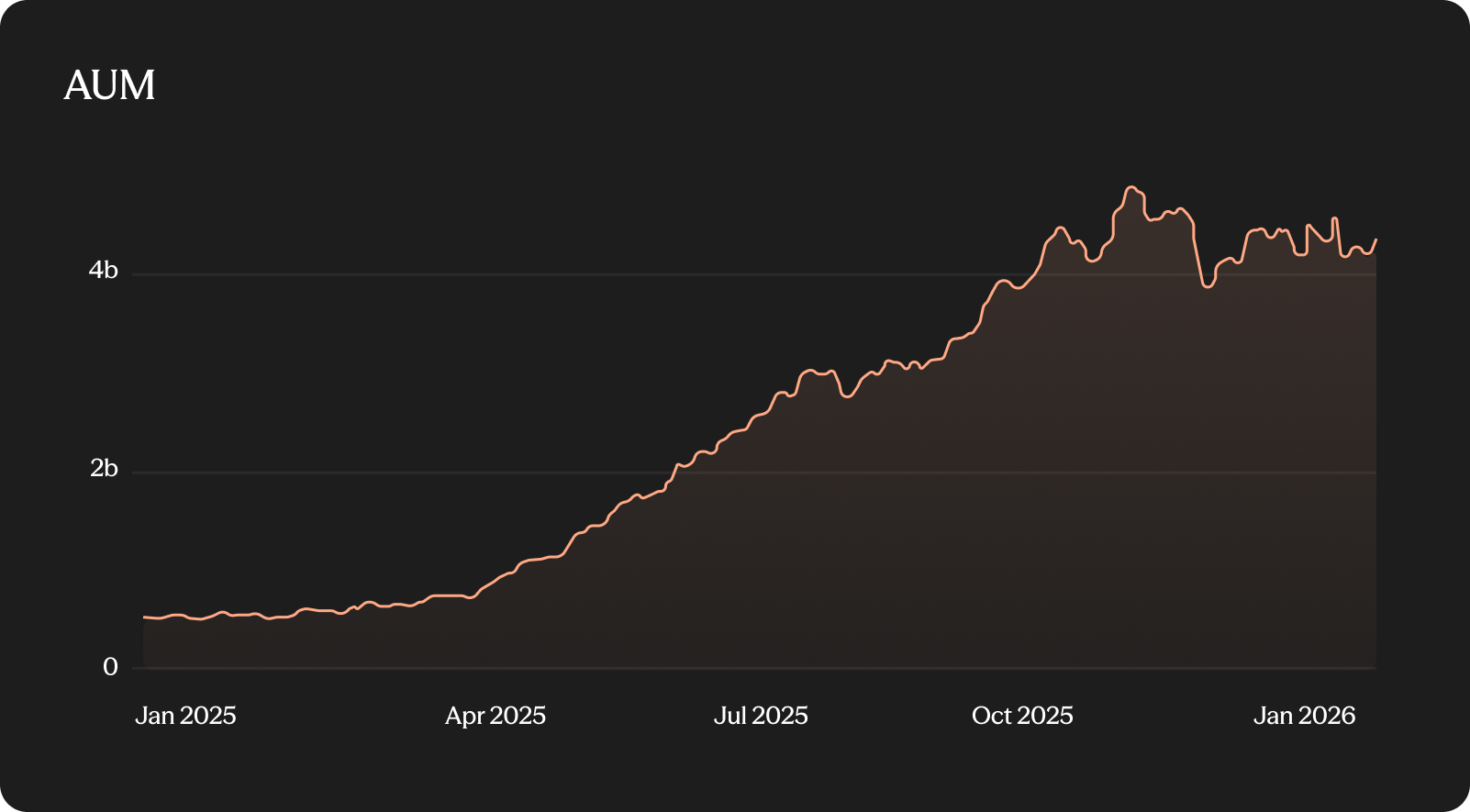

Maple's assets under management scaled from $516 million at the start of the year to $4.59 billion by year's end. This is a 767% increase driven by consistent performance, institutional-grade risk management, and operational execution.

