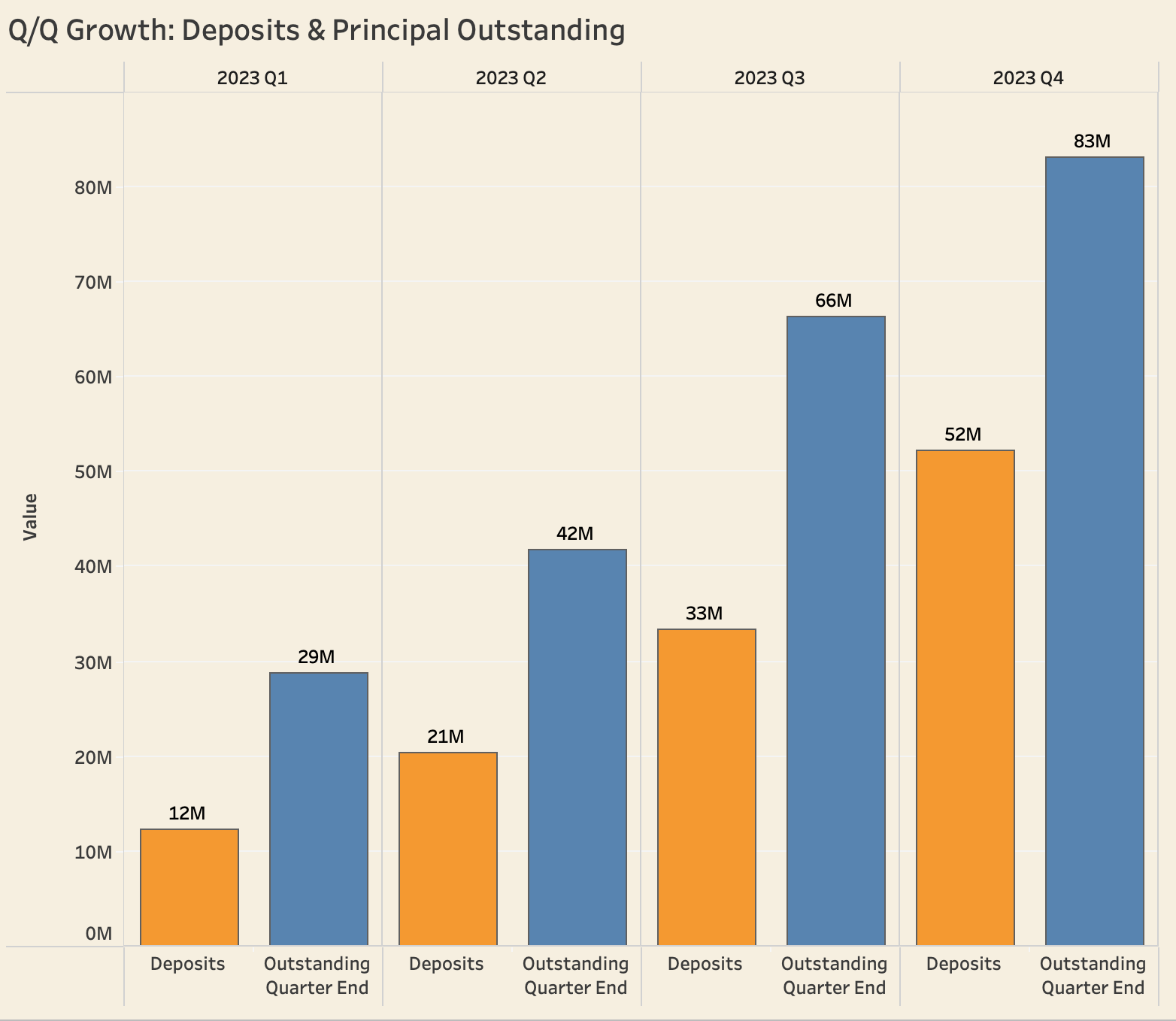

Q4 was a remarkable close to a pivotal year for Maple, as the platform continues to mature and grow in different directions. On average, loans outstanding grew by 42% every quarter this year; 52% for ARR. Maple Direct, our lending arm, continued to scale up with new and diverse credit offerings for lenders. We continued to refine our smart contract infrastructure and laid the groundwork for a brand new login / account system that takes the Maple experience to a new level. Integrations with various custodians and exciting partnerships throughout the ecosystem will help us grow the Maple ecosystem throughout 2024.

