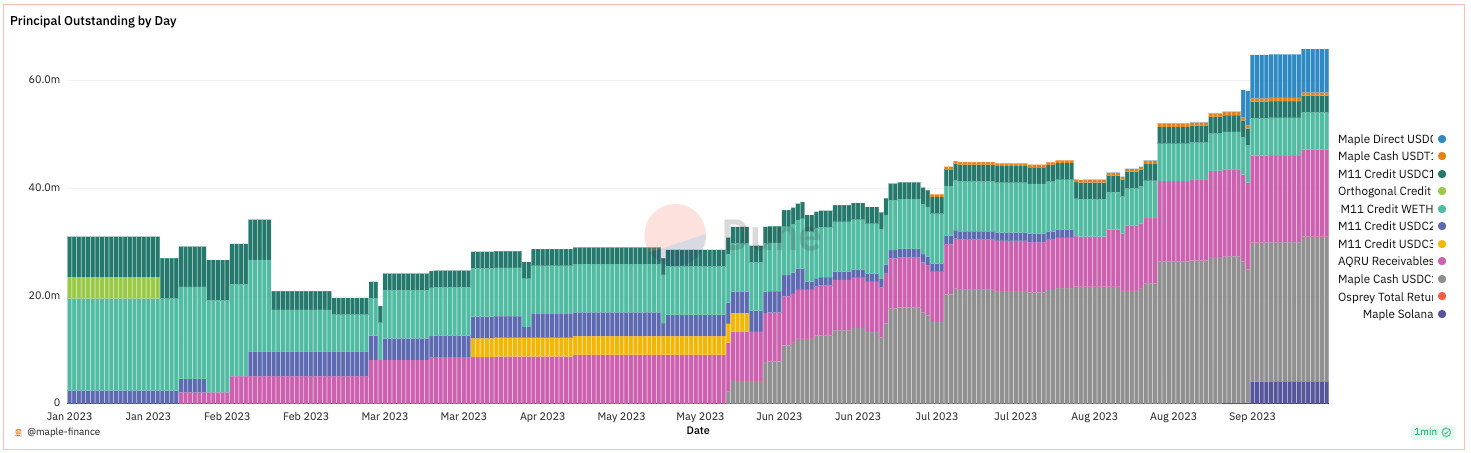

Q3 represents a pivotal moment for Maple, showcasing substantial progress and product expansion. The introduction of three new pools led to noteworthy growth in loans and protocol revenue, building on the momentum from Q2. Our Real World Asset (RWA) pools experienced remarkable growth, highlighting strong user engagement and lender commitment across a range of diverse credit products.

The data and information in this report are intended for informational purposes only and are subject to change. The data provided are based on the status of the Maple Treasury on the 30th of September 2023. All figures are shown in USD and based upon the ETH closing price of $1,671. For more information, see the disclaimer linked below.

Q3 IN REVIEW

We are proud looking back at the broad accomplishments of Maple in Q3. Every team contributed as the Maple platform continued to expand in multiple directions.