The scaling reflects Maple’s updated positioning as an onchain asset manager, as well as the protocol’s growing product lineup and expansion of distribution venues. Maple started 2025 as a DeFi protocol offering dollar-denominated yield on stablecoin deposits, and entered 2026 as the leader of its category with product reach and integrations spanning the largest platforms as well as earn programs. With $65M in yield distributed to depositors in 2025, Maple facilitated alignment between allocators looking for yield and borrowers looking for capital efficiency.

Revenue ATHs

Maple's revenue records highlight the scalability of the business model and the growing adoption of its products.

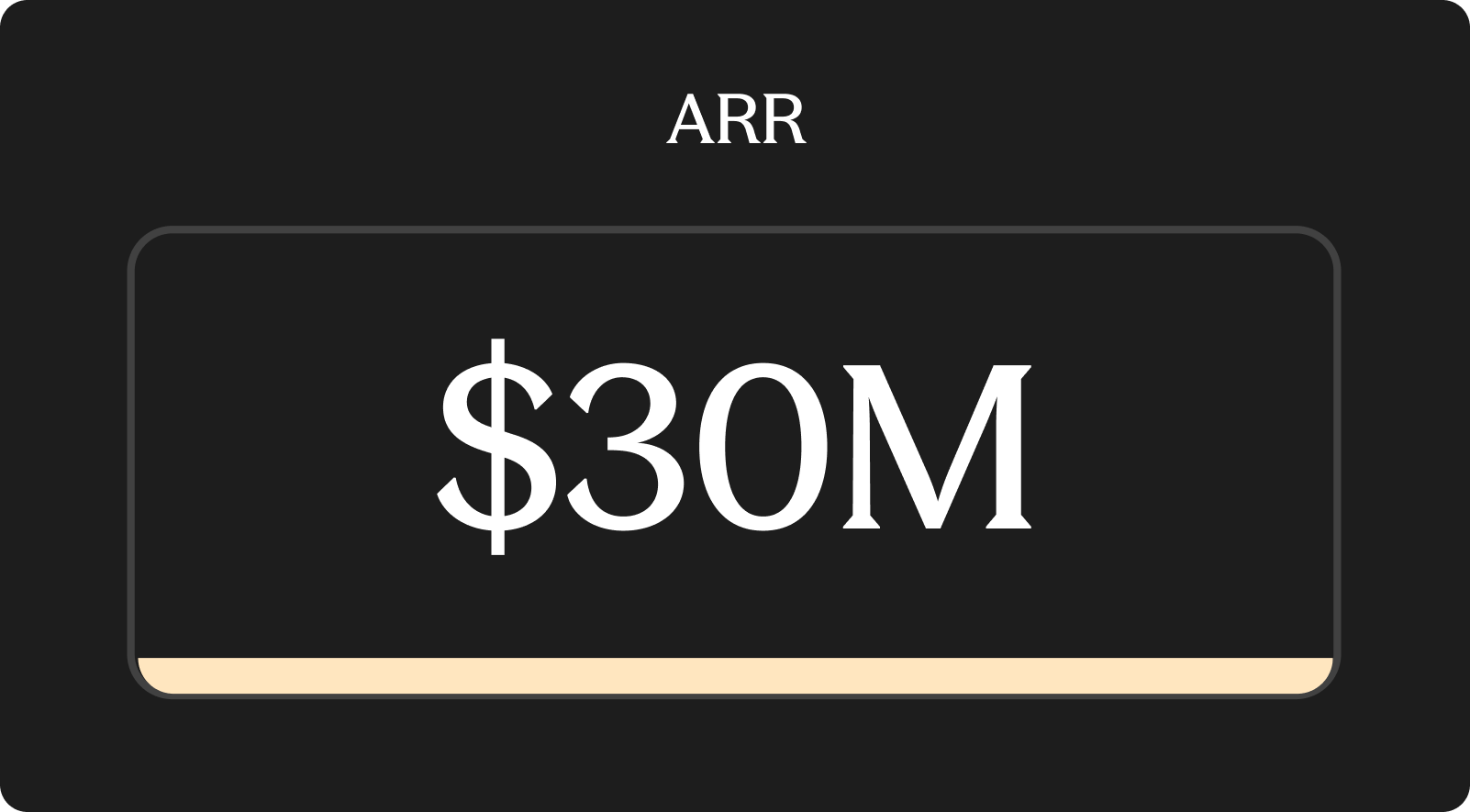

In Q4 2025, the ARR reached $30 million, demonstrating the ability to convert AUM growth into revenue scaling. The latest quarter’s performance positions Maple well to reach the $100M ARR target in 2026.

As inflows continue to accelerate, the ARR will follow. This is further boosted by Maple’s capital efficiency and ability to retain deposits.