The data and information in this report are intended for informational purposes only and are subject to change. The data provided are based on the status of the Maple Treasury on the 31st of December 2023. All figures are shown in USD and based upon the ETH closing price of $2,279.94. For more information, see the disclaimer linked below.

Q4 IN REVIEW

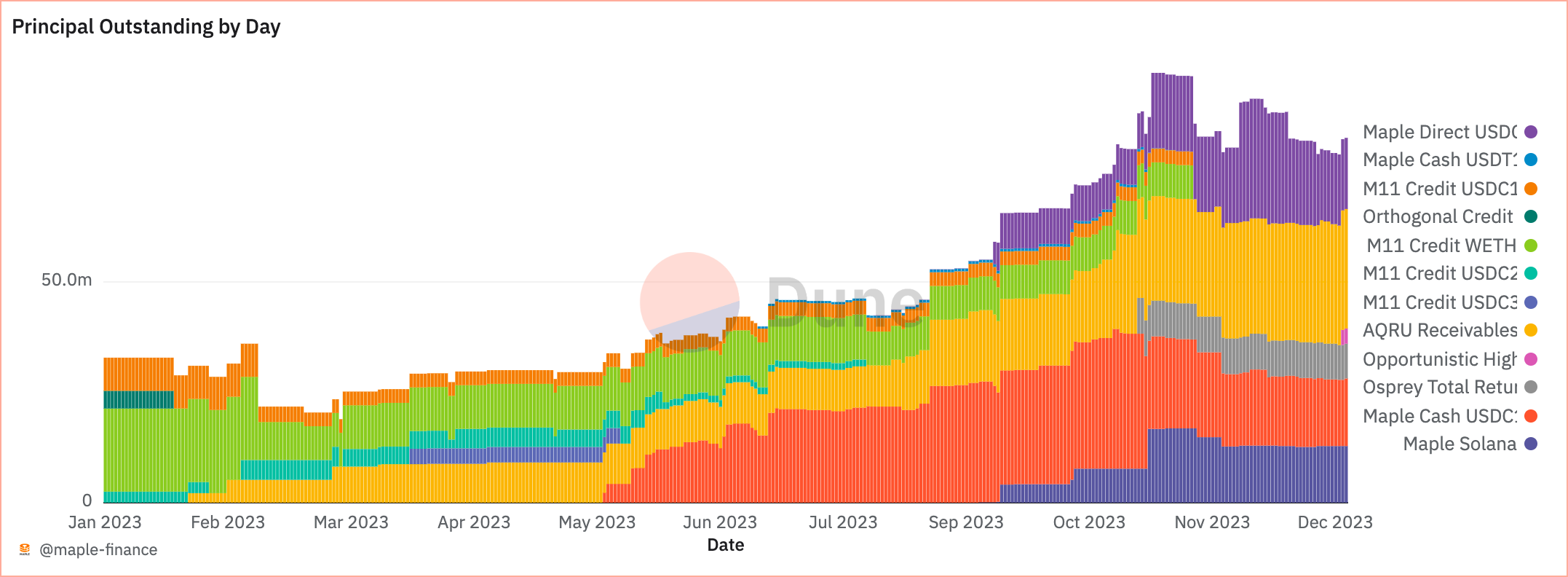

The final quarter of 2023 was one of our strongest yet. Looking at the active Pools throughout 2023, we had the most diverse offering of credit opportunities than ever before, closing the year with $0 from the set of Pools with which we opened 2023.

