Q1 tested our resolve, demanding tough decisions and disciplined action. We navigated the challenges of resetting costs post-layoffs while adapting Maple’s product for a risk-off market. Positively, the first Real World Asset pool with AQRU launched in January setting the stage for a Cash Management Solution to launch in Q2. Maple continued to advance towards the goal of building the most used on-chain capital markets platform and showcased a commitment to innovation. While Q1 didn't meet past levels of activity and growth it was a pivotal stepping stone, fueling the determination for success in Q2 and beyond. Sidney Powell, CEO and Co-Founder, Maple

The data and information in this report are intended for informational purposes only, and is subject to change. The data provided are based on the status of the Maple Treasury on the 31st March 2023. All figures are shown in USD and based upon wETH closing price of $1,824. For more information, see disclaimer linked below.

Q1 IN REVIEW

The objective for 2023 is to “build on-chain capital markets infrastructure that provides a diversified set of lending opportunities through strong and reputable Delegates”. In Q1 we advanced towards this goal when AQRU joined to offer loans to US businesses entitled to COVID tax refunds with a lending pool on Maple. In another step to diversify the platform, Lenders will soon be able to access yield sourced from U.S. Treasury bills entirely on-chain. By offering secured, unsecured, real-world and digital native lending pools Maple will realise its vision of becoming the leading on-chain debt-capital marketplace.

In Q1 Maple’s product team shipped new tools and features that enhance the lending experience on Maple. Monthly Interest statements can now be downloaded from the lender dashboard and so Lenders have all the information necessary to make informed lending decisions more information on borrowers has been made available.

The engineering team shipped the Maple SDK to make it easier for sources of capital to connect with Maple. The code base for a new open-term loan product was sent to auditors and when launched will empower Delegates to control pool liquidity, service withdrawal requests and mitigate risks for Lenders.

Lastly, we were proud to have been awarded 2nd place in the Newcomer of the Year category by Private Debt Investor readers, and scored a 92% DeFi Safety Score by DeFi Safety.

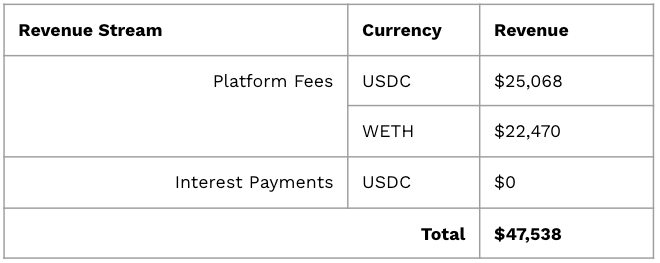

Q1 2023 REVENUE

Table 1: Maple DAO Liquidity and Loans

Total active liquidity on Maple decreased from $58 million in Q4 2022 to $27.4 million in Q1 2023 as the market recovered from the events of last year. Lender and borrower appetite remained low, with lenders electing to sit on cash or choose low-risk products and the borrowers requiring less debt-capital to operate in a quieter market.

Low demand on both the lend and borrow sides is evidenced by loan volumes of just $40.3M across 17 loans in Q1 2023. Because the Maple Treasury receives revenue by way of a ‘Platform Fee’ paid monthly by borrowers until a loan matures, equal to 66 bps annualized, revenue generated by the protocol dipped from $310,092 in Q4 2022 to $47,538 in Q1 2023.

Table 2: Q1 Maple Treasury Protocol Revenues

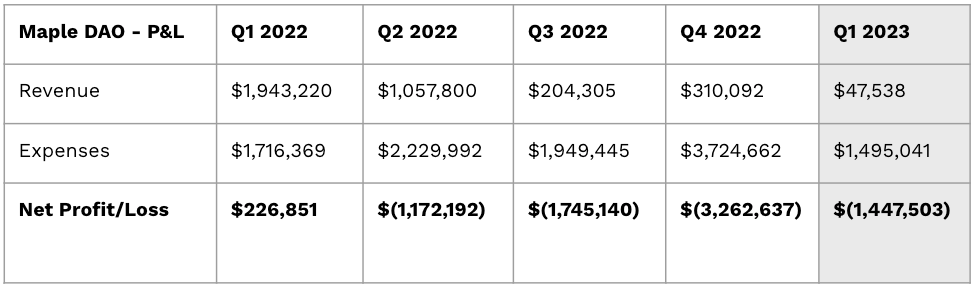

Table 3: Maple DAO P&L

In Q4 2022 Maple recalibrated its expense base by making the decision to pause Maple Solana, reducing headcount costs and refocusing department plans and budgets.

Quarterly operating expenses are now budgeted at $1.2 million or a monthly burn of $390 thousand across 2023, providing Maple protocol with ~18 months runway in a zero revenue environment.

Q1 2023 EXPENSES

Table 4: Maple Labs Q1 Actual vs Budget Variance Analysis

Above is a breakdown of Q1 2023 expenses, with an outline of budget vs. actual expenditure.