Dollar Yield Performance

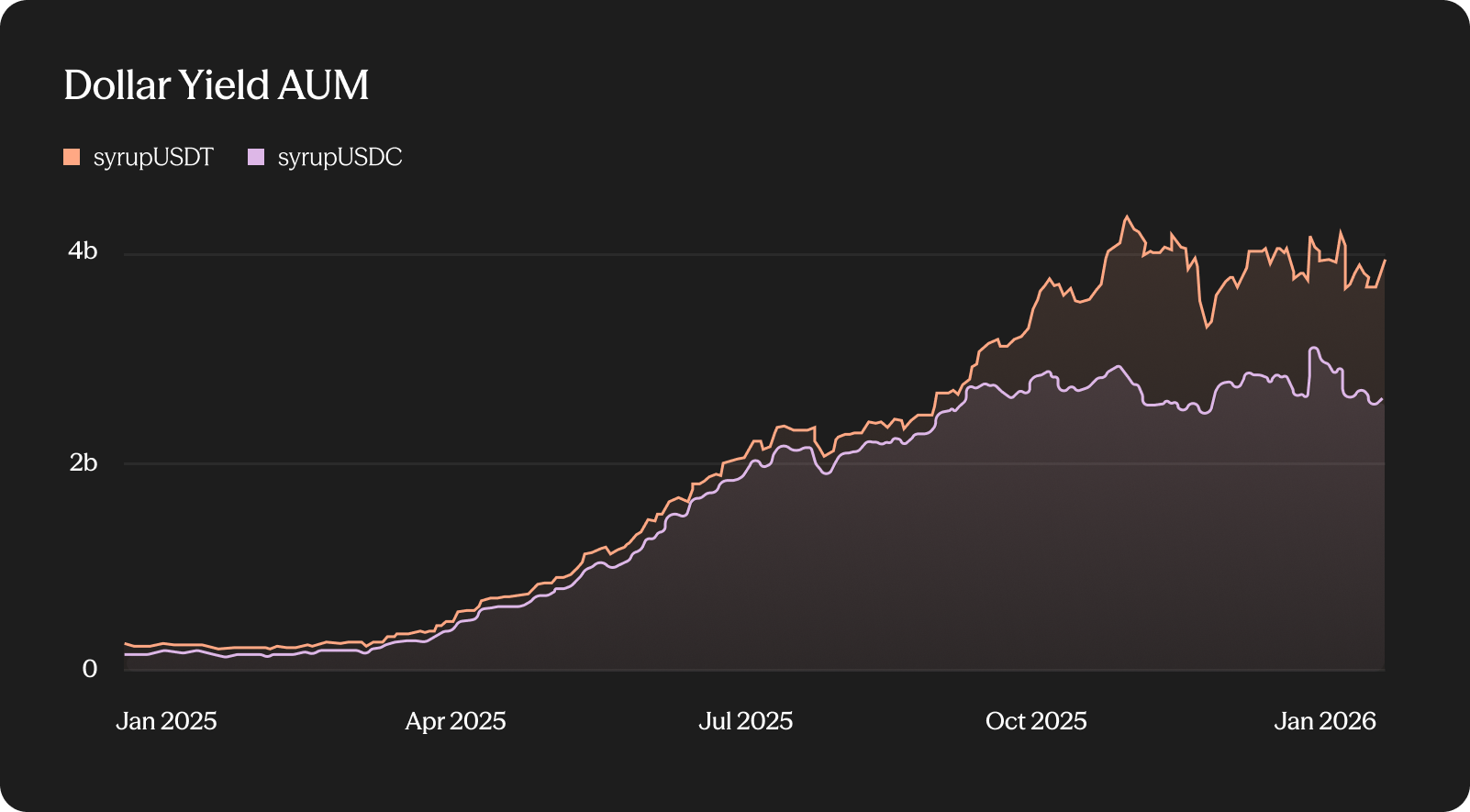

Both Maple’s flagship dollar yield products experienced exceptional growth in 2025.

syrupUSDC’s AUM reached $3.02 billion, representing a 1,826% year-over-year increase. syrupUSDT scaled to $1.12 billion, growing 1,764% over the same period. This level of expansion across both dollar products demonstrates strong demand for Maple's dollar-denominated yields across the two largest stablecoins’ user bases.

Institutional Adoption

Maple's institutional product continued to gain traction with institutional allocators and qualified individual investors.

Maple Institutional-Secured Lending reached $420 million in AUM, delivering 10.31% APY to depositors. The scalability of the product reflects the strong relationships and larger deposits that institutional allocators bring to the platform.

The institutional product is positioned well to scale further with all permissioned pools being unified into one universal product. This streamlines allocator engagement and brings additional clarity to the product range.