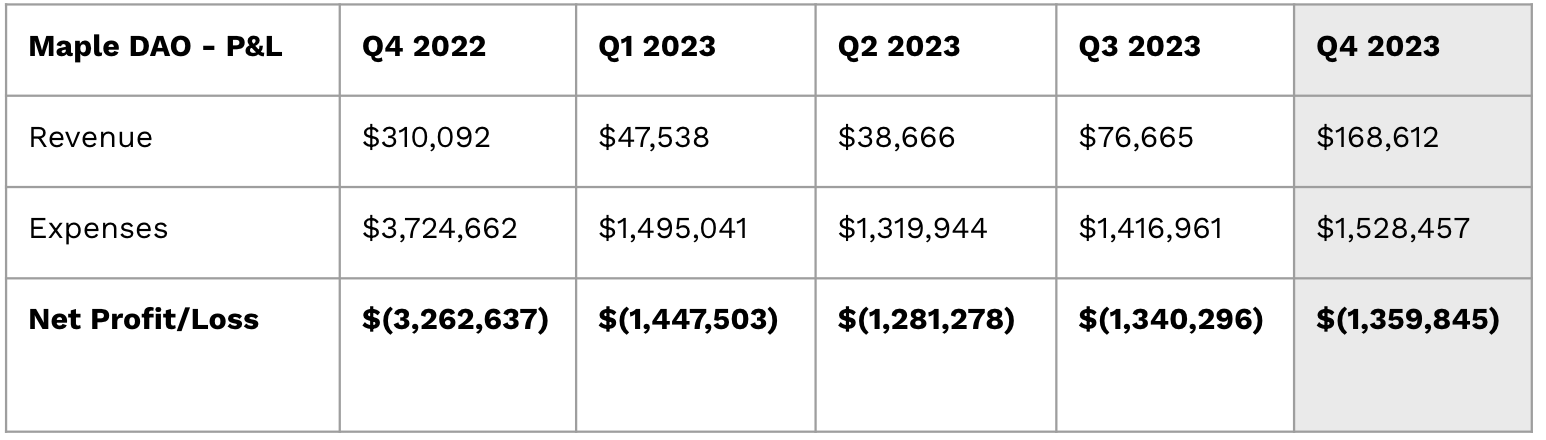

Revenues have continued to scale and the last 3 months of 2023 were Maple's highest revenue months of the year.

Opportunistic Pool Launch

We were thrilled to launch another exciting opportunity managed by our lending arm, Maple Direct. The Opportunistic High Yield Pool provides strategic financing to a top tier counterparty in the digital asset ecosystem, with a parent guaranty. Lenders in this Pool have earned a net APY of 11% since launch, and we will continue to scale this Pool moving into 2024.

Upgraded and Improved Maple Cash Management

In December, we introduced a new Withdrawal Manager to the Cash Management Pool which drastically improved the withdrawal process for lenders. Since the upgrade, average time to completed withdrawal has gone from >38 hours to ~10 hours on average. Weekday requests during business hours are being serviced in just 3 or 4 hours. No more withdrawal windows; just make your request and wait for the funds to arrive in your wallet!

Commercial Expansion

During Q4 Maple Direct launched ‘the Debt Stack’, a new podcast covering crypto credit markets. During the quarter we released the first 3 episodes with a more than doubling in listeners to each episode.

Maple announced that Circle funded a loan from its corporate treasury to Maple's Secured Lending pool to expand USDC adoption and on-chain capital markets. Besides that, relationships have been built with the major custodians to expand the secured pool offerings.