Whilst expenses outstripped revenues, it’s encouraging to see cost savings realized. Spend for Q1 23 totalled $1.4 million against Q4 spend of $2.4 million in (excluding one-off and non-recurring charges). The greatest reduction in spend can be seen with ‘Team Costs’ and ‘Operations Costs’ which include software subscriptions and team travel.

Expenses were over budget with the major variance being team and one-off costs. The total budget for Q2 2023 is $1.3 million, with team costs remaining the majority.

Q1 2023 LENDING ACTIVITY

This quarter the platform originated $40.3M in loan volume across 17 new loans, down from $87 million in loan volume across 23 new loans in Q3 2022.

In January AQRU joined Maple to provide advance finance to US businesses entitled to covid relief. Uncorrelated with crypto markets and secured by the underlying receivables, the pool enables lenders to generate interest targeted at ~10% annually on USDC, against relatively conservative collateral. The pool quickly attracted lenders and closed the quarter with $8.7 million loan volume.

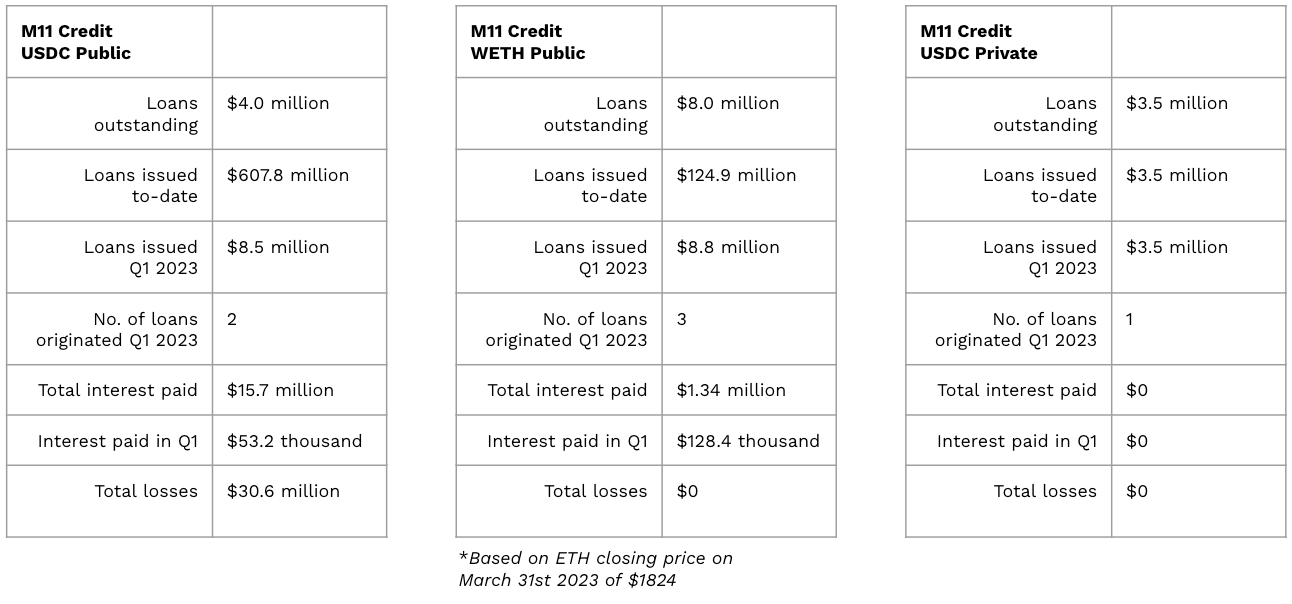

M11 Credit opened a new pool to lend to premier low-latency trading firms, and is strengthening its lending business with a new Head of Credit and an improved risk management framework. Read more.

All other pools on Maple Ethereum and Maple Solana are in run-off and not accepting new deposits.

Updates from M11 Credit

The M11 Credit USDC pool remains closed to deposits. In late January 2023, Kroll Advisory was appointed as Joint Provisional Liquidators over Orthogonal Trading and took over control of the affairs of Orthogonal Trading. Kroll is working hard to identify and recoup assets for the benefit of the creditors. Read more.

M11 Credit reached a successful resolution with Auros and a 100% repayment of funds is expected over time. Lenders in both the M11 Credit wETH pool and M11 Credit USDC pool. Read more.

Updates regarding Orthogonal Credit pool

There have been 0 new loans issued from the Orthogonal Credit pool after Maple severed ties with the parent entity in December. The pool continues to operate with Maple’s smart contract infrastructure and idle pool liquidity will be used to service withdrawals only.

Looking ahead, Maple is well-positioned to capitalize on future opportunities and solidify its position as a leading on-chain debt-capital marketplace.

Get in touch with the Maple team.

Never miss an update by signing up to our monthly newsletter.