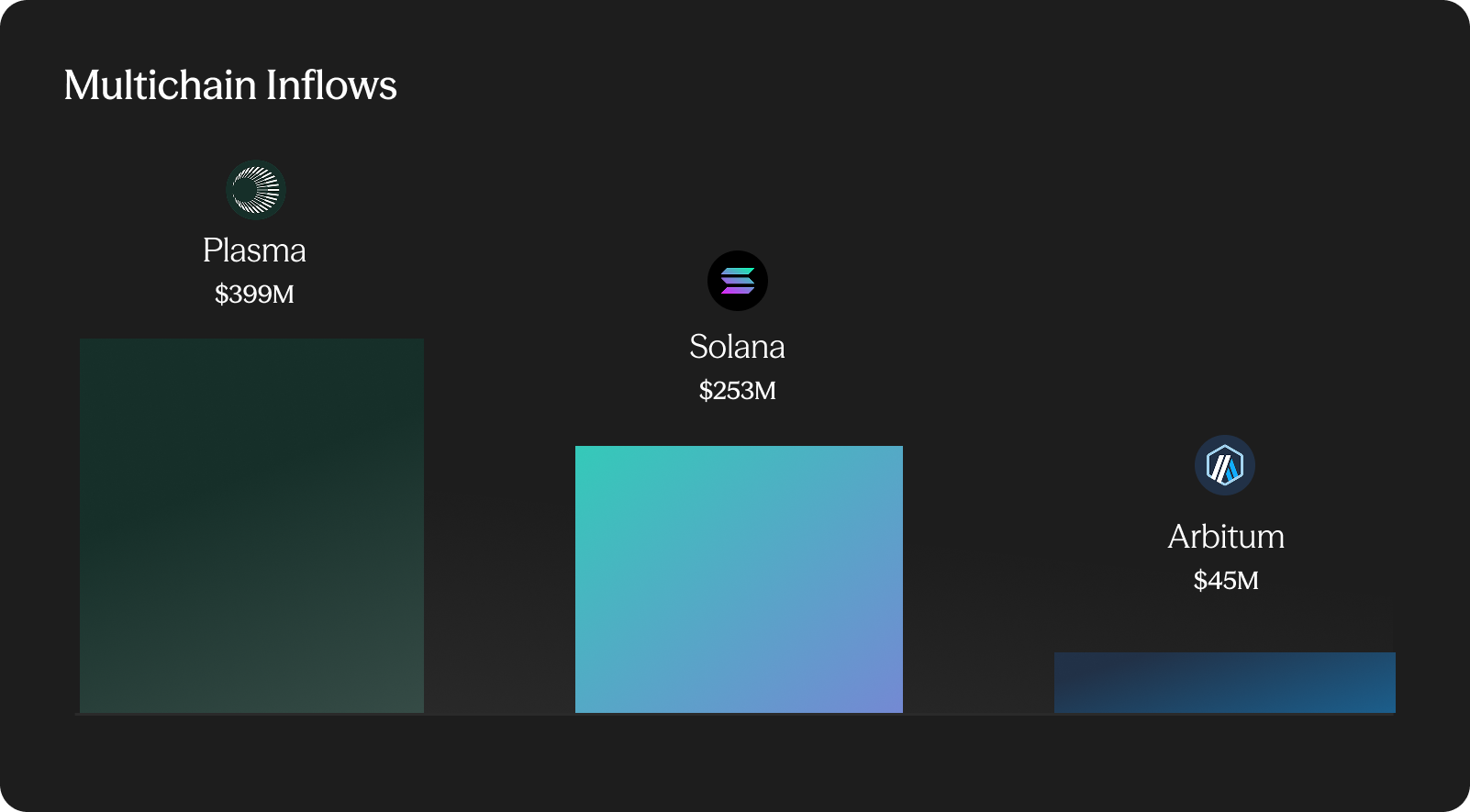

Multichain Expansion

2025 was the year Maple deployed its asset management infrastructure across chains, powered by Chainlink.

syrupUSDC launched on Solana and Arbitrum, bringing Maple's flagship dollar yield to two of the most active ecosystems in crypto. syrupUSDT arrived on Plasma, broadening access to dollar-denominated strategies for a new segment of users as well as neobanks and fintechs building earn programs.

All integrations came with strong ecosystem support on day one. Maple secured deployments with leading protocols such as Aave and Fluid. The former saw $554M+ in inflows with the latter generating over $85M in AUM for Maple. These strategic deployments broadened the distribution vectors and laid the foundation for generating scalable inflows. They enabled user access to high-yielding DeFi strategies from day one and allowed syrupUSDC and syrupUSDT to meaningfully establish themselves in the new ecosystems.

These deployments position Maple to reach depositors and fintech integration partners regardless of their chain of choice and broaden the growth verticals available to the protocol.