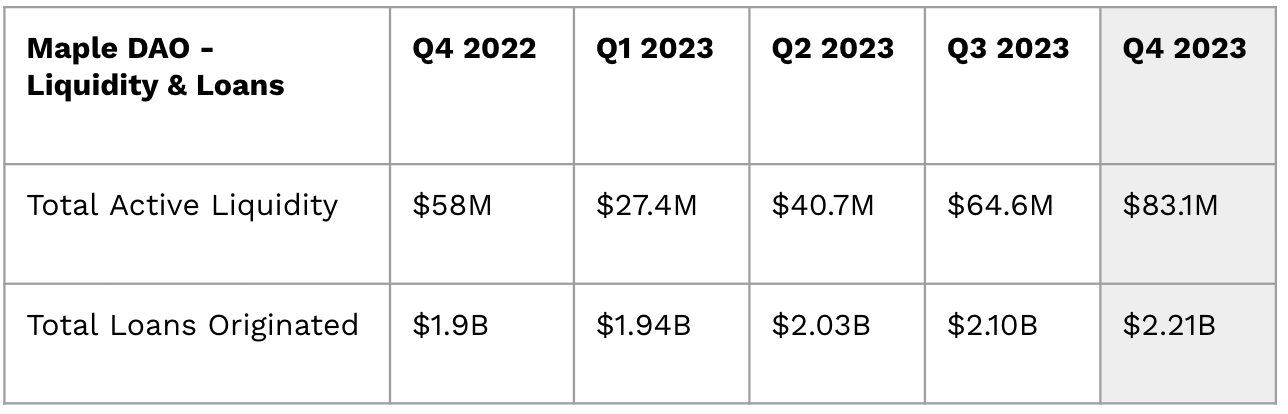

Maple attracted 52MM in deposits in Q4 and had 83MM in loans outstanding at quarter end, both representing strong growth compared to Q3.

Closing

Q4 2023 was a fitting bookend to wrap up a pivotal year in the Maple Finance story. The team is energized and excited as ever to bring back on-chain capital markets in a big way. We appreciate the continued support from investors, users, and the community, and can’t wait to see where 2024 takes us! Follow along with the growth of Maple in our new Dune dashboard!

Sid and Joe also wrote a Founder's Letter reflecting on 2023 in more detail and giving a look forward to 2024.