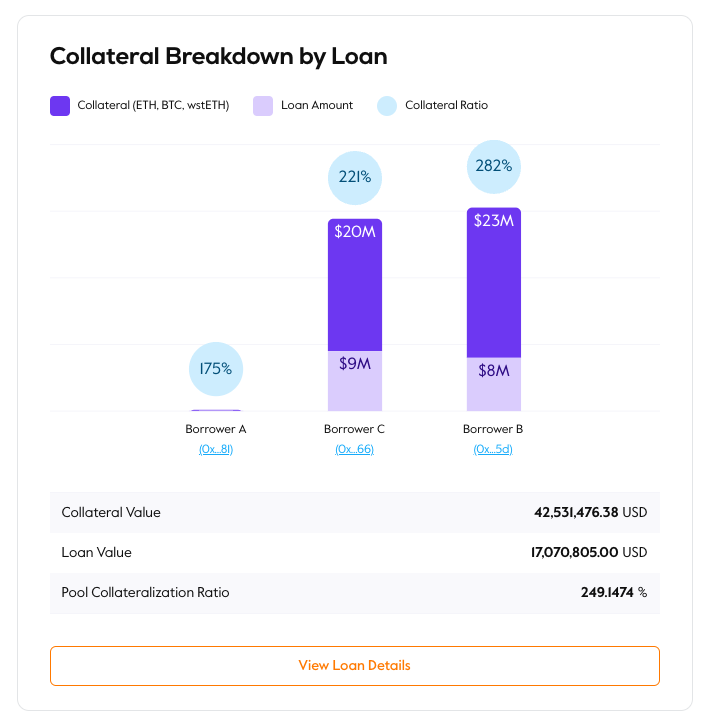

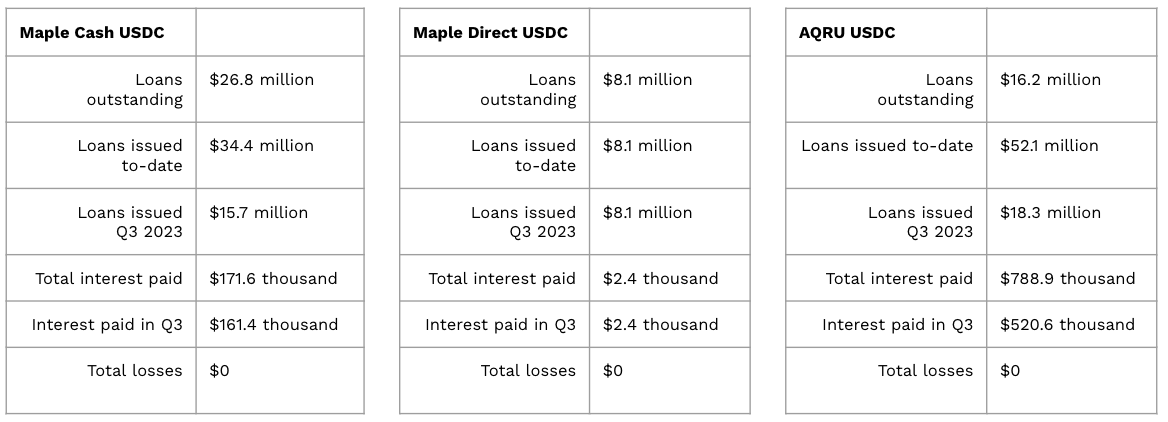

We were thrilled to issue the first loans from the Maple Direct pool, our new direct lending arm. This was highlighted in September by the $8MM USDC loan issued to a crypto-native institution; this deal was oversubscribed, with lenders attracted to the significant over-collateralization and 8-9% net APY against short dated cash rates of 5%. This pool showcases Maple’s new Active Collateral Management (ACM) feature as Maple continues to build the most advanced lending product in digital assets, aiming to fill the hole left by CeFi following the collapse of credit in crypto throughout 2022. In partnership with multiple institutional custodians, ACM provides real-time transparency for lenders and borrowers.

We reimagined our governance process and laid out the team’s ideas for future tokenomics and utility as the Maple ecosystem grows. MIP009 was the first to follow this new process, passing unanimously in favor of recapitalizing the Maple Treasury with MPL tokens. MPLv2 smart contracts were tested and deployed, and we look forward to the MPLv2 migration in the coming months.

Q3 also saw tremendous growth in our Real World Assets (RWA) pools. Our Cash Management products continued to grow - bringing treasury yields onchain to both mainnet and Solana. We reintroduced Maple on Solana with the launch of our Cash Management pool, scaling it to >$4MM in 3 weeks. AQRU Receivables grew by more than 50% in the quarter, with net APY for lenders consistently hovering around ~14%. Take a look through these and other credit opportunities in the newly redesigned Maple Marketplace.

Sid and Joe joined panels at Korea Blockchain Week and Token 2049, as we push to expand our network in the APAC region. The conference tour this fall took our team to Seoul, Hong Kong, Singapore, and Sydney, and then back to NYC for Messari Mainnet. And lastly, Maple hosted the inaugural episode of our new podcast called The Debt Stack. Be sure to follow us on Twitter for future episodes, where members of the Maple team bring on guests to talk all-things capital markets onchain.

We would like to express our gratitude to our valued customers, partners, and stakeholders for their trust and support. Our goal is to be a cornerstone of a revitalized onchain credit industry and we are excited to close out 2023 with continued strength and momentum. Follow along with the growth of Maple in our new Dune dashboard!

Q3 2023 HIGHLIGHTS

- Launched 3 new pools, including Cash Management on Solana

- Annualized revenue grew by 90% Q/Q to ~$450k

- Grew outstanding loans by 61% Q/Q

- Interest paid to LPs was up 52% Q/Q

- Active LPs on the platform rose 64% Q/Q

Q3 2023 REVENUE

Table 1: Q3 Liquidity and Total Loan Originations

Table 2: Maple DAO Revenue & Expenses

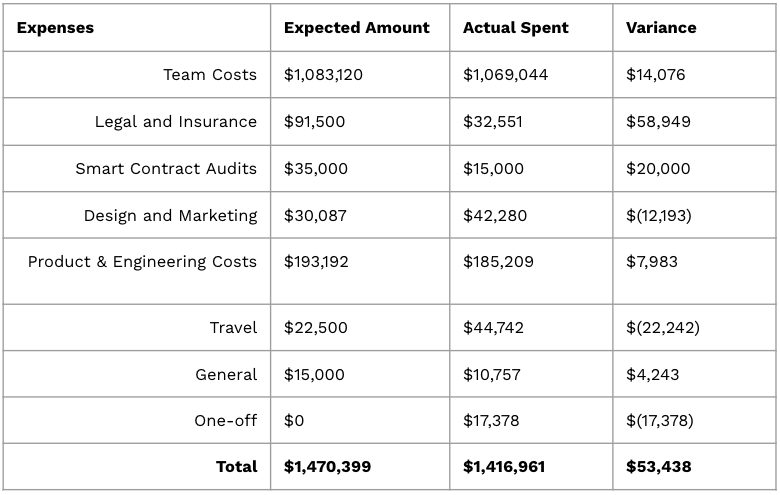

Q3 2023 EXPENSES

Q3 2023 expenses are detailed below, showcasing a comparison between budgeted and actual expenditure:

Table 3: Maple Labs Q3 Actual vs Budget Variance

Table 4: Q3 Pool Statistics