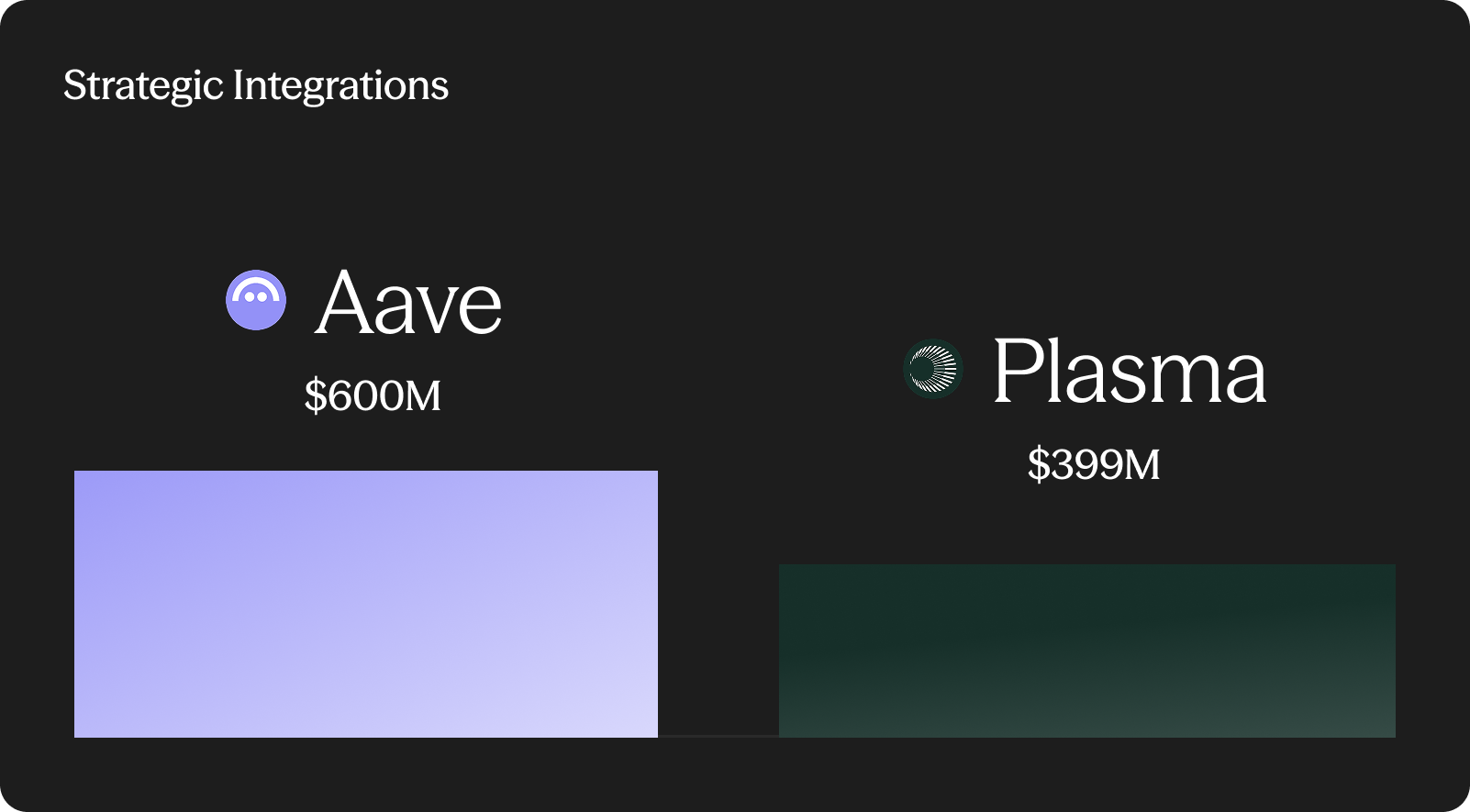

Strategic Integrations

The caliber of Maple's partners speaks to its growing role in the broader financial ecosystem.

In DeFi, integrations with Aave and Fluid established Maple's dollar yield products as key infrastructure pieces for onchain asset management. Partnerships with Cantor and Bitwise underscored Maple's position at the intersection of onchain and institutional capital. Hundreds of millions in inflows from the Sky ecosystem demonstrated Maple’s ability to attract a wide range of large allocators as well as successfully undergo external reviews and secure the necessary approvals to facilitate large capital inflows.

Exchange earn programs emerged as a new scalable growth venue. Integrations with Binance and OKX broadened Maple’s distribution network and provided direct access to millions of individual allocators looking to deposit capital. These integrations demonstrate Maple's ability to serve as backend infrastructure for consumer-facing platforms, which is relevant for fintechs and neobanks looking for yield products in 2026 and beyond.

The Lending Foundation

Maple's asset management capabilities are built on a strong overcollateralized lending framework. Maple Institutional-Secured Lending, as well as syrupUSDC and syrupUSDT all performed exceptionally well through multiple market shocks including October 11 with zero liquidations. All margin calls, whether during market volatility or not, were cured within hours. This kind of performance is continuously enabled by real-time communication and automated monitoring systems.In 2025, Maple originated loans totaling over $11.27 billion with 60 unique borrowers. The pace of growth was faster than the broader industry which reflects Maple’s leading status.

Looking Ahead

2025 scaled the model. 2026 will be about taking it to the next level and driving value to token holders. With the key goal being $100M in ARR, Maple is well-positioned to solidify its place as the leading onchain asset manager and expand to new venues.

A key part of the expansion strategy includes powering yield products for the largest fintechs and neobanks globally. As hundreds of millions of people worldwide start looking towards the next generation of financial services, Maple’s yield products become a natural choice. Bringing onchain asset management to the masses as well as further expanding what the category means will unlock new scalability vectors and reinforce Maple’s leading position in the new financial ecosystem.