Q4 2023 HIGHLIGHTS

- Grew outstanding loans by 25% Q/Q

- Interest paid to LPs was up 76% Q/Q

- Active LPs on the platform rose 45% Q/Q

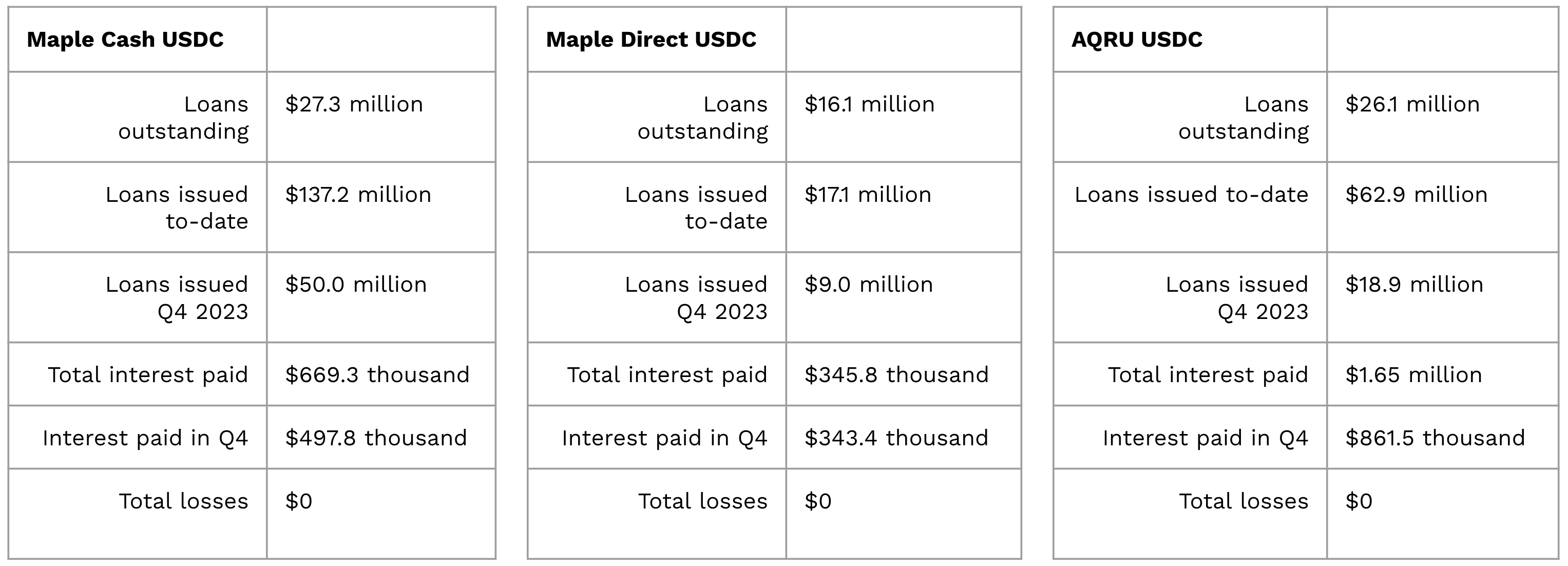

Table 1: Q4 Liquidity and Total Loan Originations

Table 2: Maple DAO Revenue & Expenses

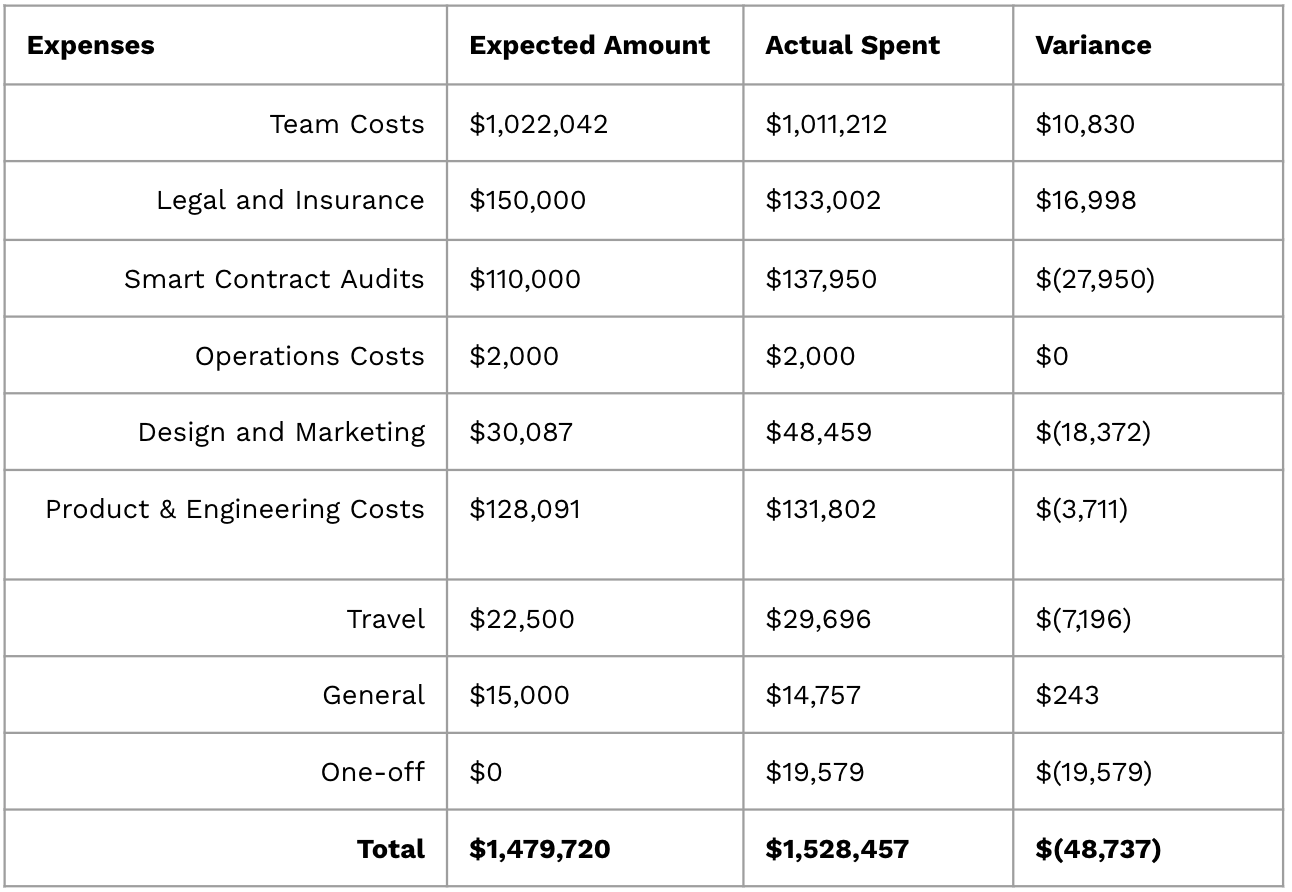

Q4 2023 EXPENSES

Q4 2023 expenses are detailed below, showcasing a comparison between budgeted and actual expenditure:

Table 3: Maple Labs Q4 Actual vs Budget Variance

Table 4: Q4 Pool Statistics